Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ARK Invest

ARK Invest kirjasi uudelleen

If the @base app takes off, it could mark the beginning of a "walled gardens" phase in Ethereum’s L2 roadmap.

Fragmentation has been the biggest criticism of L2s, but if real utility emerges through the composability of protocols built on the same tech stack, that narrative could start to shift.

The Base app will be a good test case for the walled gardens L2 thesis, as it integrates with apps across the OP Stack:

- Trading via Uniswap

- Social tokenization via Zora

- Social feed via Farcaster

This highlights growing demand for interoperability today- in usable, integrated experiences. If it works, this could result in multiple siloed ecosystem enclaves (OP Stack, Arbitrum Nitro, ZK stack) becoming the de facto market structure in the ST.

This doesn't solve fragmentation, but it might offer a temporary fix until more robust ecosystem-wide solutions emerge.

16,04K

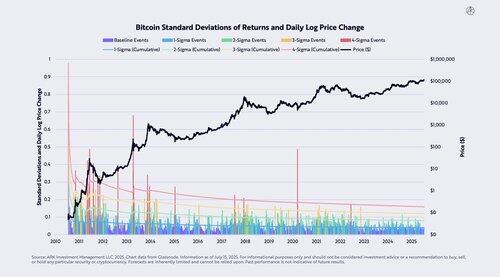

A study on bitcoin's volatility and extreme tails by ARK's Research Trading Analyst and Associate Portfolio Manager for Digital Assets @dpuellARK 👇

David Puell17.7. klo 05.54

A study on #bitcoin's volatility and extreme tails. Start of thread...

1/ Key takeaways:

1. As seen below, and somewhat obvious today, bitcoin's volatility has decreased.

2. Bitcoin has consolidated 84% of the time, above the rule-of-thumb 70% given in financial literature.

3. Bitcoin days of extreme volatility seem to have diminished over time.

4. Based solely on recorded volatility, there have been two extremely catastrophic days in the history of bitcoin. Which days? The answer is at the end of this thread.

The first chart below provides every single trading day in context on how volatile it is relative to 1 to 4 standard deviations (a.k.a. sigma units).

Let's dive in...

125,4K

ARK Invest kirjasi uudelleen

A lot of people asking about Tesla vs Waymo, some thoughts: (lmk what I'm missing)(and not meant as a diss, Waymo doing great stuff as well and clearly customers like the offering)

-Price per mile is critical in this market. People check uber and lyft and take whichever is cheapest even if by a few dollars as long as they both will come within 5min.

-Waymo’s cars are expensive relative to Tesla’s. This leads to higher price per mile.

-Waymo doesn’t have the ability to match peak/trough demand of travel like Tesla does through having people opt their vehicles into the fleet. That means to match peak demand Waymo either has a fleet with lower avg utilization, which leads to higher price per mile or they have a small fleet which can’t meet peak demand. (They are trying to solve this by partnering with Uber)

-Waymo has been offering commercial rides since 2018. Their fleet of vehicles 7 years later is ~1,500 and they plan to add 2,000 more vehicles this year (The bespokeness at this stage likely leads to very high maintenance costs). Tesla makes ~5,000 cars a day.

-There is something we aren’t seeing with Waymo. If they are safe, which appears to be true, then why aren’t they scaling much faster?

191,9K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin