Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

David Alexander II

Partner @anagramxyz | prev MD @BinanceLabs, OG @ConsenSys | Research @MetricsDAO | Chaotic Neutral 🌑

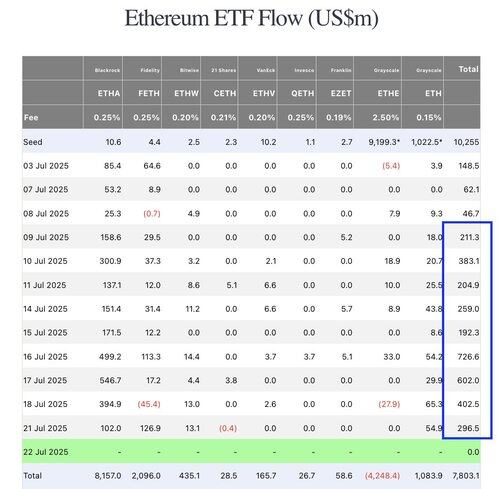

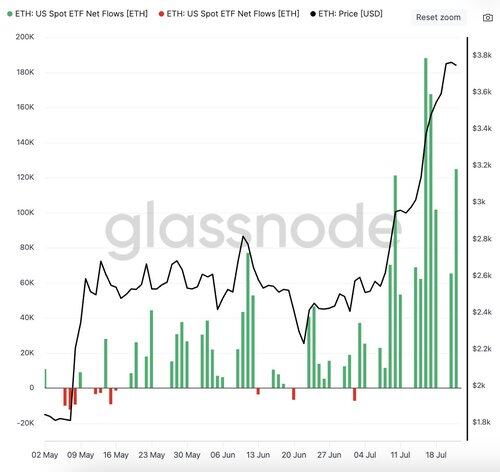

While $BTC ETFs experienced their second consecutive day of net outflows (-$68M), $ETH ETFs had their third-best day ever with $533M in net inflows.

ETH ETFs have already added $830B this week compared with BTC's -$199M.

In July, ETH ETF inflows have been positive on all but one day, and since the Pectra upgrade on May 7, inflows have been positive 85% of the time.

The tides have decidedly turned.

h/t @glassnode

5,07K

A record-breaking $4.4B of institutional inflows into digital assets last week. This marks the 14th straight week of positive net inflows and pushes the total for July to $9.2B.

Perhaps more striking is that $ETH inflows ($2.1B) are now on par with $BTC's ($2.2B).

Another interesting angle to monitor is traction with $SOL products, which have grown to $132M on the month, but are still relatively under-indexed.

h/t @CoinSharesCo

381

Another day, another record smashed: $726M poured into $ETH ETFs, the highest daily inflow ever.

This is more than the entire monthly net inflows for April ($66M) and May ($564M), combined.

Meanwhile, daily trading volumes also hit a record $2.66B, shattering the $1.8B high set earlier this week.

ETH ETFs ($1.2B) are now in position to outperform $BTC ETF inflows on the week ($1.5B) for the first time ever.

1,76K

In less than 2 months, @SharpLinkGaming has become the largest ETH treasury on the planet, amassing over 280,000 $ETH (~$836M) and surpassing @ethereumfndn. In June alone, SharpLink increased their ETH holdings by a staggering 59%.

Meanwhile, the underlying $SBET stock is up 90% month-over-month and 365% since the treasury strategy launched in May.

Congrats and buckle up @ethereumJoseph 😈

3,67K

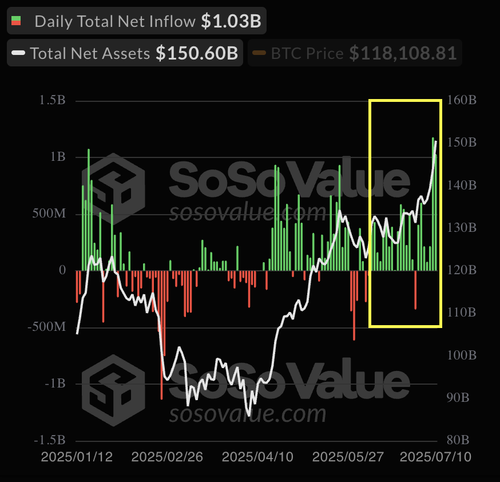

Historic week for $BTC ETFs. For the first time ever, Bitcoin ETFs had back-to-back days with over $1B in net inflows:

Thursday, July 10th: $1.17B

Friday, July 11th: $1.03B

Notably, @BlackRock's $IBIT accounted for 84% ($1.85B) of all inflows during this period. This pushes BlackRock's total Bitcoin holdings to roughly 706,000 BTC, which represents more than 3.3 % of the total circulating supply.

Overall, more than $2.72B poured into BTC ETFs this week, the most since May and the third largest of 2025. It also marks the 5th consecutive week of positive inflows.

1,48K

The first US-listed $SOL ETF offering exposure to Solana staking rewards, REX-Osprey's $SSK, experienced $58M of inflows in its first full week of trading.

ETFs with imbedded staking yield are a powerful model: investors benefit from compounding rewards, while issuers can command higher fees by earning both management fees and staking commissions.

SSK currently charges a 0.75% fee. This is 3x higher than BlackRock’s $IBIT (BTC) and $ETHA (ETH) ETF products, which don’t offer staking exposure.

h/t @FarsideUK

3,63K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin