Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

[SMART MONEY]

News that shows why REAL YIELD matters 👇

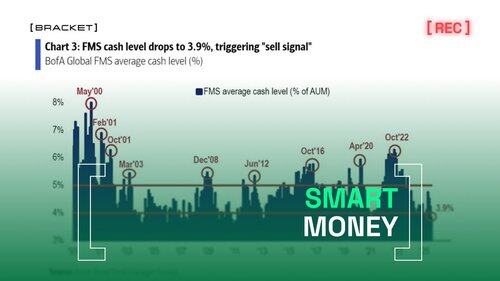

"Fund managers' cash allocation has dropped to 3.9%, the second-lowest in 12 years, according to a BofA survey of 175 participants with $434 billion in assets."

- @KobeissiLetter

Global fund managers are going risk-on.

According to BofA’s latest survey,

Cash allocations just dropped to 3.9%, the second-lowest in 12 years.

Risk levels in portfolios? Highest on record since 2001.

That’s not a fluke.

It’s the third straight month of rotation out of cash.

Tech stocks saw their biggest 3-month allocation spike since 2009.

This is what strong bull market sentiment looks like . . .

When cash gets sidelined and risk appetite climbs,

it’s not just price action, it’s positioning.

And positioning this aggressive usually signals conviction.

This backdrop matters more than most realize . . .

When TradFi goes risk-on, onchain liquidity tends to follow

As portfolios stretch for return, institutional allocators step to the plate on upcoming mandates with a vibe.

Where can I increase exposure?

Where can I find asymmetric upside?

This is macro tailwind season . . .

And it sets the stage for yield-bearing crypto products to benefit as capital rotates further out the risk curve.

Cash is out.

Conviction is in.

And in a market like this, understanding where the flows goes next is everything.

[LFG]

Source in 🧵

697

Johtavat

Rankkaus

Suosikit