Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Ryan Chow

Co-founder @SolvProtocol | Pioneering BTCFi through $SolvBTC | Integrating BTC ETFs into BTCFi to unlock new liquidity for digital assets & RWA

Ryan Chow kirjasi uudelleen

I had the pleasure of interviewing the Co-Founder of @SolvProtocol, @RyanChow_DeFi recently.

We talked about all things BTCfi, BTC Yields, Solv, and why they chose to make a yield-bearing BTC instead of another yield bearing stablecoin, and how that bet has paid off for them.

10,44K

2022 was the year it all broke.

BlockFi. Celsius. 3AC. FTX.

Everyone chasing “safe” yield on their Bitcoin suddenly realized: the yields weren't real.

And for me, that changed everything.

I’d been in crypto long enough to believe in decentralization, but it wasn’t until that moment that I truly understood what it meant to build infrastructure people could trust without trusting us.

We asked ourselves a simple question: What would it take for someone to confidently put their BTC to work, without giving up self-custody, transparency, or optionality?

That’s when the idea behind SolvBTC was born.

We didn’t try to promise insane yields.

We focused on building yield primitives, real engines that generate real returns:

• Delta-neutral DeFi strategies

• Borrow-lend loops with stablecoins

• Structured yield from integrations like Binance Launchpool

We also took compliance seriously, long before most DeFi protocols did by getting SolvBTC vaults certified as Shariah-compliant.

Fast forward:

• In one year, we crossed $100M in TVL.

• In two, we passed $1B.

• Now, we cross $2B.

And that’s only the beginning.

dudu | BIP-4202.7. klo 18.01

How did @RyanChow_DeFi and his team get SolvBTC TVL into the billions?

It all started in 2022.

BlockFi, Celsius, and co were going under.

People were hungry for decentralized alternatives to earning yield on BTC.

So @SolvProtocol stepped into the arena.

4,78K

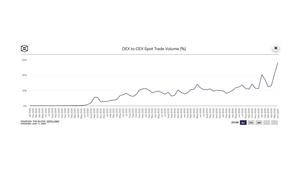

I see Web3 growth channels redirecting in the past months.

Users are no longer entering through the “traditional” funnel:

Centralized exchange → KYC → Buy → Explore.

Instead, they’re discovering apps via:

Wallet → DEX → Explore → Maybe KYC later

And this new flow is preferred, where we see:

✅ DEX volumes are surging.

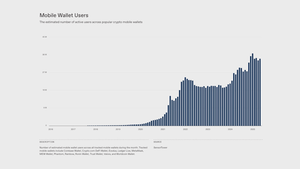

✅ Wallet downloads are climbing.

❌ But KYC compliance at first touch is still a huge drop-off point for many.

However, for many users, especially outside North America, KYC is seen as a trust barrier, not a gateway.

So what’s emerging is a “wallet-first” growth track, especially mobile wallets:

1. Users start with non-custodial wallets.

2. They bridge or receive tokens from a friend or app.

3. Their first trade happens on a DEX.

4. They interact on-chain and build trust over time.

5. Compliance only kicks in if/when higher value thresholds are crossed.

And it’s influencing how we design user flows; it has to be built for trust, not just traction:

• Wallet-native onboarding flows

• ZK-based KYC attestation layers

• Onchain rep systems that replace traditional “submit your ID” steps

• “Micro-stake” campaigns that let new users try apps with <$50, risk-free

The future of crypto is:

→ Permissionless at the start.

→ Compliant as needed.

→ Frictionless throughout.

And Solv is designing a user flow with around this strategy focusing on a wallet-native, KYC-later model.

2,87K

Proud to see that Solv's multi-chain expansion accelerating with @chainlink’s CCIP.

The result:

→ $2.5B+ TVL

→ $1.16B+ cross-chain volume

→ $960M+ in market cap growth

Composable liquidity + programmable yield

Solv Protocol20.5.2025

Solv acc(SOL)erates Bitcoin Finance with @chainlink.

Solv + Chainlink CCIP = Institutional-Grade Interoperability

With Chainlink CCIP now deployed on @solana mainnet, Solv’s strategy to expand Bitcoin use cases across the cross-chain ecosystem is scaling fast.

This unlocks Solana $19B+ across 57+ chains and Solv is proud to drive that mission with SolvBTC towards a Bitcoin-rich DeFi.

Solv is ready to lead. Let’s accelerate.

16,28K

Ryan Chow kirjasi uudelleen

It’s LIVE: fragBTC has arrived on @solana!

Introducing the first-ever native, yield-bearing Bitcoin on Solana, built on @fragmetric’s FRAG-22 standard, powered by SolvBTC.JUP strategy, and secured by @ZeusNetworkHQ.

Here's how you can earn native BTC yields on Solana 🧵👇

15,35K

I’ve always believed Bitcoin could be so much more.

Beyond being an institutional-favorite asset, it should be the backbone of a compliant, yield-driven financial system that connects every part of the world.

Today, we’ve achieved our first Shariah-compliant certification, a first-ever BTC yield product.

This means so much for us in the BTCFi sector.

We’re Breaking the Final Barrier to Institutional Bitcoin Adoption

I want to be practical. To scale with meaningful institutional participation, compliance has always been the largest and final barrier.

It's not the tech, not the market sentiments.

The hardest part is about meeting the real-world requirements of sovereign wealth funds, pension funds, and institutional allocators.

For institutions in the Middle East, with over $5 trillion in sovereign wealth assets, compliance is a non-negotiable.

Shariah principles are NON-NEGOTIABLE.

Until today, there was no Shariah-compliant Bitcoin yield solution. There way no way for trillions of dollars to enter this market responsibly.

@SolvProtocol just changed that.

We Know What Institutions Want

The crypto world loves to talk about “bringing in institutions.”

But the truth is institutions don’t budge for hot narratives. They move when the infrastructure is ready thats when the pieces fall into place.

✅ Compliant products designed for real-world demands.

✅ Clear regulatory alignment.

✅ Seamless asset management tools.

At Solv, we build what institutions actually need to deploy real capital, sustainably, at scale, and compliantly.

SolvBTC.CORE was built with an institutional framework.

Halal BTCFi

No doubt that the Middle East is leading the next phase of digital asset adoption. CEXes like Binance, even have detailed GTM strategies in Dubai/UAE.

Bitcoin ownership is already high, and it will only get higher. At the same time, institutions need halal strategies that grow capital responsibly, just like how communities need products that respect their values.

That’s what Halal BTCFi represents. A financial layer where Bitcoin becomes yield-bearing, backed by real-world assets, and fully compliant with Shariah principles.

The Dawn of Bitcoin’s Biggest Expansion

I believe we are at the beginning of the most important expansion in Bitcoin’s history.

BTC will scale by real adoption, serious capital, and infrastructure that earns trust across borders, religions, and regulatory environments.

At Solv, we’re building that institutional infrastructure, step by step, product by product.

And with SolvBTC.CORE as the first Shariah-compliant product, it will now be a blueprint for what compliant, institutional BitcoinFi truly looks like.

Solv Protocol29.4.2025

SolvBTC.CORE Unlocks $5T+ in Middle East Funds

Solv, with @Coredao_Org & @NawaFinance , launches the world’s first Shariah-compliant Bitcoin yield product.

🧵👇

29,99K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin