Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

0xMoon

I used to open Twitter every day

This Rug ran away, and the big market was flooded

The whole person is physically and mentally comfortable, even if I am half in stock

Now open Twitter every day

This 100U earns 1 million U, and that eats hundreds of times

I wish USDT had returned to zero

Niner 🍡九儿3 tuntia sitten

I still like bear markets

Everyone can't make money

And in the bull market, it seems that I am the only one who can't make money

1,03K

That's right

Like some of the tokens I held in the last round

You can take four years

I'm young and don't need to think too much about it at all

But this round four years later

I have to think about selling cash out in a reasonable position

Because I need significant cash flow to allocate assets

Earning less won't make me lose anything, but the withdrawal of existing assets will be very uncomfortable

TingHu♪7 tuntia sitten

I tend to think that it's not a matter of perspective, it's a matter of how much money you have.

When you have a lot of money, whether it is holding Bitcoin or Ethereum, you don't need to cash out, you can live well, and all kinds of expenses are fine.

However, this is not the case for most people, and everyone needs to earn money to live, which is the root cause of what many people call "short-sightedness".

6,53K

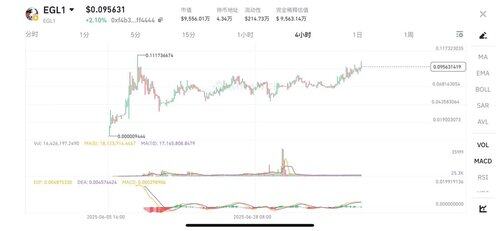

$EGL 1 What do you say about this wave?

I feel like the Hawks are not just pulling the game

There is really a BNB Chain being built

Take other projects to buy chips from other projects together

0xMoon14.7. klo 19.30

I said the eagles are accumulating power sideways

What is the market value of 100 million in this wave?

Won the WLFI game

Is it time for Trump and the BSC Foundation to buy today?

9,22K

0xMoon kirjasi uudelleen

One of the most worthwhile tokens to stock up on for the long term is TRX

Every time the market fluctuates, waves of lively narratives are staged in the cryptocurrency circle, and the projects that can really cross the bull and bear are finally returned to quiet data. That's exactly what TRON is. From 2018 to the present, TRON has firmly established itself on the most basic and realistic application scenario: the world's largest stablecoin payment network.

Tens of billions of dollars of funds are settled through TRON every day, and on-chain fees and financial service income continue to accumulate, constituting TRON's stable underlying cash flow. This confidence comes from the real use of users around the world, laying the foundation for expanding from stablecoins to DeFi and RWA.

The high APY of sTRX makes holding TRX more deterministic for the long term

The core of on-chain finance will always be the rate of return. However, high yields are easy, but high yields and steady sustainability are not easy to achieve. Instead of creating or subsidizing TRON out of thin air, TRON annualized sTRX rewards on-chain revenue and fees to staking users.

For those who are optimistic about TRX for a long time, simply hoarding coins is just a price game, while sTRX staking can not only obtain stable APY, but also form a positive cycle of token holding and income in the continuous growth of the TRON ecosystem. To some extent, sTRX has become an important plus point for TRX's long-term allocation, allowing funds to not only stay on the chain, but also continue to generate income.

Ecological transition: from the payment chain to the closed loop of capital flow

In the past, when it came to TRON, the first reaction of most people was the stablecoin transfer chain. But in the past two years, TRON's role has been quietly changing. The rollout of a series of on-chain financial infrastructures such as JustLend, Sun io, and Smart Allocator has actually built TRON into a self-contained closed loop of capital flows.

TRON is no longer just a simple USDT transfer tool, but a network that can support multiple financial scenarios such as on-chain lending, wealth management, and asset scheduling. Combined with the introduction of decentralized USDD and RWA assets, this network has even begun to map to the real asset world. Real asset returns and on-chain fund interoperability have begun to appear a clear interaction path.

Brother Sun's strategic layout: All in USA, no longer just a hot chase

Brother Sun's changes this year are visible to the naked eye: from frequent hot spots in the past to a low-key and pragmatic layout of the US market, the strategic focus has been completely shifted.

He has invested heavily in WLFI projects, personally serving as an advisor, strategically investing resources and actively engaging with the mainstream U.S. financial narrative. Behind this is his judgment of the trend: the future of the chain cannot exist separately from the real financial system, and the compliance tracks of RWA, stablecoin compliance and ETF are the real important battlefields in the next cycle.

This pragmatic layout is not a change in Brother Sun's style, but the essence of long-termism that he has always been clear: landing first, then layout, and never making a pavilion in the air.

It's no accident that TRON has come to where it is today.

It has chosen a less sexy, but more long-term and pragmatic path.

@justinsuntron @trondaoCN #TRONEcoStar

15,04K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin