Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Steve

CEO & Co-Founder @FourPillarsFP

It seems like Passport works for Koreans. But still I think this is not the best way to do it.

Steve17.7. klo 10.47

It feels like the @ikadotxyz team is making a serious mistake with the current token claim process.

Right now, Korean users are unable to claim their tokens because they can’t complete KYC.

KYC for token claims? Sure, that’s understandable—but if that was going to be a requirement, it should’ve been clearly communicated from the very beginning. I, for one, don’t recall ever seeing any such notice.

Look, it’s fine to run bold or experimental strategies—but excluding Korean users who have participated fairly in the ecosystem? That’s not the way to build goodwill in this market.

I’m also concerned that this kind of approach from IKA could end up reflecting negatively on the broader @SuiNetwork ecosystem. Of course, I know they’re different team—but public perception doesn’t always make that distinction.

I’ve seen a lot of airdrop strategies over the years, but this one is uniquely weird.

If this doesn’t get fixed, IKA really shouldn’t expect to host any successful meetups or activations in Korea period.

3,04K

It feels like the @ikadotxyz team is making a serious mistake with the current token claim process.

Right now, Korean users are unable to claim their tokens because they can’t complete KYC.

KYC for token claims? Sure, that’s understandable—but if that was going to be a requirement, it should’ve been clearly communicated from the very beginning. I, for one, don’t recall ever seeing any such notice.

Look, it’s fine to run bold or experimental strategies—but excluding Korean users who have participated fairly in the ecosystem? That’s not the way to build goodwill in this market.

I’m also concerned that this kind of approach from IKA could end up reflecting negatively on the broader @SuiNetwork ecosystem. Of course, I know they’re different team—but public perception doesn’t always make that distinction.

I’ve seen a lot of airdrop strategies over the years, but this one is uniquely weird.

If this doesn’t get fixed, IKA really shouldn’t expect to host any successful meetups or activations in Korea period.

23,01K

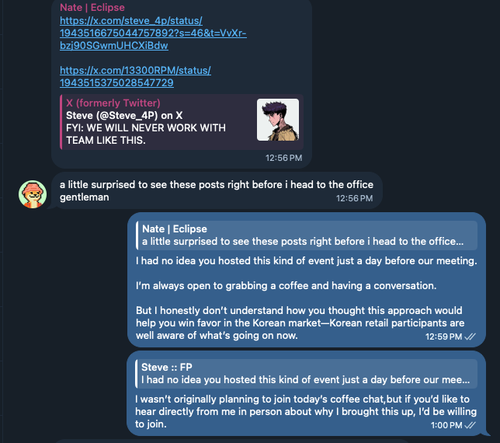

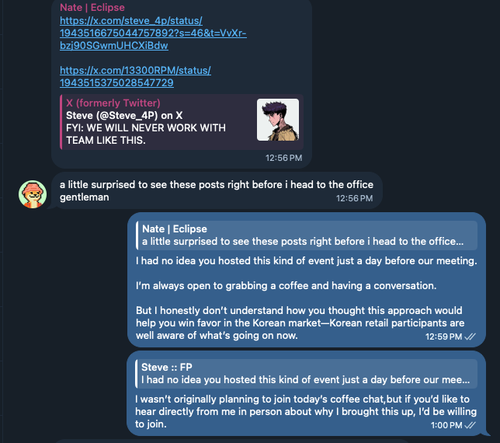

Eclipse: “We’re fully committed to Korea.”

Also Eclipse: Blocks @jasonyeah0503 — founder of one of Korea’s most respected crypto firms, @DeSpreadTeam.

Is this a new playbook? if so, good luck.

Jasonyeah | DeSpread17.7. klo 10.27

Wow

@asclubnft @Alucard_eth Blocked ASC holder (I have 2 ASC)

This is what we called ‘Real community’

RIP @EclipseFND @akachacolate @0xtaetaehoho

1,95K

Hum. Not only did they just “accidentally” emphasize “foods” but also they literally gave more airdrops to those who attended “food meetups” than ASC holders.

Looks like I wasn’t the one misunderstanding things after all.

Steve11.7. klo 15.51

Coincidentally, since @akachacolate is in Korea right now, he reached out after reading this post and suggested we meet up to talk. So we did.

It turns out there were a few misunderstandings. First, Nate seemed to believe that hosting an event was important in order to generate attention in the Korean market. Up until now, @EclipseFND hadn’t really been on the radar in Korea, so the idea was to attract attention by hosting something locally.

In addition, the dinner event was meant to differentiate Eclipse from other protocols and explain how it’s doing things differently — and ideally, to convert Korean attendees into onchain users. But from what I heard, that message didn’t land as well as they had hoped.

To be honest, even though I saw multiple KOLs posting about the event, the spotlight was completely on the food, and not on what Eclipse was actually trying to say or do. Even if some KOLs tried to communicate the message, it likely got drowned out by all the hype around the fancy meal. The signal was lost in the noise — the medium overshadowed the message.

Also, to be fair, many scammy projects in the past have used “good food” and fancy dinners to promote themselves in Korea, so when Eclipse came in and hosted a similar style of event, it naturally made me skeptical as well.

That said, I do think it would be unfair to single them out. Other protocols have spent anywhere from $500K to $1 million on extravagant events in Korea too — so criticizing Eclipse for hosting a dinner feels a bit hypocritical in that broader context.

However, I still believe their airdrop strategy is a valid point of criticism. Realistically, those who bridged $ETH into Eclipse and tried DeFi apps are much more likely to become long-term users. But the airdrop seemed to disproportionately reward people who simply clicked the Turbo tab — which raises questions about how well the airdrop was actually designed.

Of course, no project gets everything right from the beginning. But perhaps it would’ve been better to clearly define the airdrop criteria up front. Imagine someone who bridged ETH, used DeFi protocols, and still got nothing — while someone else who just showed up for a fancy dinner got rewarded. It’s not hard to see why that would feel unfair.

Ultimately, I hope projects approach the Korean market with a bit more thoughtfulness. As important as this market is, the way teams are showing up here is starting to become a bit extreme. Less food, more product. Less flash, more authenticity. Those are the kinds of projects I want to see getting more attention.

In that regard, I think @AbstractChain set a great example — rather than hosting a flashy event, they focused on onboarding real partners like @officialmodhaus & @triplescosmos, and that made all the difference.

1,67K

Coincidentally, since @akachacolate is in Korea right now, he reached out after reading this post and suggested we meet up to talk. So we did.

It turns out there were a few misunderstandings. First, Nate seemed to believe that hosting an event was important in order to generate attention in the Korean market. Up until now, @EclipseFND hadn’t really been on the radar in Korea, so the idea was to attract attention by hosting something locally.

In addition, the dinner event was meant to differentiate Eclipse from other protocols and explain how it’s doing things differently — and ideally, to convert Korean attendees into onchain users. But from what I heard, that message didn’t land as well as they had hoped.

To be honest, even though I saw multiple KOLs posting about the event, the spotlight was completely on the food, and not on what Eclipse was actually trying to say or do. Even if some KOLs tried to communicate the message, it likely got drowned out by all the hype around the fancy meal. The signal was lost in the noise — the medium overshadowed the message.

Also, to be fair, many scammy projects in the past have used “good food” and fancy dinners to promote themselves in Korea, so when Eclipse came in and hosted a similar style of event, it naturally made me skeptical as well.

That said, I do think it would be unfair to single them out. Other protocols have spent anywhere from $500K to $1 million on extravagant events in Korea too — so criticizing Eclipse for hosting a dinner feels a bit hypocritical in that broader context.

However, I still believe their airdrop strategy is a valid point of criticism. Realistically, those who bridged $ETH into Eclipse and tried DeFi apps are much more likely to become long-term users. But the airdrop seemed to disproportionately reward people who simply clicked the Turbo tab — which raises questions about how well the airdrop was actually designed.

