Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

This is not a "normal."

We have reached a point where Bitcoin is moving in a literal STRAIGHT-LINE higher.

Rates are rising, the USD is down -11% in 6 months, and crypto is up +$1 TRILLION in 3 months.

What's happening? Bitcoin has entered "crisis mode."

(a thread)

Bitcoin has reached a point where it is quite literally making new all time highs multiple times a day.

Since the US House passed President Trump's "Big Beautiful Bill" on July 3rd, Bitcoin is up +$15,000.

If the surge in gold prices didn't alert you, Bitcoin should.

Does it get any more obvious than this?

Take a look at the YTD performance of Bitcoin and the US Dollar Index, $DXY.

There were two distinct points of divergence:

April 9th after the 90-day tariff pause and July 1st as the "Big Beautiful Bill" was passed.

It's beyond clear.

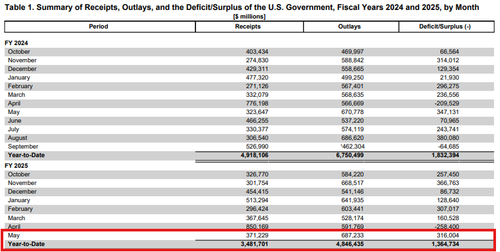

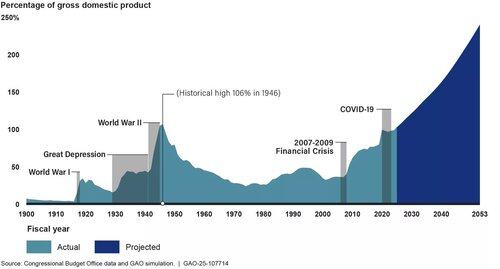

Heading into July, the market received data that the US posted a $316 BILLION deficit for May 2025 alone.

This marked the 3rd largest deficit on record, but markets remained hopeful as @ElonMusk pushed back on the spending bill.

But, this did not last long into July.

And, it seemed that Bitcoin was rallying on trade deal hopes.

But, whether trade deals were announced or not, the market was seeing the same outcome:

Yields are rising, Bitcoin is rising, the USD is falling, and gold is rising.

This simply is not a "normal" situation.

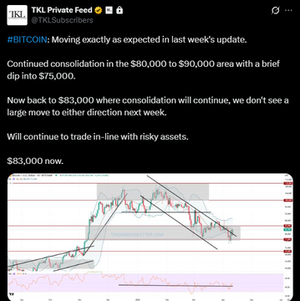

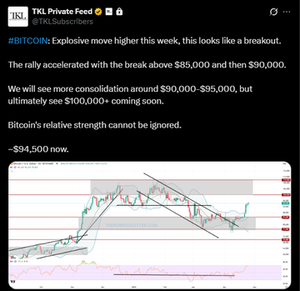

We got ahead of this trend. Below are some alerts for our premium members.

We bought dips into $80,000, $90,000, $100,000 and called for $115,000.

On Friday, we raised our target to $120,000+ which was just hit.

Subscribe below to access our alerts:

It's really a double-whammy for gold and Bitcoin here.

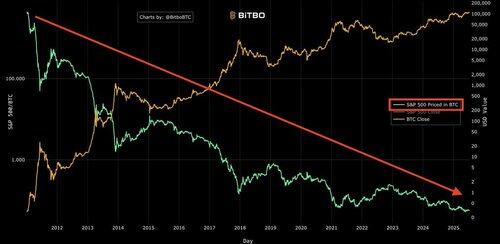

The S&P 500 in Bitcoin terms is DOWN -15% year-to-date.

Since 2012, the S&P 500 in Bitcoin terms is down -99.98%.

Not only is Bitcoin gaining value, but the US Dollar is losing value.

Once again, watch the US deficit.

And, it appears that institutional capital is chasing this Bitcoin run.

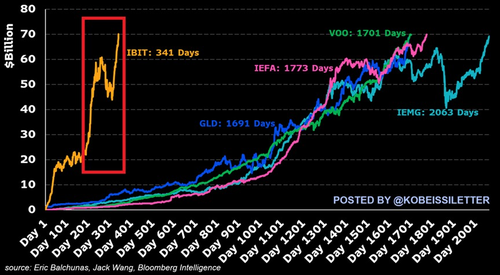

Bitcoin ETF, $IBIT, has reached a record $76 BILLION in assets under management in under 350 days.

By comparison, it took the largest gold ETF, $GLD, over 15 years to reach the same milestone.

In our discussions with institutional investors, we have noticed a recurring theme.

Family offices, hedge funds, and institutional capital, more broadly speaking, can no longer ignore Bitcoin.

Even the "conservative" funds are looking to allocate ~1% of AUM to BTC.

Furthermore, when we say Bitcoin has entered "crisis mode" this isn't necessarily a bearish call for other assets.

In fact, risky assets will continue to run higher as the short-term effects of more deficit spending are "bullish."

The long-term effects certainly are not.

The ironic part is that eliminating the US deficit would solve most of our problems.

It would lower rates, reduce inflation, and strengthen the US Dollar.

But, Bitcoin knows this clearly will not happen, with the rally accelerating after the spending bill was passed.

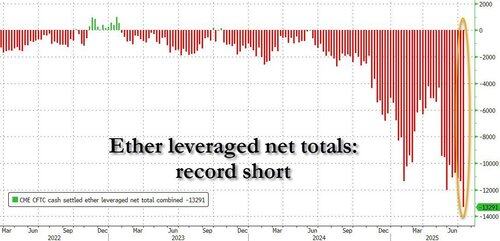

Lastly, it's interesting that leverage shorts on Ether are now at a record high, per ZeroHedge.

We saw the same exact situation before the April 2025 bottom.

Is a major crypto short squeeze set to begin?

Follow us @KobeissiLetter for real time analysis as this develops.

1,88M

Johtavat

Rankkaus

Suosikit