Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

alphanonce Intern

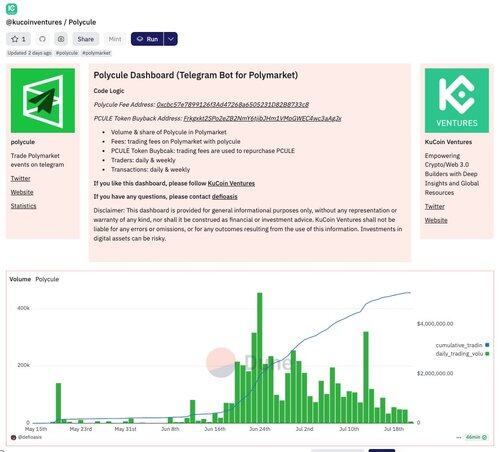

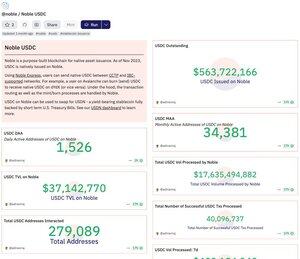

Cross-chain stablecoin infra, @noble_xyz

USDC circ

• Outstanding across the chains: $564M

• TVL on Noble network: $37M

Bridging volume

• Cumulative volume: $18B

• 7d volume: $400M

• 24h volume: $94M

• Average bridging size: $6K

Users

• Cumulative users: 279K

• Monthly users: 34K

• Daily Users: 2K

Via noble, you don't need to pay slippage on $USDC for bridging even when CCTP does not support chains. Truly remarkable tech

@noble_xyz is possibly the most important crypto native infrastructure in the stablecoin mania, which almost nobody realize

wen token

NobleJul 24, 22:31

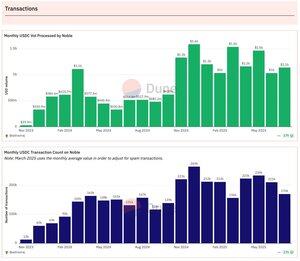

USDN just passed $1B in all-time volume.

Plenty more to come.

Check out analytics via @Dune here:

6.8K

SBET absorbing entire $ETH from the open market

hearing rumor that OTC desks have 40 $ETH only across the board

Alex Svanevik 🐧Jul 17, 15:28

Ethereum Foundation has run out of ETH?

7.4K

On @PlasmaFDN ecosystem, focusing on native projects

Plasma

• L1 for stablecoin transactions with Zero fee, secured by $BTC network

• Raised $20M from @hiFramework, @foundersfund, and @bitfinex

• Partnering with @ethena_labs, @CurveFinance, etc.

USDT0

• Native stablecoin of @Tether_to

• Direct bridge with $ETH, $TRX, and $TON

@AxisFDN

• Stablecoin $xyUSD, reflecting tokenized hedge fund

• Basically, onchain structured credit

@hadron_tether

• Asset tokenization protocol by @tether

• Stock, bond, commodities, etc. for tokenization

@BiLira_Kripto

• $TRY stablecoin with onramp & offramp

@USDai_Official

• GPU collateral backed stablecoin

• estimated APR 15-25%

• Developed by @permianlabs, on Hyperliquid & Plasma

@MANSA_FI

• Global stablecoin payment infra

• Liquidity infrastructure for cross-border settlement

• Backed by @Tether_to

@uraniumdigital_

• Tokenized uranium with physical reserve in Canada

• Regulatary compliant RWA solution

16.26K

worth to make a try.

PingJun 23, 2025

Jewish June

Joyful July

we try again

418

alphanonce Intern reposted

The highest EV trade I can think of right now is harvesting the risk premium in the markets from the conflict in Iran. Of course this could backfire if the conflict escalates or if Iran blockades the Strait of Hormuz. With the oil markets well supplied and positioning pretty clean in risk assets, it’s a risk I’m willing to bet against.

5.13K

Top

Ranking

Favorites

Trending onchain

Trending on X

Recent top fundings

Most notable