Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

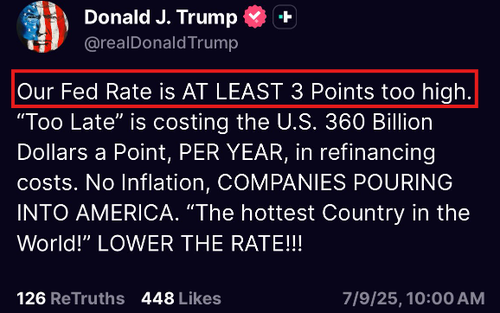

It's official:

President Trump is now calling for the first 300+ basis point interest rate cut in US history.

This would be 3 TIMES larger than the 100 bps cut on March 15th, 2020, the largest in history.

So, what happens if the Fed does this? Let us explain.

(a thread)

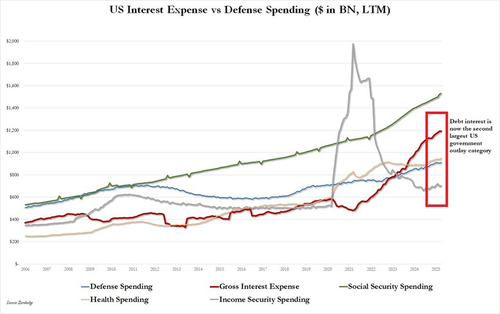

First, President Trump mentions that higher rates are costing the US more money on interest expense.

At a high level, this is true.

Annual interest expense on US debt has reached $1.2 TRILLION over the last 12 months.

The US is now paying $3.3 BILLION in interest per day.

Now, let's examine the benefits.

President Trump claims a 300 bps rate cut would save $360B/point per year, or $1.08T/year.

It seems Trump computed the $360B/year figure from 1% x $36 trillion in US debt.

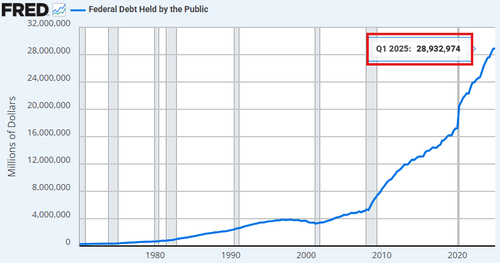

However, only publicly held debt matters, which stands at ~$29B.

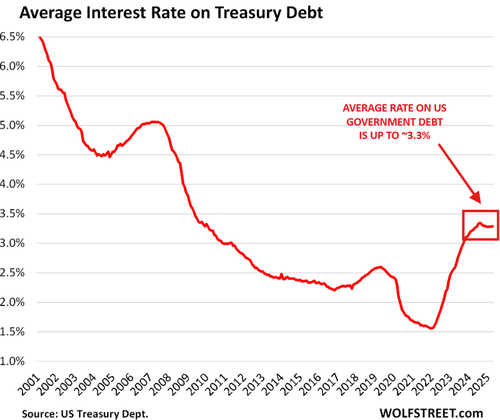

The average rate on US debt is ~3.3%.

If the rate on ALL $29B in public debt was cut by 300 bps, the US could save $290B × 3 = $870B/year.

However, refinancing all of this debt immediately would be impossible.

Realistically, 20% could be refinanced in year 1 to save ~$174B.

Let's assume the 300 bps of rate cuts are applied to 20% of US debt held by the public per year.

5-year cumulative savings on interest expense could near ~$2.5 trillion.

But, what about the costs?

A 300 bps rate cut would send shockwaves through the economy.

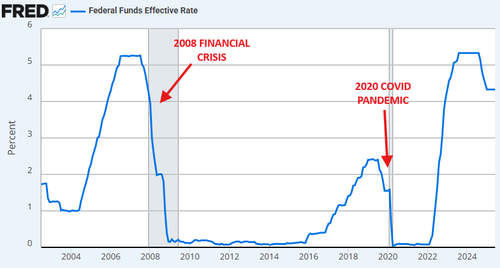

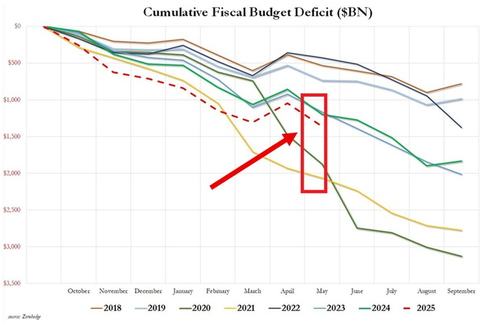

To put this into perspective, take a look at the chart below.

Not even 2008 or 2020 saw a single rate cut of over 100 basis points.

In March 2020, we saw an emergency cut of 100 bps, or ONE THIRD of what Trump is calling for now.

100 bps is the largest single cut in history.

This would come with a US economy that is already growing at +3.8% YoY.

As a result, we would expect to see a resurgence in CPI inflation, likely exceeding 5%.

And, while it would initially send stocks higher as seen in March 2020, there's no such thing as "free money."

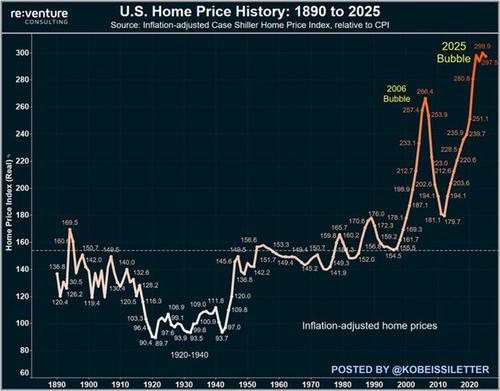

What about housing?

Mortgage rates would fall from ~7% to ~4% into a market that has already seen prices rise +50% since 2020.

We believe home prices would rise another 25%+.

While mortgage rates would drop, the surge in prices would undo any affordability improvements.

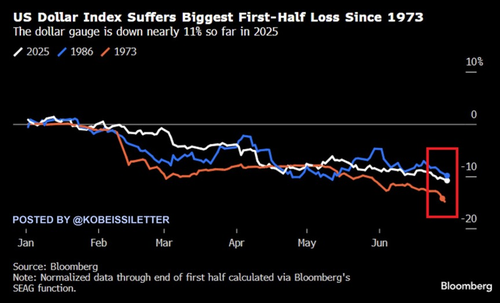

Furthermore, the US Dollar would see a significant drop, which we see exceeding -10% from current levels.

This would build on a -10.8% drop in the USD in Q1 and Q2 2025, the worst start to a year since 1973.

On the positive side, it would encourage more trade with the US.

It's also worth noting that the Fed has never implemented a rate cut of 75 bps or more outside of a recession.

As we are clearly NOT in a recession right now, history would be made.

A super-sized rate cut into a strong economy would serve as short-term "jet fuel."

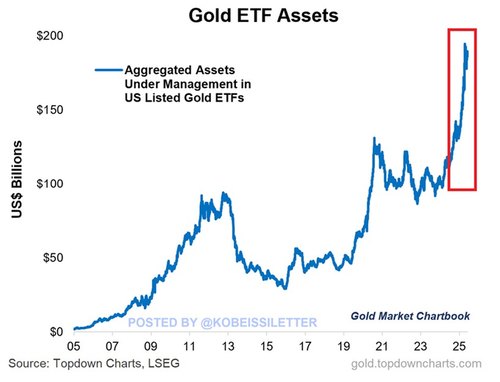

We think gold prices would surge to $5,000+ as inflation rebounds and the USD drops.

As we saw in 2021-2024, gold benefits from this type of economic environment.

In fact, gold is now up +40% in 12 months and +80% over the last 5 years.

Rate cuts would super-charge this run.

In other words, just about ALL asset prices would skyrocket.

We believe a 300 bps rate cut would push the S&P 500 to 7,000+, oil prices to $80+/barrel, gold to $5,000+/oz, and home prices +25%.

The near-term effects would be bullish, but long-term inflation would surge.

Lastly, we continue to believe the solution to rapidly rising US interest expense is simply to borrow less.

The US Treasury posted a $316 billion budget deficit in May, the third-largest on record.

We have a spending problem which can NOT be resolved by interest rates.

2,54M

Johtavat

Rankkaus

Suosikit