Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

百萬Eric | Day Trader

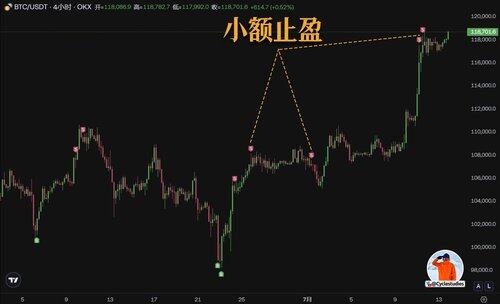

Yesterday, I strategically reduced my positions in Bitcoin #bitcoin and some altcoins.

Now the market is experiencing a general decline, but because I made the decision to reduce my positions in advance, I feel no psychological pressure at all.

The next step is to look for an opportunity to add back the positions I reduced.

Position addition logic: Focus on the structural support at the 4-hour level, EMA moving averages, and the resonance of oversold signals.

百萬Eric | Day Trader14.7. klo 14.41

Take partial profits on positions that have risen significantly to reduce psychological pressure on holding.

At the same time, set multiple alerts at previous high resistance and previous low support levels.

Be prepared in advance for both scenarios of pullbacks or breakouts.

If the pullback is manageable and the pace is gentle, I will consider adding to my position.

If the market continues to break out and accelerates, then I will take a small profit in line with the trend.

#bitcoin

70,79K

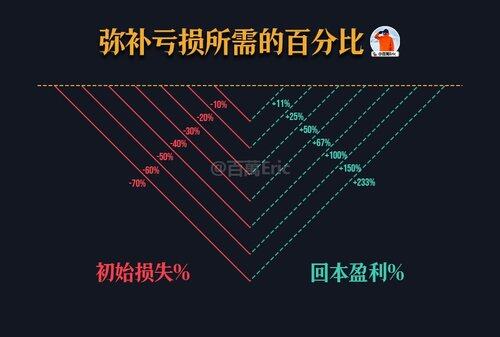

Most people think that they can recover from losses by "earning it back," but they overlook a basic mathematical fact: losses decrease linearly, while recovering is an exponential rise.

If you lose 10%, you only need to earn 11%; if you lose 50%, you need to double your investment; and if you lose 70%, you need to achieve a 233% return just to break even—this does not even account for the time, psychological factors, and market opportunities lost.

Therefore, what truly determines the life or death of a trade is not a missed opportunity or a small profit, but whether a single loss expands into a disaster.

87,39K

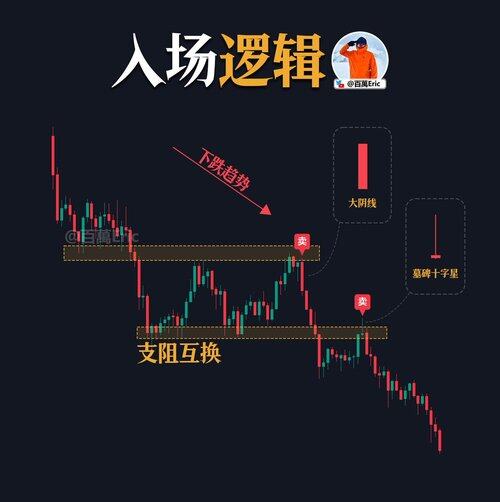

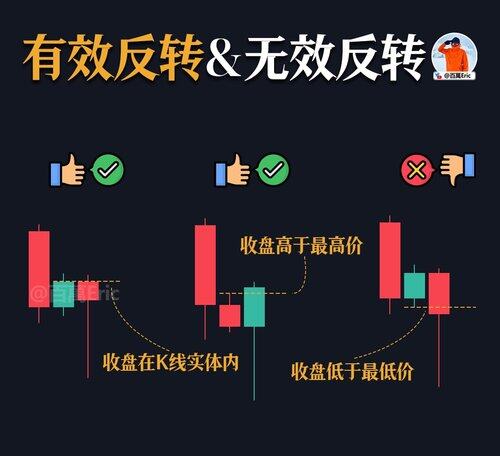

A truly effective reversal pattern often has two characteristics:

1. The closing price strongly recovers the previous candlestick's body or key high and low points, indicating that the market not only "tests the bottom" or "tries the market," but also gains confirming buying or selling pressure.

2. The strength of the closing price determines the market's attitude; no matter how long the shadow is, if it closes at the lower end of the range or even makes a new low, it only indicates that the market does not accept the reversal.

35,89K

The market will continuously throw out those small opportunities that seem like they could be worth pursuing, as if testing your patience and self-control.

You have to see through them time and again, rejecting them each time, remaining calm and composed, until it truly presents a high-odds, clearly structured big opportunity.

38,8K

Price pattern comparison is a market analysis method that has low information density but is very intuitive, especially friendly for trading beginners.

Taking the trend in the chart as an example, many people will immediately think, "Ethereum #ETH is likely to replicate Bitcoin's upward pattern," which is very persuasive.

But the problem lies here: the more similar the patterns, the easier it is for people to develop a "confirmation bias," leading to impulsive entry.

I believe many people have had this experience: when looking at the chart, it seems too similar, and they jump in immediately, only to get shaken out; yet when you observe the market as a bystander, it actually follows a completely consistent pattern. This dissonance can cause a lot of anxiety.

So, how should this chart be understood? Especially, how should beginners use it? In fact, one sentence is enough—this type of chart belongs to the analysis category, meant to help you quickly understand what stage the current market is roughly in, rather than serving as a direct signal for making trades.

52,48K

If there is a pullback, wait for key levels + signals before considering adding to the position;

If there is no pullback, continue to take small profits according to the strategy.

How Bitcoin moves is its own business; how to limit risk is my business.

I won't jump out of my strategy framework to gamble on the market just to "give it a try."

27,81K

Bitcoin #bitcoin is still in a narrow range of fluctuations, and there are currently no simple, straightforward, foolproof opportunities. The focus should be on defense in operations; it's better to do less than to do more.

Looking back at the past three instances of 4-hour overbought conditions, the price performance afterward has been quite good each time.

So now I'm just waiting for one thing: a gentle decline back to near the EMA, combined with oversold signals.

45,85K

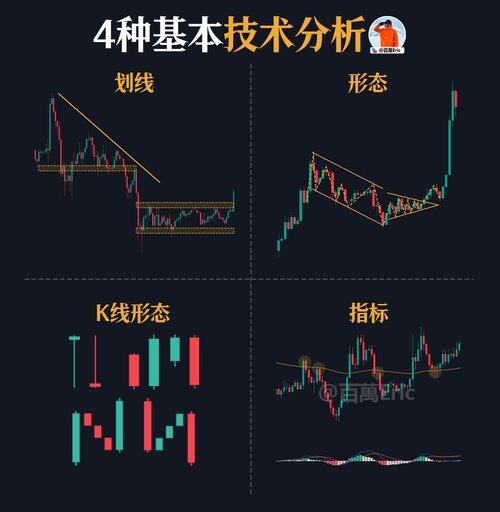

The market never has just one interpretation.

The trends, consolidations, breakouts, and reversals you see actually depend on the perspective from which you observe.

【Lines】 represent the perspective of spatial structure, used to identify support and resistance, as well as structural changes.

【Patterns】 represent the perspective of capital games, reflecting how long and short positions organize their offense and defense.

【Candlesticks】 represent the perspective of behavioral rhythm, revealing the strength of local emotions and the rhythm of fluctuations.

【Indicators】 represent the perspective of momentum and data, helping us calibrate subjective judgments with objective numbers.

Stay objective, establish your own statistical advantage; it doesn't really matter which tool you use.

30,68K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin