Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The GENIUS Act is getting signed today, bringing clear rules of the road for stablecoins.

Here's why stablecoins are better money, how they're better for people and businesses, and the mental models you can use to understand them.

My master thread on stablecoins.

👇

First, stablecoins are better money. They are faster, cheaper, and more global than legacy payments (card, bank, etc). Plus they're easier to program, so entrepreneurs can build better products.

That's why stablecoins will eat payments.

13.12.2024

Stablecoins will eat payments

Today the payment landscape is dominated by gatekeepers & extractive networks - stifling competition, limiting the creativity of builders & taxing the profitability of every business

All businesses want to add 2% to their bottom line

Here's how👇

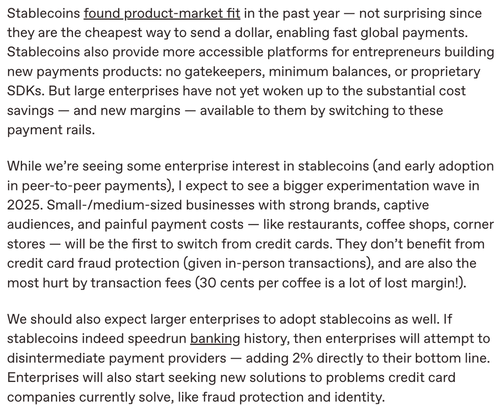

Last year, we knew stablecoins would change payments, but we were still early into the narrative. If you want to understand the different types of stablecoins and how they relate to the best historical analogy, bank notes, this is the post for you.

14.11.2024

Stablecoins have found product market fit - they're a nearly free, nearly instant, infinitely flexible payments platform. There are over $160B stablecoins issued & they were used for 2x the volume of the Visa network! ($8.5T v $3.9T in Q2 24)

Here’s my framework for stablecoins.

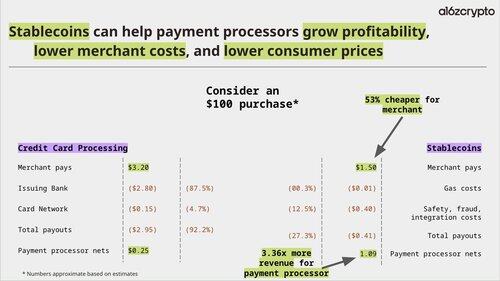

Stablecoins will win because they improve profitability for payment processors AND merchants by simplifying the payment process and reducing middlemen.

Everyone benefits except extractive networks.

7.6.2025

The reason payment processors are adopting stables is simple: they can make more money while offering a better product.

Stablecoins improve the profitability of the lowest margin businesses the most: restaurants, grocery stores, coffee shops

All businesses want to add 2% to their bottom line (profits!). Some businesses can do this by encouraging customers to switch to stablecoin payments.

5.12.2024

Stablecoin adoption in payments is going to happen surprisingly fast. All businesses want to add 2% to their bottom line!

My contribution to a16z's Big Ideas in Crypto for 2025 👇

Stablecoins encourage competition. Entrepreneurs can build better, global products more easily, expanding consumer choice.

Just as the cloud made it easier to build a website or a SaaS product, stablecoins will make it easier to build financial products.

14.6.2025

Stablecoins are better because they encourage competition.

Now anyone can program money - the fixed & marginal costs of building a fintech are lower. More competition = better prices, better experiences, more access

Speed & cost (< 1 second, 1 cent) matter, but it's the permissionless programmability that's going to change the market

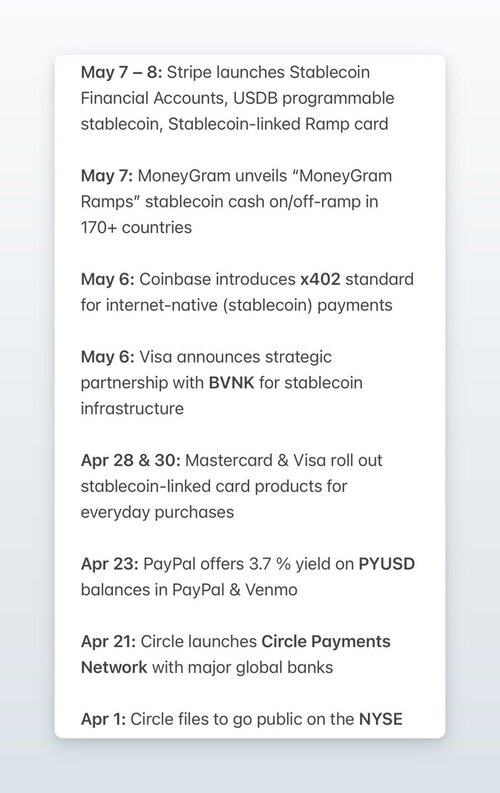

Fintechs are already embracing stablecoins. The spring of 2025 was among the most important in payments history as big payments companies began to invest seriously in better money.

9.5.2025

The past month has been among the most important in payment history: the month fintechs embraced stablecoins

Legacy payment companies are bootstrapping an onchain economy.

I break down the key announcements & share my thoughts on what they mean for the industry

Full post below

There are still problems to be solved (although these problems are easier to address with the GENIUS Act's clear regulation).

Stablecoins have clear rules of the road today, but the next step is for stablecoins to "just be money"

5.6.2025

There are three structural issues we have to solve before stablecoins become money:

1️⃣ universal stablecoin fungibility

2️⃣ dollar stablecoins in non-dollar economies

3️⃣ effects of better money backed by treasuries

A lot here. Let's unpack & look at the opportunities. Essay 👇

We're still early. With clear regulation, entrepreneurs and businesses can improve how stablecoins become part of everyday life by building:

credit, remittances, subscriptions, refunds, identity, discounting, PoS integration, onramps, offramps, wallets, foreign exchange, streaming payments, micropayments, compliance, KYC, tax integration, analytics, ERP integration, invoicing,

Today is a great day. The GENIUS Act is inflection point in the history of payments, money, ownership, and financial inclusion.

I'm excited about the next chapter. With better, cheaper, faster money, new products, and global access to dollars.

Read all my work on stablecoins here:

19,19K

Johtavat

Rankkaus

Suosikit