Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Carlos Domingo

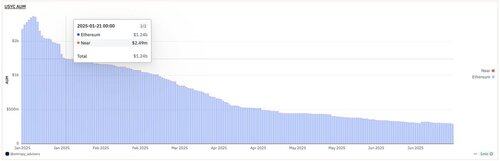

Meanwhile, this is what the rest of the tokenized treasuries products did during the same period. Circle was the only product that decreased (and significantly) in the entire market.

Tom Wan18.7. klo 17.35

Circle announced the acquisition of Hashnote, the issuer of USYC (Tokenized MMF), on January 21, 2025. Back then, USYC still had an AUM of $1.2B.

Currently, the AUM of USYC has dropped to $285 million, representing a 76% decrease since the acquisition announcement

11,76K

Carlos Domingo kirjasi uudelleen

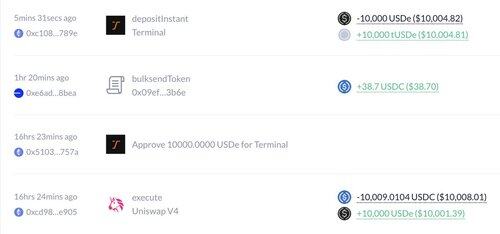

Just deposited 10K $USDe into @Terminal_fi.

My reasoning:

• 30x Terminal points + Ethena points

• A partner of Ethena, Pendle, and Ether Fi

• $100M+ in pre-deposits (that's massive)

• No big marketing yet

• Will serve as the central liquidity hub of @convergeonchain

I have a feeling that this might be something big.

12,01K

This comment is right, but the issue is the terminology; those are not tokenized stocks, they are tokenized something else that is not the real stock

MRG2.7. klo 19.47

Tokenized stocks introduce additional counterparty risk, higher trading fees, increased security risk, thinner liquidity, lack shareholders rights and in most models don’t even hold the underlying shares.

Where do I sign up?

1,25K

If they are getting revenues paid to their token holders, how is their token not a security?

Haseeb >|<9.7. klo 22.05

Wow, this video...

$PUMP is going to be getting 25% of Pump revenues, so beyond one of the largest ICOs ever, this will be one of the highest gross revenue tokens in crypto.

(not an investor)

9,55K

So the recent flurry of announcements of tokenized stocks might be illegal? Shocking. Who would have said it.

Can we now kill those derivatives and wrappers and return to doing the right thing, focusing on native tokenization?

"a token that does not provide the holder with legal and beneficial ownership of the underlying security could be a “security-based swap” that cannot be traded off-exchange by retail persons"

Hester Peirce10.7. klo 01.02

Some thoughts on tokenization of securities:

15,73K

Carlos Domingo kirjasi uudelleen

More from Infra Gardens: @KAndrewHuang talks value accrual on L1s vs. purpose-built L2s.

Key takeaway:

Apps on shared chains like Solana lose ~50% of value they generate. Apps with scale will follow @convergeonchain and @RobinhoodApp: Own the chain, keep 100% of the value.

3,61K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin