Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

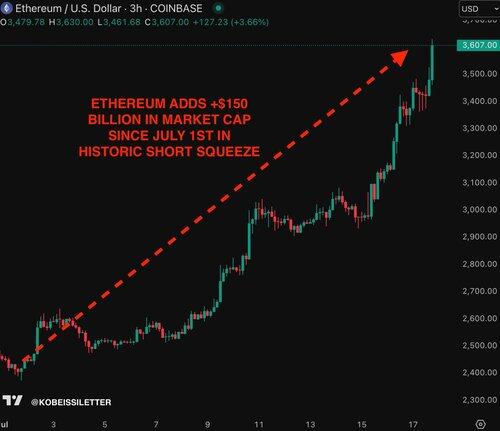

Ethereum is making HISTORY:

We are currently witnessing one of the LARGEST short squeezes in crypto history.

Ethereum has added +$150 BILLION in market cap since July 1st, days after net SHORT exposure hit record highs.

What's happening? Let us explain.

(a thread)

Take a look at the chart below:

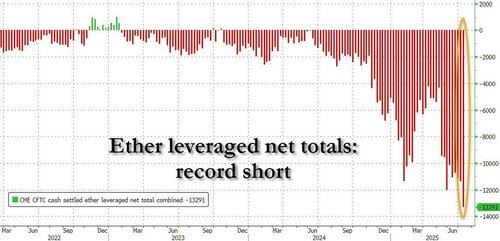

Heading into July, net leverage shorts on Ethereum hit a record high, per Zerohedge.

In fact, net short exposure was ~25% ABOVE levels seen in February 2025.

As a result, Ethereum has surged +70% in less than one month.

But that's not all.

And, it get's even more interesting:

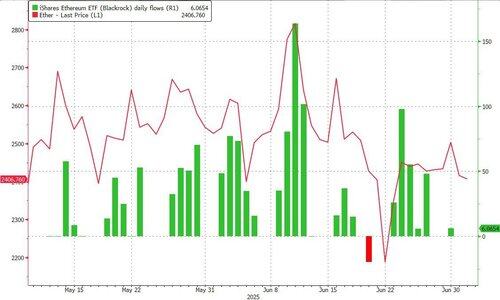

Heading into July 1st, Blackrock's ETF added Ethereum on 29 of the previous 30 days, per Zerohedge.

Yet, prices were DOWN because of the sudden surge in leveraged short exposure, as noted in the above post.

Someone knew this was coming.

We are seeing similar effects in Ripple as well as relative strength in Bitcoin.

Bitcoin is officially back at $120,000 and has now added +$900 BILLION of market cap since the April low.

After months of lagging, Ethereum and Ripple are finally catching up to Bitcoin.

Furthermore, markets are now pricing-in a massive report from FT today.

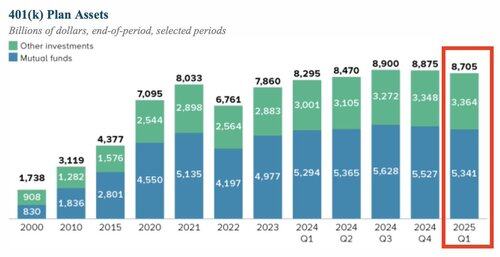

President Trump is set to sign an executive order as soon as this week allowing 401k retirement plans to invest in crypto.

This would be one of the most bullish developments in crypto history.

As of Q1 2025, there are a whopping $8.7 TRILLION in US 401Ks.

To put this into perspective, the total market cap of crypto is currently $3.8 trillion.

This means capital worth ~2.3 TIMES more than the entire crypto market will soon have access to crypto.

This is historic.

On top of this, the US House passed all three major Bitcoin and crypto bills this week:

1. Clarity Act

2. Genius Act

3. Anti-CBDC Act

The biggest win for crypto is that it now has bipartisan support.

Candidates who do not embrace crypto are no longer able to win elections.

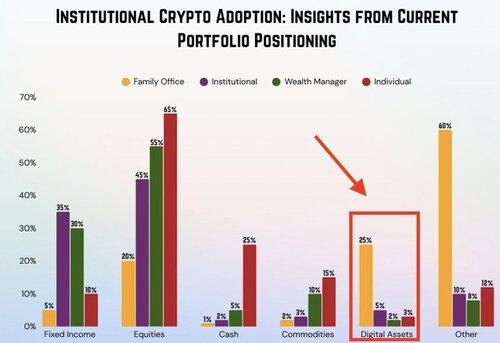

As we have said, institutional capital can no longer ignore crypto.

Bitcoin has seen a +90% CAGR over the last 13 years, crushing just about any asset in the world.

We continue to hear from a growing number of institutional investors that AUM is being allocated to crypto.

Lastly, don't forget about the biggest bullish driver of crypto: the US deficit spending crisis.

Not only is Bitcoin up +55% since April, but the USD is down -10% YTD.

The USD is in an eternal bear market.

Follow us @KobeissiLetter for real time analysis as this develops.

1,59M

Johtavat

Rankkaus

Suosikit