Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Chris Dixon

Programming, philosophy, history, internet, startups, crypto. Author of Read Write Own. Managing Partner @a16zcrypto.

Clear rules for stablecoins and the road ahead

At the White House today, the first piece of U.S. crypto legislation will be signed into law: the GENIUS Act. It provides clear rules for stablecoins.

This is a historic moment — not just for crypto, but for the world at large. That’s because stablecoins give us something we’ve never really had before: open money infrastructure.

Stablecoins are a better form of money: faster, cheaper, and more global. They cut fees and eliminate intermediaries. They are auditable and programmable. They allow developers to build new kinds of apps that weren’t possible before: low-to-no cost remittances, programmatic micropayments, AI-native transactions, transparent and disintermediated global commerce, and more.

Stablecoins give the world access to the dollar, they spread financial freedom, and they ensure that the next generation of financial infrastructure is built on U.S. standards.

For too long, innovators in crypto have operated under legal uncertainty. That uncertainty has stifled progress, driven builders offshore, and created a fragmented internet. The GENIUS Act reverses this: it creates clarity for stablecoins and sets us on a path toward broader crypto market structure reforms.

This is how the internet moves forward: through clear rule-making. With the GENIUS Act, stablecoins have clear rules, paving the way for better payments, financial products, and an overhaul of the global financial system.

Next, we need the same for the rest of the crypto market. The Senate can do this by passing the CLARITY Act, which provides clear rules of the road for the broader crypto industry, opening a path for innovators while also protecting consumers from scams and bad actors.

We believe that the U.S. can lead the next era of the internet — the read-write-own era — by enabling open, user-owned protocols instead of the closed, corporate platforms that defined the last one. This legislation lays the foundation for that future. It's the beginning of a new chapter.

61,14K

The House just made history by passing major legislation on stablecoins (GENIUS Act) and market structure (CLARITY Act) in an overwhelmingly bipartisan way.

This is a huge moment for crypto and for all Americans. We’re very close to having comprehensive, proactive rules in place for the first time.

Next up: the GENIUS Act goes to the President’s desk for his signature. After that, the Senate should pass the CLARITY Act.

We believe passing these laws is the best way to ensure that America remains the world leader in the next era of the internet.

Thank you to all the cosponsors of these bills and the incredible supporters on both sides of the aisle in Congress.

96,36K

Chris Dixon kirjasi uudelleen

Big thanks to @SenatorTimScott, @SenLummis, @BoHines, and @DavidSacks for your leadership.

Getting comprehensive crypto market structure legislation passed has been sorely needed for years. We’re incredibly supportive of this effort to make it happen by Sept 30.

American consumers and crypto builders need clear, effective rules, and we stand ready to help get this done.

25,96K

Today the Senate took the historic step by passing the GENIUS Act with broad bipartisan support.

This stablecoin bill protects consumers and gives entrepreneurs the guardrails they need to drive innovation and economic growth in crypto and beyond.

Now we need comprehensive market structure legislation so the US can lead in building blockchain networks.

74,19K

I’m excited to announce we’ve led a $33 million seed round in @yupp_ai, a consumer product that allows anyone to discover and compare the latest AI models for free. AI needs robust and trustworthy human data. Crypto is built to provide it.

Modern AI systems are shaped not only by compute and algorithms but by human feedback. Companies use post-training techniques such as Reinforcement Learning from Human Feedback (RLHF) and Direct Preference Optimisation (DPO) to improve their models. These techniques can reduce bias and enable higher quality, more coherent responses to prompts — crucial for accelerating progress in AI. Model evaluation is similarly critical, but a model can only be made better after first deciding what “better” means.

That’s where challenges arise: Companies don't like to share — they keep their data and training processes secret. As a result, model improvements are constrained by what can be learned from closed systems or static benchmarks that are rarely informed by real-world use. These constraints make AI models difficult to evaluate. Users are also left in the dark, with little insight into how their feedback shapes models or whether it’s used at all. Some leaderboards and crowdsourcing sites attempt to shed light here, but they generally don’t enable users to audit their contributions or see any direct benefit from participating. Platforms that claim to be fair and transparent often rely more on good faith than enforceable standards.

We believe crypto can bring transparency and ownership to this murky area of AI. Blockchains can make it easier for people to receive rewards for their contributions. They can also provide AI builders with assurances about the quality and provenance of the feedback data and evaluations they’re incorporating into their models. So users get incentives, builders get trustworthy data, and everyone can audit either side of the open market.

Yupp crowdsources model evaluation: users enter prompts, see multiple AI-generated responses side-by-side, and then pick the best ones. Their choices create digitally signed “packets” of preference data that are useful for AI post-training and evaluation. In addition to users getting access to the latest models for free, they receive rewards based on the feedback that they provide.

Yupp’s design turns human judgment into a renewable economic resource. Data “expires” as newer interactions replace it, creating a natural flywheel: more usage yields fresher evaluations; fresher evaluations yield better models; better models attract more usage. All participants — from users to AI model builders — can participate and see that the same transparent rules apply to everyone, ensuring a credibly neutral marketplace. No one can hide the scoreboard, and no one can manipulate the rewards or results.

The founders bring deep experience in both AI and crypto. They built consumer-scale machine learning products together in the early days of Twitter. @pankaj ran global consumer engineering for Google Pay and @Coinbase. @gilad was a machine learning lead at GoogleX. The early team already counts senior engineers from Google, Coinbase, and top research labs.

AI needs strong, reliable evaluation based on large-scale human input. Crypto is the trust machine that can help deliver it. By enabling people worldwide to contribute model-improving feedback, Yupp aims to become the default evaluation layer for the future of AI. We’re proud to back Yupp and look forward to helping them build the onchain feedback loop that ensures the rewards of AI innovation are shared by everyone who helps create it.

79,59K

Chris Dixon kirjasi uudelleen

Wait — the bank froze your life savings?

Debanking exposed...

Imagine waking up one day to find your bank account frozen.

No warning.

No explanation.

No recourse.

This is not a thought experiment. It’s a real situation. And it’s happened not just to crypto companies and their founders, but to ordinary people who are just trying to live their lives. That includes our guest today, who learned firsthand what it means to be “debanked.”

In this episode, we talk about the unseen algorithms that monitor people’s accounts, the ramifications of the Bank Secrecy Act, and how crypto and decentralized finance may offer a much-needed check — and safety net — against the opaque systems of traditional finance.

Full episode:

Timestamps:

(0:00) Introduction

(2:03) The Problem of Debanking

(5:58) Debanking: A Personal Story

(7:33) Understanding the Bank Secrecy Act

(11:53) The Information Vacuum

(16:55) The Impact on Crypto Companies

(20:07) Addressing Skeptics

(22:07) Banks: Good vs. Bad

(27:35) The Scariest Moment

(36:17) “Operation Chokepoint 2.0”

(38:08) History of the Bank Secrecy Act

(44:04) Security Theater

(45:31) What Would You Change?

(48:45) The Impact of Financial Consolidation

(49:30) Crypto as Banking Solution

(53:02) Is Debanking Still Happening?

(58:35) Unresolved Mysteries

(1:01:47) One More Debanking Story

(1:08:07) Conspiracy or Coincidence?

(1:09:39) It Shouldn’t Be This Hard

(1:11:18) Out From Under the SEC’s Cloud

(1:14:23) The Urgent Need for Legislation

(1:17:26) Possible Tech Futures

(1:19:33) Advice for Founders

(1:22:04) Final Thoughts

w/ @MinarikLaw @EMinSF @rhhackett

28,16K

Yesterday was big. Market structure legislation got passed out of both the House Ag and Financial Services committees with bipartisan support.

This bill does 3 things:

1- protects consumers

2- gives long-term incentives for both builders & investors

3- makes sure crypto stays in the U.S.

If we want a better internet we need blockchain networks being built here in America. This bill enables that.

Yesterday was a solid step in the right direction, but we now need this bill to come to the House floor and then move to the Senate for approval.

Let’s get this done so we can ensure the U.S. remains the crypto leader for decades to come.

137,76K

Chris Dixon kirjasi uudelleen

Stablecoins now present what I believe is the first credible opportunity to onboard a billion people into crypto.

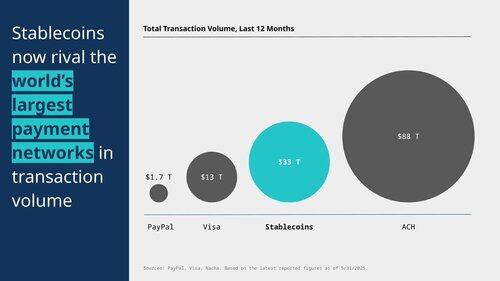

If you haven’t checked in on the latest stablecoin data recently, you might be surprised. Stablecoins have done $33 trillion in transaction volume in the last 12 months, consistently hitting new all time highs.

To put that into perspective, that’s close to 20 times the volume of PayPal, close to 3 times the volume of Visa, and quickly approaching the volume of ACH.

It’s incredible to see stablecoins in the mix among these massive global payment networks that have been around for decades.

48,59K

Today, a bipartisan group of leaders in the House took an important step in introducing crypto market structure legislation: the CLARITY Act. This follows the recent progress on sound stablecoin legislation and is crucial for ensuring US leadership in blockchain technologies.

The CLARITY Act shows a meaningful effort to strike the right balance between laying out appropriate guardrails for the industry while also supporting responsible entrepreneurship and innovation. It signals strong momentum toward smart regulation.

We look forward to working with policymakers to ensure strong consumer protections that build public trust while giving entrepreneurs the clarity — and level playing field — they need to keep innovating.

It’s time. Congress should move quickly and pass market structure legislation. The future of crypto in America depends on it. 🇺🇸

183,96K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin