Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

[SMART MONEY]

News that shows why REAL YIELD matters 👇

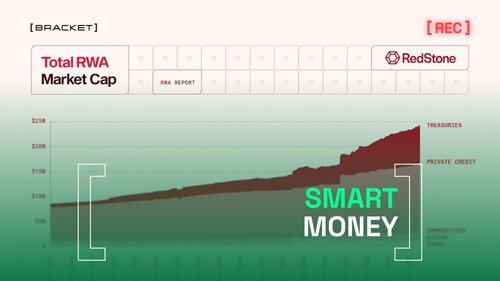

"RWA tokenization exploded from $5B in 2022 to over $24B by June 2025 (+380%), making it crypto’s 2nd fastest-growing sector after stablecoins."

- @redstone_defi, @gauntlet_xyz, @rwa_xyz

RWA summer is real.

And it’s not a niche narrative anymore . . .

Tokenized real-world assets (RWAs) have grown 380% since 2022,

from $5B to over $24B as of June 2025.

BlackRock, JPMorgan and others moving from pilot to production.

Private credit leads the way, $14B+ in DeFi-native lending.

Protocols like @maplefinance and @pendle_fi are already running it.

@Securitize is bridging compliance.

RedStone is building price oracles for it all.

Why does this matter?

Because RWAs unlock a $400T TradFi market value . . .

That’s 130x bigger than the current crypto cap.

And they do it with infrastructure.

RWAs are turning real-world capital into composable DeFi money.

Not just stored. Put to work.

[SMART MONEY] knows what this means . . .

More onchain liquidity.

New sources of structured yield.

Next phase of the DeFi cycle, already in motion.

Understand the rails.

Watch the inflows.

Yield is no longer just about crypto-native assets . . .

It’s about asset classes coming onchain.

2025 = Everything Changes

Source in 🧵

3,55K

Johtavat

Rankkaus

Suosikit