Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

With institutions barreling into public ETH treasury plays – we're seeing ETH getting sucked out of on-chain markets, both a unique opportunity to fill in the supply gap and an adverse impact on the ETH leverage looping trade.

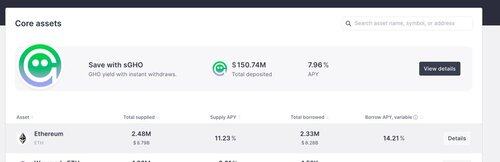

Current ETH supply rate on Aave just blew out to 11%, borrow rate at 14%. Second time this week.

Over the last 24hrs, WETH TVL on Morpho is up 17%, with rates around 2%. This is important because of the leverage ETH loop where the underlying asset makes 3.4%.

If rates spike over 4%, you'll see these start to unwind. Currently stETH withdrawals on lido are taking 10 days given queue, stETH depegged by 2bps on secondary markets, and as ETH price action continues you'll see longer withdrawal queues, depegs and rate spikes.

Bullish ETH, but with any move this fast, all eyes on risk and making sure you're working with the right counterparties.

When will these treasury companies start deploying into Aave and Morpho on the supply side 👀

ETH inflows into public treasuries and ETFs:

ETH 30d inflows at an ATH of 683.5K ETH (against a supply of 72.7K according to / -6.8K ETH according to ).

ETH 7d inflows going parabolic at 422K ETH (against a supply of 16.3K ETH according to / -2.4K ETH according to

76.98K

Top

Ranking

Favorites