Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Eli5DeFi

➥ CT Smart Accounts You Should Follow Pt. 2

Smart Accounts to Follow is back with its second parts.

These accounts consistently share insights to help you navigate the chaotic world of Web3. Here's the list (NFA + DYOR):

➠ @YashasEdu - I've known Yashas since the bear market hit. He is one of the most underrated and insightful writers. I can't say enough you just need to check his feeds to get the smartest takes.

➠ @Eugene_Bulltime - True to his username, Eugene is heavily bullish on $BTC and its BTCFi ecosystem. He explains every concept with clarity.

➠ @Jonasoeth - Jonaso is a DeFi writer who shares unique insights and actionable advice not found elsewhere. He prioritizes quality and avoids echo chambers.

➠ @Tanaka_L2 - Tanaka has a unique approach to content creation. You can learn a lot about crafting engaging and informative material from him.

➠ @cryptorinweb3 - A standout in technical and fundamental analysis, Cryptorin effectively combines various media in his content.

➠ @RubiksWeb3hub - For unconventional content with thought-provoking topics, Rubiks is your go-to source.

➠ @twindoges - One of the best alpha finders. Some of the early projects I found came from Richie. I often bookmark his posts.

➠ @0xDefiLeo - Leo is the combination of grit and intelligence. His posts have become more artistic with a Renaissance theme, but don't let that fool you the information is pure alpha.

➠ @SherifDefi - Sherif is one of my friends who frequently shares good takes and technical analysis.

➠ @WorldOfMercek - If you want to check what's trending, just follow Mercek. He's always at the forefront, and his content is easy to understand.

➠ @Flowslikeosmo - Beyond good content, I suggest turning on notifications for Osmo and checking the tickers she shares.

➠ @AmirOrmu - Amir is part of @castle_labs, so you already know what to expect from his posts.

➠ @lordjorx - I followed Jordi recently and enjoyed his posts about $ETH with solid fundamental reasoning. His other posts are also great to read.

➠ @TheDeFiKenshin - Another $ETH bull friend who shares many alpha projects.

➠ @0xALTF4 - Check out his content about @KaitoAI pre-TGE projects it's some of the best.

➠ @0xKaiFi - A budding creator I like. His posts are informative and feature good visuals.

5,02K

Eli5DeFi kirjasi uudelleen

The community spoke loud and clear and we listened.

We have removed the vesting terms from the community sale and all token allocations will be 100% unlocked at TGE.

LFG - head to the @KaitoAI Capital Launchpad now!

We appreciate those who have already pledged and you will be given preferential allocation, and we’ve taken a snapshot.

119,75K

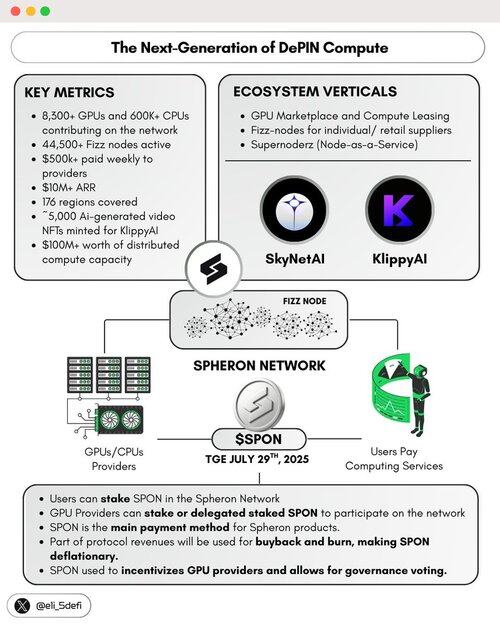

➥ The Next-Generation of DePIN Compute

DePIN Compute has surpassing $20B+ total market cap and one of the leading protocol is @SpheronFDN that also preparing for its $SPON TGE.

Let's do quick recap and what's makes Spheron different from other compute protocols. 🧵

...

— What is Spheron?

Spheron Network is a decentralized computing protocol that integrates data centers and retail GPUs/CPUs into a vast, community-powered infrastructure. This offers unparalleled flexibility, scalability, and cost-efficiency for AI workloads.

Spheron is developing not just a single product, but a comprehensive ecosystem:

➠ GPU Marketplace and Compute Leasing

➠ Fizz-nodes for individual/ retail suppliers

➠ Supernoderz (Node-as-a-Service)

➠ @theskynetxbt - A forthcoming no-code platform for deploying AI agents and workflows without programming skills

➠ @Klippy_AI - An AI-powered text-to-video tool leveraging Spheron's GPU infrastructure and agentic capabilities.

➠ More to come: Aquanode, SDK-CLI, Console, etc.

...

— Spheron Key Metrics

To date, Spheron already achieved remarkable milestones:

➠ 8,300+ GPUs and 600K+ CPUs contributing on the network

➠ 44,500+ Fizz nodes active

➠ $500k+ paid weekly to providers

➠ $10M+ ARR, covered 176 regions

➠ ~5,000 Ai-generated video NFTs minted for KlippyAI

➠ $100M+ worth of distributed compute capacity

...

— $SPON Key Metrics

$SPON is the utility token for the Spheron ecosystem, scheduled to launch on July 29, 2025 on the @base chain with several exchanges already announced their support such as @mexc, @bitgetglobal and @Gate_io.

Its utilities include:

➠ Payments for leasing compute resources on Spheron's marketplace

➠ Staking to join the network and earn higher-tier rewards

➠ Governance voting

These utilities will be available from day one to ensure real usage and early adoption, given Spheron's established product-market fit.

A portion of the protocol's revenue will be allocated to buy back and burn SPON, accelerating its deflation.

...

— Wrap-Up (NFA + DYOR)

Spheron is crafting the ultimate community-driven compute stack for AI, Web3, and agentic apps; decentralized, verifiable, and builder-owned, not cloud-controlled. Spheron's vertical product depth fuels an ecosystem that thrives.

The metrics above are just the beginning. With the compute market's potential at $5B+, capturing just 5% of the TAM could be a game-changer for Spheron.

Are you ready for the era of 10,000 Web3 AI agents powered by Spheron?

2,69K

Achieving over $400 million in restaked $BTC is no small feat.

This is particularly impressive when you're developing new infrastructure for a future economy grounded in BTC-derived security.

Are we on the verge of witnessing a true BTCFi season with @satlayer?

SatLayer 🟨🧊23.7. klo 20.00

When $400M is written in the clouds, you know it’s real ☁️

𝐒𝐀𝐓𝐋𝐀𝐘𝐄𝐑 𝐉𝐔𝐒𝐓 𝐇𝐈𝐓 𝐀𝐍 𝐀𝐓𝐇 𝐓𝐕𝐋 𝐈𝐍 𝐁𝐓𝐂 𝐃𝐄𝐏𝐎𝐒𝐈𝐓𝐄𝐃

The new economy on Bitcoin is on the move 🔥

1,38K

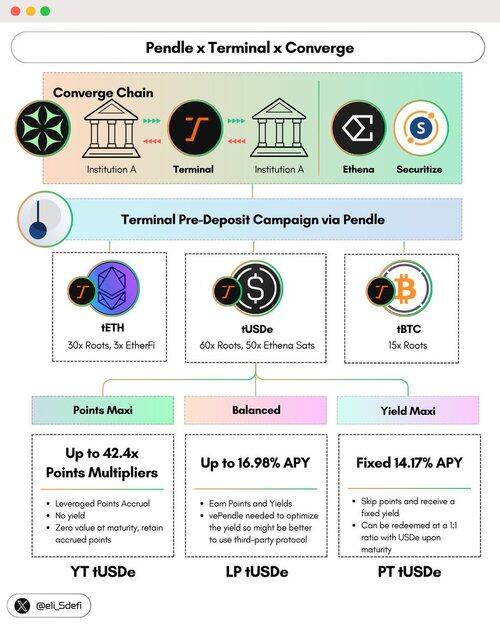

➥ The Next Asymmetric Opportunities - PTC

Time to get serious.

Forget the echo chamber of half-baked protocols on some leaderboards lacking strategy and revenue post-TGE.

What you need are early-bird opportunities before anyone else even whispers about them, and this post is your guide.

Let me introduce you the triumvirate, PTC, or Pendle-Terminal-Converge, your next winning move. Why?

Dive into our 30-second report 📖

...

— Before We Move On

We have previously provided detailed explanations of @pendle_fi and @convergeonchain in our earlier posts:

✧ Pendle →

✧ Converge →

If you're not familiar with these protocols, we recommend reviewing the posts above to better understand the aspects discussed in our content.

...

— What is Terminal?

@Terminal_fi is an institutional-grade protocol designed as a liquidity hub and interface for regulated institutions accessing DeFi yield. Key features include:

➠ Built on the Converge Chain and backed by Ethena and @Securitize

➠ Focused on institutional asset trading

➠ Utilizes sUSDe as the base currency for exchange

➠ Mitigates slippage and impermanent loss regardless of position size, common issues in AMM DEX for large orders

Terminal aims to facilitate trillions in trading volume brought by institutions, acting as a native liquidity hub and becomes the growth catalyst for the Converge ecosystem.

...

— The PTC Alpha Opportunities

Here's the alpha: you can participate early in Terminal by pre-depositing in the Pendle Pools below (maturity date: September 25, 2025):

✧ tUSDe → 60x Roots, 50x Ethena Sats

✧ tETH → 30x Roots, 3x @ether_fi Points

✧ tBTC → 15x Roots

Roots are Terminal's native points and can be converted to $TML upon TGE. To date, $100 million has been reached in TVL, with Pendle contributing 71% of that total.

My favorite among these three is the tUSDe pool. Here are the assets you should choose based on your risk preference:

✧ You can maximize points by buying YT, which gives you optimal exposure if you want to go big on $TML with a multiplier up to 42.4x. However, YT will have zero value at maturity while retaining accrued points, and you can trade it freely beforehand.

✧ You might choose a more conservative approach by selecting PT tUSDe, which gives you approximately 14% fixed APY but you'll forgo all points. Frankly, this is better than the 10% APY on vanilla sUSDe.

✧ Or if you want some balance, choose LP tUSDe, which allows you to get exposure to both points and yield at the same time.

...

— Wrap-Up (NFA + DYOR)

Why I believe this presents an asymmetric opportunity:

First, institutional adoption is inevitable, and these institutions will need a new venue for trading. Among other solutions, Converge provides the programmability and composability similar to DeFi for institutions, with backing from Ethena and Securitize.

Second, Terminal is quietly becoming the unofficial DEX for the Converge ecosystem, and the best way to maximize exposure is through Pendle, which offers diverse strategies depending on your goals. Are you betting on $TML, or do you want to earn better yields on USDe, or both?

The choice is yours. 👀

11,05K

➥ The New Economy is Built Upon Bitcoin

This narrative is among the boldest, making it especially worth exploring if you are heavily invested in $BTC.

How can we transform Bitcoin into a de facto global reserve asset? @satlayer might have a way to achieve this.

Check out our 30-second brief report 🧵

...

— What is SatLayer?

SatLayer is leading Bitcoin restaking protocol that allow it to become fully programmable and boosts Bitcoin's liquidity via BVS (Bitcoin Validated Service) with myriads use-case and multiple layer of yields:

➠ BTC staking

➠ BTC LST of your choice - @Lombard_Finance, @SolvProtocol, @Bedrock_DeFi, @LorenzoProtocol, etc.)

➠ L1 incentives - @SuiNetwork , @berachain , @build_on_bob, etc.

➠ SatLayer’s own Sats2 points with TGE soon.

