Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

In Q2 $AAVE traded at a ~50x P/Revenue multiple which I initially thought was rather expensive.

Having looked at catalysts in more detail I believe @aave is one of the protocols primed to benefit from GENIUS act and the institutionalisation of crypto.

A thread 🧵

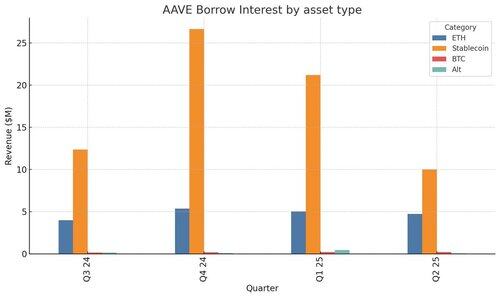

In fact over the last year 77% of $AAVE's borrow interest revenues (i.e. excludes liquidations, $GHO, and smaller revenue streams) come from stablecoin lending. Data from

In the following tweets I include some modelling as to how this might look like by 2030.

2,16K

Johtavat

Rankkaus

Suosikit