Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Q2 2025 On-Chain Data Recap: AI & Social DApps Surge, DeFi Faces Challenges

On-Chain Data Analysis

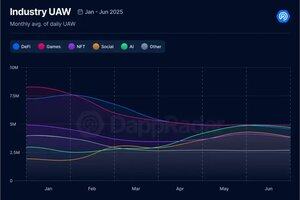

In Q2 2025, the average daily active unique wallets (DAUWs) for DApps reached 24.3 million, down 2.5% quarter-on-quarter but up 247% compared to early 2024.

-The number of active wallets in the DeFi sector decreased by 33%, GameFi dropped by 17%, while Social and AI DApps saw an increase in active wallets.

-The newly introduced "Dormant DApp" metric shows a 2% increase in inactive DeFi DApps, a 9% increase in gaming DApps, a 10% increase in NFT DApps, a 40% decrease in inactive high-risk DApps, and a 129% increase in inactive AI DApps, corresponding to 16 applications.

-Active wallet numbers across DApp sectors diverged: DeFi and GameFi declined by 33% and 17% respectively, while Social and AI DApps saw significant growth, with AI agent DApps particularly strong and Virtuals Protocol standing out.

Total DeFi TVL (Total Value Locked) reached $200 billion, up 28% quarter-on-quarter, with Ethereum contributing a 36% rebound.

-DeFi sector fundraising was $483 million, down 50% quarter-on-quarter, with a total of $1.4 billion raised in the first two quarters of 2025.

-Ethereum maintained its dominance in DeFi with a 62% share of TVL, Solana accounted for 10%, and Hyperliquid L1 saw an outstanding 547% TVL surge.

NFT market trading volume fell 45% to $867 million, but transaction count surged 78% to 14.9 million, and the number of traders increased by 20%, reflecting a sharp drop in average prices alongside increased user activity.

-RWA (Real World Asset) NFTs saw a 29% increase in trading volume, becoming the second-largest NFT segment, with Courtyard platform ranking as the second-largest NFT marketplace for the quarter.

-Game NFT trading was led by Guild of Guardians, surpassing BAYC and CryptoPunks, marking a pivotal shift in the game NFT market.

Data Insights and Industry Analysis

The DApp ecosystem is undergoing profound changes in user behavior and market structure, with AI agent and social DApps rising rapidly and gradually encroaching on the market share of traditional DeFi and gaming, indicating growing demand for utility and task-oriented capabilities.

The NFT market is shifting from status-driven assets to functional and real-world asset tokenization (RWA), with increased transaction volume and user activity but lower prices, signaling a fundamental transition from speculation to value empowerment, further reinforced by the rise of game NFTs.

Although DeFi benefited from a crypto market rebound and saw a substantial increase in TVL, the sharp decline in fundraising reflects capital markets' caution, suggesting DeFi is entering a more mature capital allocation phase where future growth will rely more on real utility than hype.

User retention and funding remain major challenges for AI and game DApps; despite rapid growth, high inactivity rates and financial pressure indicate short project lifecycles, making user experience and security critical for future competition.

Outlook

AI agent and social DApps are expected to maintain rapid growth, with AI applications likely to surpass Gaming or DeFi in user activity by year-end, becoming the new dominant force in the DApp ecosystem.

The NFT market will be further driven by RWA and gaming assets, with real-world asset tokenization poised to become a key catalyst for mainstream NFT adoption, leading to a more diverse and functional market structure.

The DeFi sector is set to enter a phase of more rational capital allocation and application value orientation, with TVL likely to keep growing but fundraising slowing, making project quality and security the focus for investment.

While overall price data has rebounded recently, on-chain data structures continue to evolve, and user behavior and market structure are undergoing significant transformation; OKX Ventures will continue to monitor and share ongoing developments.

Reference https://t.co/mhCukRKES5

3,7K

Johtavat

Rankkaus

Suosikit