Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The Learning Pill 💊

Curating crypto alfa, insights and new projects so you can make it //

Nothing here is financial advice.

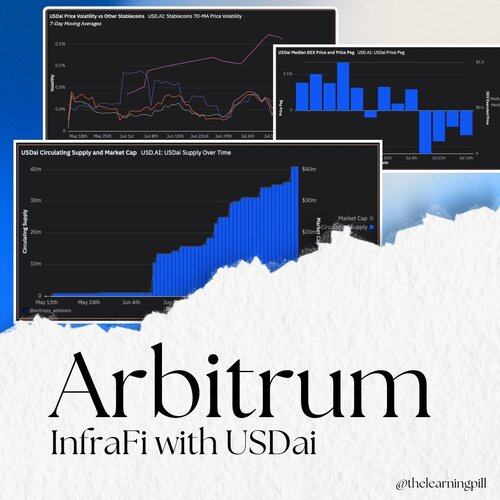

Commitment to capital efficiency looks like this 👇

• committed funds are used to farm for yield

• surplus are refunded

• bonus tokens for a boost (500K $esAMP incentives)

@AmpedFinance is no stranger to the Sonic ecosystem and will be launching soon on @AtlantisOnSonic

Atlantis17.7. klo 23.02

🌊 The $AMPED Public Sale kicks off on July 21st at 3 PM UTC.

With $300M+ in volume, $900K+ in fees, and 17.8K+ users, @AmpedFinance emerges as our first launch partner, and the numbers don’t lie. It’s going to be a massive start! 🔥

Here’s how it works 👇

3,46K

7 GUD READS 📚 (Edition No. 47)

Pill's curated list of alpha you should cannot miss → from macro perspectives on Bitcoin and Ethereum, to the final meta(?) 👇

1️⃣ Narrative economics in crypto markets by @0xjawor

2️⃣ The final meta by @peacefuldecay

3️⃣ Ethereum's "Ultrasound Money" Vision by @IngsParty

4️⃣ The Myth of the Billion-Dollar Idea by @chilla_ct

5️⃣ Can Monad Really "Make It"? By @Defi_Warhol

6️⃣ Bitcoin is the most important asset of our generation. By @Lombard_Finance

7️⃣ From HODL to High Finance: The Narrative Arc of Crypto’s 2025 Bull Cycle by @RubiksWeb3hub

13,74K

most AI startups are basically renting their entire existence from AWS, Google Cloud, or Azure

sounds convenient, right? not entirely true...

all these reliance on AI infra will drive costs → slow down innovation → affect business viability

just these reasons usher in the case of crypto x AI, moving from traditional infra to the blockchain for cheaper, more powerful, and accessible services - something that @nucocloud could play a role in

think InfraFi would also play a huge role in the next phase of supporting AI startups

1,45K

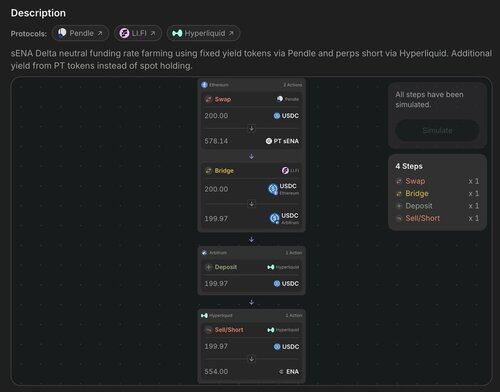

wen INFINIT v2 for us?

this is just a teaser for what's coming up on @Infinit_Labs - a truly simplified DeFi strategy that eliminates all the backend complexity for users

imagine when there are many more DeFi agents available, offering countless cross-chain strategies (already 100+ data sources)

if this also drives points accumulation (pls Pill really hope it does), then it becomes a complete no-brainer

no more manually searching for the best points farming opportunities and executing them step-by-step

this WILL change everything

INFINIT16.7. klo 23.00

Leaked from the INFINIT V2 Private Alpha:

sENA delta neutral strategy earning 69.35% APY — fully automated by INFINIT Agent Swarm.

1 click

3 protocols (Pendle, Hyperliquid, LiFi)

4 steps (PT, bridge, short)

100% user control

Input any asset, preview the flow, and let the agent swarm execute.

INFINIT V2 is coming.

The future is agentic DeFi.

10,94K

The Learning Pill 💊 kirjasi uudelleen

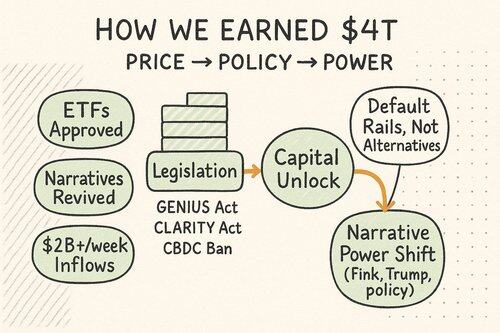

Crypto didn’t drift into a $4 trillion market cap by accident.

It was a convergence;

Of price catalysts.

Of political will.

Of power shifting from incumbents to internet-native institutions.

Let’s walk through the major milestones that turned a fringe movement into a parallel financial system on the rise.

● When the Charts Turned Conviction Into Capital

Bitcoin reclaimed the narrative in late 2024.

- Spot ETFs got greenlit.

- Sovereigns started stacking.

- Halving supply shocks coincided with fresh demand.

BlackRock, Fidelity, and Ark were no longer talking about digital gold, they were buying it on behalf of retirement savers.

The ETF flows snowballed:

- $5B+ net inflows per month since April

- Ethereum ETFs followed suit, with a delayed launch but faster catch-up

By mid-2025:

✅ $BTC broke past $120K

✅ $ETH rallied past $3.6K

✅ $XRP hit ATHs

✅ Even meme coins surged, as liquidity returned in force

But price alone doesn’t explain the $4T milestone.

12,07K

Aptos: The Global Trading Engine

• New ATH for app rev

• New ATH for spot DEX volumes

• Stablecoins supply crossing $1.3B

• BTCFi scene is growing, >$450M in bridged BTC assets

• Raptr, Shardines, Zaptos architecture making things move fast on Aptos

Blockworks Research16.7. klo 22.01

1/ With ecosystem metrics at all time highs and continued improvements on its technical architecture, Aptos is laying the foundation for a global trading engine.

Here are some takeaways from our latest report, unlocked by @Aptos 🧵

5,95K

surpassed their $1.5B syrupUSDC target

some ways to go for Maple Institutional and BTC Yield but confident the team will find the ways

anything can happen, many new developments can greatly contribute

syrUP

Maple17.7. klo 23.37

Maple reaches $3B AUM.

That's 300% growth in 3 months.

Becoming the largest asset manager onchain wasn’t enough.

Just getting started.🥞

5,16K

the USDT explosion on @Aptos has been wild

just 263 days after USDT launched on Aptos, we're seeing growth numbers that are neck-and-neck with Tron and Solana

sure, BNB is still way out in front, but the fact that Aptos is even in this conversation is pretty remarkable

so why are people flocking to mint USDT on Aptos? the answer lies in what's brewing in the eco

whether you're looking at the emerging RWA space or the rapidly evolving DeFi landscape, Aptos is becoming a playground for serious opportunities (LSTs, leveraged looping, BTCFi etc.)

the momentum is undeniable. Pill believes that Aptos' eco is nowhere near its peak

with this kind of trajectory and the infrastructure developments we're seeing, the growth story is far from over

cookiemon10.7. klo 19.35

>< Native USDT on Aptos for 263 days

Using the launch date of native USDT on each chain as day 0, we align and compare growth.

After 100 days, Aptos is far ahead.

After 263 days, it surpasses Tron and is on par with Solana, with a supply of nearly $950 million.

@Aptos has steady growth and a solid foundation, with limitless possibilities for the future.

USDT moves better on Aptos.

8,44K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin