Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

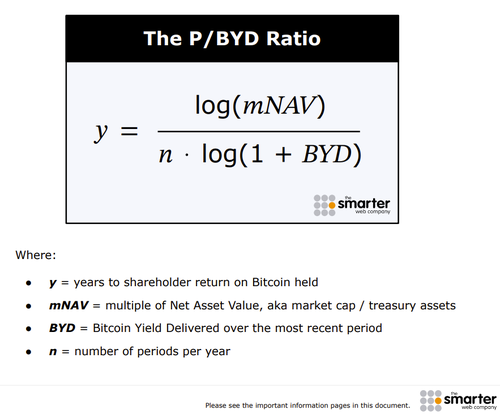

Just read the @Croesus_BTC document on their new metric P/BYD (pronounced p-bid)

Firstly, I am super happy that $SWC is putting this sort of stuff out there to move the whole industry forward - it really enhances the MSTR (US), MTPL (JP) and SWC (UK) as the top 3 narrative.

Secondly I really like the metric as an improved version of Days to Cover, focusing specifically on the BTC Yield over set time periods, the 'n' value.

Initially I was skeptical reading it (as I have been of the Days to Cover metric) as P/BYD assumes the same level of growth can be maintained.

But as Jesse points out, both SWC and MTPL have actually accelerated growth more recently on the P/BYD metric.

Tracking and looking at P/BYD over different time periods is how you can get a better read of it.

I.e. I imagine you will need to look at a 30 day P/BYD, QTD, YTD, H1, and 1Y P/BYD.

Very interested in others thoughts on this.

7,59K

Johtavat

Rankkaus

Suosikit