➠ BVS yield, which generate real economic yield

➠ Downstream DeFi integrations

To date, SatLayer achieved remarkable milestones:

➠ 405,658 restakers

➠ 3,447.71 BTC (~$408M) as of Jul 21, 2025

➠ Backed by leading investors including @CastleIslandVC, @hack_vc, @FTI_Global, @OKX_Ventures, @mirana, @cmsholdings, and more.

BVS is not merely vaporware; it is already being utilized and integrated into several use-cases.

...

— SatLayer BVS in Action

➠ BTC-backed insurance/principal protection

Partnering with @NexusMutual and @RelmInsurance to offer principal-protected BTC yield products for institutions, staking platforms, ETF/ETP issuers, and BTC treasuries. Products include:

- Principal and Slashing Protection

- Liquidation Coverage

- Off-chain Coverage

- Reinsurance

Berkshire Hathaway grew by acquiring insurance firms and investing the generated float and we might see similar situation with SatLayer BVS as the potential untapped market is >$1T.

-

➠ RWA

Partnering with @plumenetwork to provide BTC security for SkyLink, the Plume RWA transfer layer integrated with @LayerZero_Core DVN.

SatLayer is developing a Bitcoin-secured backstop for Plume’s Nest Credit vaults, offering instant liquidity and principal coverage for a restaking yield premium.

-

➠ Stablecoins

@capmoney_ will integrate with SatLayer for enhanced yield and security using restaked BTC for its stablecoin.

This integration allows Cap to run multiple strategies with Franklin Templeton, Apollo, IMC Trading, and others, backed by Bitcoin's economic security.

-

➠ Yield-bearing BTC-backed Liquidity Float / Onchain Prime Brokerage

Restaked BTC mitigates duration risk to enable quicker settlement for AI infrastructure loans, offering a liquidity backstop for Plume vaults, trading (arbitrage, cross-margin), PayFi, and bridging abstraction.

...

— Wrap-Up (NFA + DYOR)

SatLayer is not only creating a programmable infrastructure for Bitcoin, rather its expand Bitcoin into irreplaceable component of the future of finance via BVS integration.

As the TGE is on the horizon, I think it will be great opportunity to participate and stake $BTC on SatLayer because not only accruing multiple source of yield, you will also earn Sats2 points which can be converted to SatLayer token upon launch.

So, do you think our economy will be built upon Bitcoin? I think Yes.

280

Finally, "Better" launches on the @KaitoAI Capital Launchpad.

Personally, I believe @TheoriqAI - $THQ offers improved terms and greater transparency compared to previous one.

Let's see the terms:

⟶ Date & Time: Friday, July 25th, 2025, at 12:00 PM UTC

⟶ Valuation: $75M (50% better from previous $150M valuation round)

⟶ Fundraising Target: $2M

⟶ Minimum Allocation: $1,000

⟶ Maximum Allocation: $100,000

⟶ Vesting Terms:

25% unlocked at TGE (Token Generation Event)

37.5% unlocked at 12 months

37.5% linear vesting from months 13–24

Everything seems normal, and you can receive your token immediately after the TGE with a reasonable percentage, while the remainder will be vested. I prefer this option, especially for retail investors with limited liquidity.

Kaito AI 🌊23.7. klo 22.08

Details of the @TheoriqAI public sale going live on our Capital Launchpad on Friday!

When: 12:00PM UTC, 25th July 2025

Valuation: $75M (giving an exclusive 50% lower entry than prev $150M valuation round)

Target raise: $2M

Vesting: 25% unlock at TGE, 37.5% after 12M, 37.5% linear (Month 13-24)

Min/Max Allocation: $1,000 - $100,000

Theoriq is building a scalable foundation for the Agentic Economy, enabling agents to execute DeFi strategies autonomously. Their team built up of Al experts from Google, Vector Institute and Teradata, and crypto veterans from Consensys, Gnosis and Goldman Sachs.

They've previously raised over $10M - backed by Hack VC, IOSG, LongHash, Figment, HashKey, Inception, Alumni Ventures and more.

Make sure to complete your account set up now to be ready on Friday 🤝

5,1K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin