Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

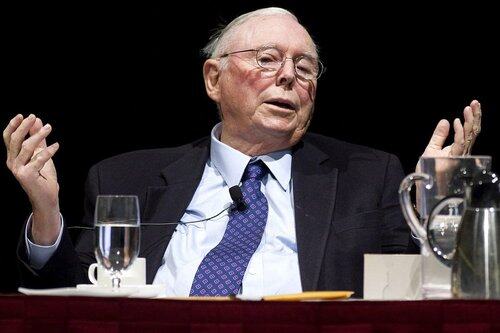

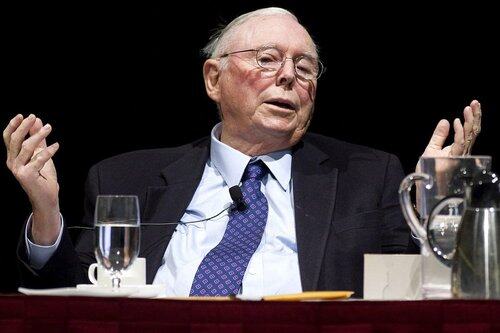

Charlie Munger once said:

"Only those with character can sit there with cash and do nothing. What I have today is thanks to not chasing mediocre opportunities."

Here are 7 investment principles I've learned from him: 🧵

1. Characteristics of Excellent Companies

The best companies usually share three common traits:

• Simple business model

• Competitive advantage

• Strong management capabilities

If all three are present, the only thing left to consider is the price.

2. Reverse Thinking

If you want to make money in the market, the focus should be on:

How you are losing money, and then avoid doing those things.

The most money I personally make often comes from stocks that I think won't lose too much, rather than those I think will make a lot.

3. Observe the overlooked areas

If you don't have much money right now and can't raise funds from others, you won't get rich by investing in obvious opportunities.

You need to focus on small companies that institutions cannot invest in.

That is where your opportunity lies.

4. Play the Long Game

In the market, most people only focus on the short term.

This makes the market act like a voting machine in the short term, but like a weighing machine in the long term.

When most people are fixated on the short term, if you are willing to look at issues from a long-term perspective, you gain a competitive advantage.

5. Learn from the mistakes of others

Learning from your own mistakes is costly;

Learning from others' mistakes is free.

Learn as much as possible from the failures of others.

6. Don't short

Shorting is a zero-sum game.

Even if you make the right call, you could still lose money.

But if you go long and make the right call, you will definitely make money.

The risks of shorting are too high; there's no need to take that path.

7. When you're wrong, you need to change your mind.

Don't stubbornly cling to mistakes just for the sake of pride.

Pride won't make you money; it will only lead to losses.

As Stanley Druckenmiller said, a great investor must learn the art of being flexible.

Rigid thinking in investing is equivalent to slow death.

Thanks for reading! 👍

Chinese translation from:

Follow me @0xCheshire for more content.

If you liked this article, please help retweet 🔄 the first tweet so that more people can see it: 👇

18.7. klo 20.08

Charlie Munger once said:

"Only those with character can sit there with cash and do nothing. What I have today is thanks to not chasing mediocre opportunities."

Here are 7 investment principles I've learned from him: 🧵

28,2K

Johtavat

Rankkaus

Suosikit