Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

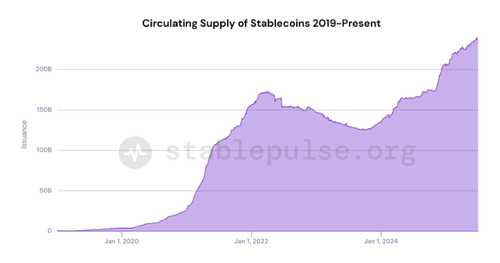

Stablecoins are spreading the dollar faster than any financial tech in history.

And Ethereum is becoming the financial backbone.

For Ethereum’s 10th birthday, we’re publishing our updated @ElectricCapital ETH thesis:

Remaking the Case for ETH 🧵

1/

3/

Demand for dollars is exploding

Individuals want USD for security: 21% of the world lives w/ >6% inflation

Businesses need it to transact

For the first time, anyone can hold dollars via stablecoins

stablecoins: 60x growth since 2020

4/

But stablecoin users don’t just want to hold digital dollars.

They want truly global financial services:

→ Yield

→ Lending

→ Investment

→ Wealth creation

Traditional finance can’t serve this market.

Ethereum can.

5/

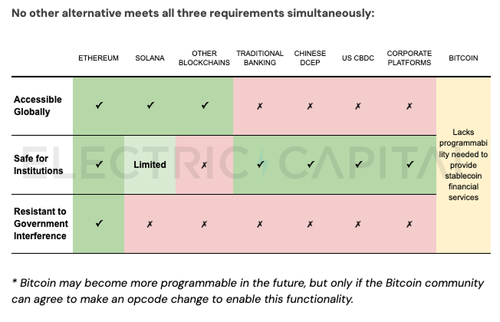

To meet this demand for truly global financial services, a system must be:

– Accessible globally (no geographic gatekeeping)

– Safe for institutions (security + regulatory clarity)

– Resistant to gov't interference

Ethereum delivers all three.

6/

How Ethereum uniquely delivers a global financial system:

→ Accessible: 24/7, open to anyone with internet

→ Safe for institutions: 10+ yrs uptime, ETH = commodity, customizable L2 stack, largest DeFi economy

→ Gov-resistant: no single point of control

7/

Ethereum delivers on all 3 requirements because of its decentralization built over 10 years:

→ Community-funded PoW launch

→ 1M+ validators across 100+ countries + client diversity

→ Largest open source dev ecosystem

This level of neutrality is nearly impossible to replicate

8/

Today, Ethereum hosts the world's largest digital financial economy:

– $140B+ in stablecoins

– $60B+ in DeFi

– $7B+ in tokenized real-world assets

9/

ETH is becoming the reserve asset of the onchain dollar economy.

Reserve assets are trusted assets used for collateral, savings, & settlement

TradFi has US treasuries, usd, gold

On Ethereum, it’s ETH:

→ Scarce

→ Yield-generating

→ Deeply integrated

→ Seizure-resistant

283,46K

Johtavat

Rankkaus

Suosikit