Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

People are seriously underestimating how big this is.

@grovedotfinance is bringing tokenized private credit to the @SkyEcosystem. That’s a game-changer.

Why does it matter?

It opens up a new source of yield that isn’t tied to crypto or U.S. Treasuries.

It’s built to scale. Big time.

You’ve probably heard of BlackRock’s BUIDL ETF. Its yield comes from U.S. Treasuries, which move with Fed interest rates. That’s fine until rates drop.

Now picture something similar, but instead of public debt, it taps into private credit.

Even better? It doesn’t take on that risk directly.

Instead, it invests in AAA-rated CLOs — high-grade, diversified bundles of corporate loans. AAA means they get paid first and carry the lowest risk.

These aren’t niche products either.

Grove is going to allocate into $JAAA, an ETF from Janus Henderson that executes the strategy above.

Today It has $21.65 billion in AUM.

What it means for @Sky? Massive potential.

And the yield?

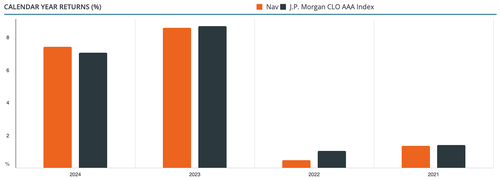

2024: 7.41%

2023: 8.58%

2022: 0.49%

2021: 1.35%

Pretty attractive.

But remember: Sky/Grove isn’t tied to this one strategy only, they can lean into private credit when markets are strong, and shift to other strategies when they’re not.

If there’s one KPI that matters for Sky right now, it’s the number of unique yield opportunities it can access. That’s what drives competitive, risk-adjusted returns at scale.

25.6.2025

🌳 Introducing @grovedotfinance - a new Star in the @skyecosystem!

Steakhouse Financial is building Grove, an institutional-grade credit platform to unlock USDS's full potential by bridging DeFi and traditional finance

8,35K

Johtavat

Rankkaus

Suosikit