Of course, no project gets everything right from the beginning. But perhaps it would’ve been better to clearly define the airdrop criteria up front. Imagine someone who bridged ETH, used DeFi protocols, and still got nothing — while someone else who just showed up for a fancy dinner got rewarded. It’s not hard to see why that would feel unfair.

Ultimately, I hope projects approach the Korean market with a bit more thoughtfulness. As important as this market is, the way teams are showing up here is starting to become a bit extreme. Less food, more product. Less flash, more authenticity. Those are the kinds of projects I want to see getting more attention.

In that regard, I think @AbstractChain set a great example — rather than hosting a flashy event, they focused on onboarding real partners like @officialmodhaus & @triplescosmos, and that made all the difference.

Steve11.7. klo 11.44

FYI: WE WILL NEVER WORK WITH TEAM LIKE THIS.

5,16K

But buddy, one day all that effort is definitely going to pay off. I really root for teams like @eigenlayer.

Go Ditto and @sreeramkannan

Ditto11.7. klo 13.19

Me seeing projects throwing fancy meetups in APAC while not taking care of their ecosystem builders / contributors

1,51K

FYI: WE WILL NEVER WORK WITH TEAM LIKE THIS.

100y.eth11.7. klo 11.16

Wow @EclipseFND did no airdrop to real onchain users and threw luxury meetup in Korea to promise token airdrop to attendees.

what a comedy

(image h/t @DefiIgnas @Edward__Park)

6,59K

I wrote this because I heard that some validators view their validator business as a “good cash cow.” While that’s commendable, they should also be more responsible for their actions.

We should do better.

Steve10.7. klo 21.03

Validator Management Must Be Part of Layer 1 Tokenomics

While mature networks like @ethereum or @solana may warrant a different discussion, the reality is starkly different for newly launched Layer 1 chains.

In their early stages, these networks often engage in a quasi-transactional process of distributing massive delegations to validators as a form of “compensation,” laying down the starting line for network participation.

Though I haven’t analyzed every new chain’s validator set in detail, the overall trend is clear. Becoming a top 10 validator often guarantees annual token rewards exceeding $100,000. For chains with even moderate recognition, the figure climbs to $300,000–$500,000, and cases exceeding $1 million per year are not uncommon.

But the issue isn’t simply that validators earn a lot.

My position has always been: “As long as validators contribute value equal to—or greater than—what they receive, the system is functioning appropriately.”

The real problem is that we lack the means to verify those contributions. If token inflation burdens holders while the validator’s tangible impact remains opaque, isn’t that a design flaw?

Quantitative metrics like token rewards are transparently recorded on-chain. But the actual contributions of validators—community support, SDK improvements, participation in governance, or organizing local events—aren’t easily captured through on-chain data. As a result, most networks offer near-zero visibility into a critical question: “How much positive impact is this validator actually having on the ecosystem?”

I believe foundations and core teams must establish minimum contribution standards. The era of assessing validators solely by uptime and performance is over. Technical reliability is just the baseline. Networks should holistically evaluate validators based on community building, developer ecosystem growth, and their role in governance discourse. In essence, each validator should have a public “KPI dashboard.”

Transparency isn’t optional—it’s a mandate. Foundations must publish standardized, periodic (e.g., quarterly or biannual) validator contribution reports. Ideally, these reports should allow side-by-side comparison of on-chain data (e.g., rewards, uptime) and off-chain contributions (e.g., number of dev PRs, hosted events, community engagement).

This level of disclosure would empower token holders and the community to answer a crucial question themselves: “Why is this validator receiving so much?”

Furthermore, it may be time to consider dynamic reward adjustments. Validators falling below a defined contribution threshold could face reduced—or even revoked—rewards. Conversely, outstanding contributors should be incentivized with additional rewards. Just as healthy businesses measure ROI, a healthy protocol should assess its “inflation ROI.”

Token holders and the community deserve to know: What services are validators providing to justify hundreds of thousands in annual rewards? If this information asymmetry persists, it will ultimately erode trust in the token—and suppress its value.

If the crypto ecosystem wants to champion decentralization and transparency, it must start by scrutinizing the activities of its largest inflation beneficiaries.

At the end of the day, inflation is a cost paid by the network. If we can’t clearly account for who is receiving it, why, and how much—then tokenomics devolves into empty arithmetic. Especially when validators sit at the top of the cost structure, measuring and disclosing their utility isn’t just good practice—it’s an existential strategy.

And every time I hear that a validator on a certain chain is earning over a million dollars a year, I find myself asking, in all honesty:

“What kind of service or value are they delivering to command such compensation?”

That curiosity, I believe, is where the journey toward a more transparent and resilient ecosystem begins.

1,67K

Validator Management Must Be Part of Layer 1 Tokenomics

While mature networks like @ethereum or @solana may warrant a different discussion, the reality is starkly different for newly launched Layer 1 chains.

In their early stages, these networks often engage in a quasi-transactional process of distributing massive delegations to validators as a form of “compensation,” laying down the starting line for network participation.

Though I haven’t analyzed every new chain’s validator set in detail, the overall trend is clear. Becoming a top 10 validator often guarantees annual token rewards exceeding $100,000. For chains with even moderate recognition, the figure climbs to $300,000–$500,000, and cases exceeding $1 million per year are not uncommon.

But the issue isn’t simply that validators earn a lot.

My position has always been: “As long as validators contribute value equal to—or greater than—what they receive, the system is functioning appropriately.”

The real problem is that we lack the means to verify those contributions. If token inflation burdens holders while the validator’s tangible impact remains opaque, isn’t that a design flaw?

Quantitative metrics like token rewards are transparently recorded on-chain. But the actual contributions of validators—community support, SDK improvements, participation in governance, or organizing local events—aren’t easily captured through on-chain data. As a result, most networks offer near-zero visibility into a critical question: “How much positive impact is this validator actually having on the ecosystem?”

I believe foundations and core teams must establish minimum contribution standards. The era of assessing validators solely by uptime and performance is over. Technical reliability is just the baseline. Networks should holistically evaluate validators based on community building, developer ecosystem growth, and their role in governance discourse. In essence, each validator should have a public “KPI dashboard.”

Transparency isn’t optional—it’s a mandate. Foundations must publish standardized, periodic (e.g., quarterly or biannual) validator contribution reports. Ideally, these reports should allow side-by-side comparison of on-chain data (e.g., rewards, uptime) and off-chain contributions (e.g., number of dev PRs, hosted events, community engagement).

This level of disclosure would empower token holders and the community to answer a crucial question themselves: “Why is this validator receiving so much?”

Furthermore, it may be time to consider dynamic reward adjustments. Validators falling below a defined contribution threshold could face reduced—or even revoked—rewards. Conversely, outstanding contributors should be incentivized with additional rewards. Just as healthy businesses measure ROI, a healthy protocol should assess its “inflation ROI.”

Token holders and the community deserve to know: What services are validators providing to justify hundreds of thousands in annual rewards? If this information asymmetry persists, it will ultimately erode trust in the token—and suppress its value.

If the crypto ecosystem wants to champion decentralization and transparency, it must start by scrutinizing the activities of its largest inflation beneficiaries.

At the end of the day, inflation is a cost paid by the network. If we can’t clearly account for who is receiving it, why, and how much—then tokenomics devolves into empty arithmetic. Especially when validators sit at the top of the cost structure, measuring and disclosing their utility isn’t just good practice—it’s an existential strategy.

And every time I hear that a validator on a certain chain is earning over a million dollars a year, I find myself asking, in all honesty:

“What kind of service or value are they delivering to command such compensation?”

That curiosity, I believe, is where the journey toward a more transparent and resilient ecosystem begins.

5,69K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin