Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

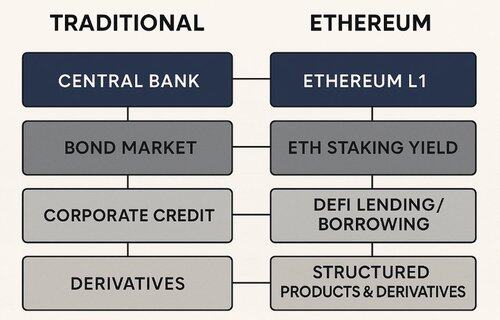

Ethereum is not just a technology platform anymore, it’s evolving into a monetary layer.

It’s an exciting moment for me, one that brings me back to my early days contributing to the development of Singapore’s capital markets in early 90s. Back then, we were laying the foundations of a bond market from scratch in a small, open economy with no independent monetary policy. Not unlike crypto today. The process was iterative: first creating sovereign benchmarks, then enabling corporate credit issuance, and eventually building a robust ecosystem for derivatives and structured products. That infrastructure became the backbone of Singapore’s rise as a global financial center.

Watching Ethereum evolve now with native yield curves, programmatic collateral, and decentralized rate formation, feels remarkably familiar. We're witnessing the early architecture of a new financial system emerge, this time on-chain. The parallels are striking, and the potential is just as real.

For years, Ethereum was known as the blockchain for smart contracts and decentralized applications. Most people still see Ethereum as “tech.”Smart contracts. Gas tokens. Scaling problems. But that narrative is getting stale. Recent developments suggest a shift is underway,one that mirrors the evolution of fiat-based capital markets.

The latest Q2 ETH report from The DeFi Report, summarized by @BanklessHQ, tells a different story, one the mainstream continues to overlook: Ethereum’s transition toward becoming a store-of-value network with bond-like characteristics, something akin to a sovereign infrastructure for digital finance.

“Ethereum is showing clear signs of evolving into a store of value (cue the Blue Money Gospel).” [Bankless]

Here are the signals:

🔹 L2s handle the volume and execute. L1 settles. Activity now lives on rollups with 12.7x more daily transactions than Mainnet. But value consolidates on Ethereum L1. TVL, RWAs, treasuries, they anchor to base layer security. Ethereum is behaving less like a smart contract platform, more like monetary infrastructure.

🔹 ETH is hoarded, not spent.

ETH supply on exchanges is falling. DeFi activity down. But staking, treasuries, and ETFs up. ETH isn’t leaving. It’s being stored. Like dollars in uncertainty, ETH is becoming a preferred reserve not a medium of exchange a new type of balance sheet positioning

🔹 ETH staking yield is monetary, not economic.

88% of validator rewards come from issuance, not transaction fees. Ethereum now looks less like a revenue-generating business, more like a central bank issuing native bonds. This is a hallmark of bond-like assets: yield is driven by monetary policy, not usage-based revenue.

🔹 Institutions are accumulating.

ETH on ETF balance sheets rose to 4.1M (+20% QoQ). Corporate treasuries increased 5,800% in just one quarter. This isn’t DeFi degens playing games. It’s macro allocation behavior, a real institutional positioning in digital base-layer assets

It’s been fascinating to watch how @TreehouseFi , a financial data and infrastructure company I’m particularly fond of, recognized this paradigm shift early.

Their development of DOR, a benchmark methodology to track ETH-native yield using a novel consensus mechanism, addresses a growing need for transparent, standardized pricing tools in DeFi. In a world where ETH is no longer just transactional gas, but a core layer-1 yield instrument, such tools are foundational.

Treehouse’s framework maps out the yield curve of Ethereum:

TESR (Treehouse Ethereum Staking Rate) quantifies validator returns, effectively representing Ethereum’s “base rate”, akin to Fed Funds.

TELR (Lending) and TEBR (Borrowing) are liquidity-weighted indexes tracking ETH money market rates across DeFi, akin to SOFR or LIBOR in traditional finance.

Treehouse launched tETH, a tokenized representation of staking yield. It’s composable, DeFi-native, and contributes to the convergence of fragmented on-chain ETH rates. This not only improves capital efficiency, but also enables ETH to function as programmable collateral in more sophisticated financial structures.

For regulators, this shift challenges assumptions about crypto being purely speculative. ETH is behaving more like a monetary instrument with predictable issuance and defined roles in financial infrastructure. For fintech innovators, it opens the door to building products that integrate digital yield, programmable debt, or structured on-chain exposure.

For institutional investors, it represents the emergence of a digital asset class with interest rate curves, monetary dynamics, and treasury-like behavior, but global, composable, and permissionless.

We're witnessing the organic formation of a digital capital market with Ethereum as the base layer and ETH functioning as a digital sovereign bond.

#ETH #ethereum #DeFi #Treehouse #tETH #DOR @mytwogweis

822

Johtavat

Rankkaus

Suosikit