Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

A.J. Warner

Building the future of Ethereum @offchainlabs with my smol brain big body | Food-lover | Opinions are my own and most importantly #budsallday

Lfg. Arbitrum Everywhere.

Nethermind7 tuntia sitten

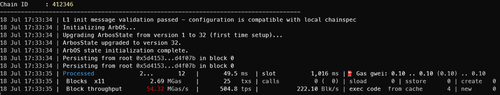

First blocks processed using the Nethermind execution client on a full @Arbitrum local chain simulation🧪 A major step in our partnership to bring high-performance client diversity to Arbitrum.

We are using a modified version of nitro-testnode to initialize a fresh local chain and process blocks using the Nethermind Client. This will be our foundation for testing newly implemented features and configurations. We are currently working on web assembly execution and adding stylus support.

Up next: Syncing to Sepolia testnet.

813

Really excited to have this chat. L2 governance and business models are very misunderstood. Time to educate.

Arbitrum Everywhere.

tunez (evm/acc) 🤖16 tuntia sitten

Join myself and @ajwarner90 from Arbitrum tomorrow at 12pm EST as we discuss L1s and L2s.

Set your reminder now 😉

1,96K

A.J. Warner kirjasi uudelleen

Back to work tomorrow after a few weeks of paternity leave 👶🏻. In only a few weeks, the growth on @arbitrum has been insane:

- Robinhood deploying on Arb One and Hood chain ⛓️

- @talos_is the 1st Onchain Labs incubated project is cooking hard👨🍳

- Huge moves locked in at Arbitrum Gaming Ventures, more soon.

- @PayPal is deploying on Arbitrum.

- Plus about 30 other big things happening every day on Arbitrum.

Fired up to be back!

4,01K

The "stablecoins have created the ChatGPT moment for crypto" narrative that @fundstrat has been sharing has been such an effective marketing campaign for Ethereum because of the perspective changes it has caused.

Ethereum really struggled the last 18 months in an environment where crypto became much more focused on short-term narratives and current revenue metrics precisely because it was not competitive across these dimensions.

The reality is, if you prioritize short-term revenue, the decision-making from an technology perspective and business development priority are not things that Ethereum is particularly good at delivering on or values.

Memecoins/Content coins, or basically anything that has an extremely low cost of capital or opportunity cost to deploy are by far the highest contributions to revenue. This is because of the sheer volume deployed, willingness to pay for sniping, and other forms of MEV that occur. It isn't that different than the NFT craze on Ethereum in 2021.

Ethereum as a chain does not have the technological design to prioritize this the same way monolithic or very high throughput chains do at scale. So they struggled.

The "ChatGPT moment" framing has shifted the pendulum back to a narrative where if you build and enable something that can change the world, the TAM is endless. This is where Ethereum, the L2 architecture and the EVM broadly shine.

Revenue matters too of course, but the form of revenue, and the ability for it to grow as a function of enabled demand is what causes the "ChatGPT moment" analogy to resonate. There is no tech stack in a better position than Ethereum for this.

We need more of this educational framing for Ethereum. This isn't a revenue story. It is a growth story enabled by revolutionary technology.

3,87K

Very smart to do this as the public is looking at mechanisms to get exposure to stablecoins. Curious to see how it plays out.

Congrats to @gdog97_ @n2ckchong and the rest of the team!

Ethena Labs21.7. klo 21.25

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol "USDE", which includes a $60 million contribution of ENA from the Ethena Foundation

Equity markets will now have direct access and exposure to the most important emerging trend in all of finance:

The growth of digital dollars and stablecoins.

To bootstrap its acquisition strategy, StablecoinX Inc. will use all of the $260 million cash proceeds from the raise (less amounts for certain expenses) to buy locked ENA from a subsidiary of the Ethena Foundation.

Starting today, the Ethena Foundation subsidiary (via third-party market makers) will use 100% of the $260 million cash proceeds from the token sale to strategically purchase $ENA across publicly traded venues over the coming weeks, further aligning the Foundation’s incentives with those of StableCoinX shareholders.

The planned deployment schedule is approximately $5m daily from today over the course of the next 6 weeks. At current prices $260m represents roughly 8% of circulating supply.

Importantly, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion. Ideally, tokens will never be sold with a sole focus on accumulation.

To the extent StableCoinX subsequently raises capital with the intent of purchasing additional locked ENA from the Ethena Foundation or its affiliates, cash proceeds from those token sales are planned to be used to purchase spot $ENA.

StableCoinX's treasury strategy is a deliberate, multi‑year capital allocation strategy that will enables StableCoinX to capture the enormous value of the secular surge in demand for digital dollars while compounding ENA per share to the benefit of shareholders.

1,95K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin