Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Vechain's staking architecture has changed.

@vechainofficial StarGate is live, marking the network’s pivot from passive infrastructure to user-directed participation.

[Progress overview] ↓

This shift isn’t just cosmetic. StarGate introduces on-chain traceability to staking; each position is minted as an NFT, making your delegation visible, transferable and verifiable.

It turns staking from a backend process into a user-owned record.

And that matters more than it sounds.

A majority of chains treat staking as a background function; something abstract, gated, or custodial.

StarGate gives users direct ownership over their stake, with visibility, flexibility, and eventually portability.

Participation becomes an asset, not a checkbox.

There are no lockups and no external dependencies. Users can exit anytime but $VTHO rewards are paid in 7-day cycles. Even if you exit early, rewards unlock only at the end of that cycle.

For the first 6 months, 5.48B $VTHO is being distributed as bonus yield on top of base rates.

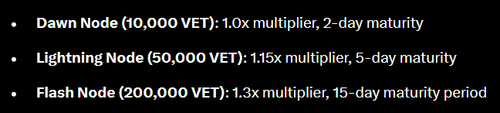

Reward rates depend on node tier and maturity period. Higher stakes unlock higher multipliers but even the lowest tier (Dawn Node, 10,000 $VET) starts earning after just 2 days.

Each node is represented by an NFT, which records your position, tier, and reward status on-chain.

To simplify tracking, each staking position is issued as a tokenized record on-chain.

This record stores:

• Your staked amount

• Node type

• Reward tier

• Maturity status

It makes your position transparent, portable (soon), and verifiable without relying on dashboards or spreadsheets.

When you unstake, the Delegator NFT is burned and the rewards end.

For regular Economic Nodes, you can restart at any time.

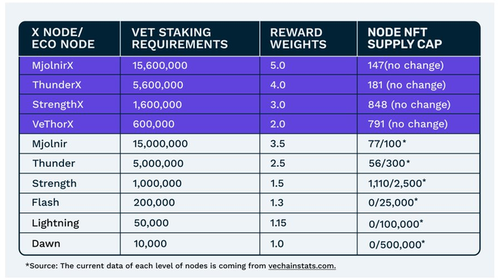

But for X-Node holders, the burn is permanent. Once unstaked, that specific X-Node and its enhanced multipliers can’t be recreated.

That permanence isn’t just a design choice.

X-Nodes were created early to recognize long-term network supporters.

Their enhanced multipliers reflect that role, but so do the strict exit conditions.

It’s a structural trade-off: higher weight, but no way back once exited.

For most users, economic nodes offer more flexibility.

You can stake, exit, and re-enter without permanent loss.

Multipliers range from 1.0x to 3.5x, depending on the amount staked and how long you're willing to wait for rewards to unlock.

Each node tier also comes with a maturity period — a short wait before you can claim your first rewards.

Examples:

• Dawn Node → 2 days

• Lightning Node → 5 days

• Flash Node → 15 days

• X-Nodes → up to 60 days

To avoid guesswork, the community built tools to model your rewards and staking splits:

→ VeChainStats APY Estimator: for visualizing yield across nodes

→ Redeno Simulator: optimizes staking strategy based on VET amount

Helpful if you’re balancing multiple node types or timing exits.

StarGate isn’t standalone, it’s part of VeChain’s broader shift:

• Galactica (now live): fee market, StarGate, staking UX

• Hayabusa (2025): validator decentralization, VTHO inflation reduction

• Interstellar (future): full EVM parity, JSON-RPC, and chain interoperability

This is phase one of a deeper protocol evolution.

Staking used to mean delegation without visibility.

Now it means holding a position with weight, timing, and consequence.

VeChain's shift with StarGate turns participation into something active and traceable.

13.33K

Top

Ranking

Favorites