Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ViNc | Pendle Sensei 🌸

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

is Pendle coming to HyperEVM this week? (cough cough hint hint nudge nudge)

This week in Pendle:

- New pools launching: Hyperwave hwHLP [HEVM] 25-SEP | Kinetiq kHYPE [HEVM] 18-DEC | Hyperbeat ultra HYPE [HEVM] 18-DEC | StakeDAO asdPendle 25-SEP

- New Maturity launches: sUSDe [ETH] 25-NOV | Midas mEDGE [ETH] 30-OCT | Midas mMEV [ETH] 30-OCT

- Community Pools launching: Infinifi siUSD [ETH] 25-SEP | SparkleX’s spETH [ETH] 09-OCT | Obol’s stOBOL [ETH] 13-NOV | sigmaSP [SONIC] 09-OCT | StabilityFarm wmetaUSD 18-DEC

- Highlight: PSA FOR PT-sUSDe 31-JUL holders: double digit fixed yields available for PT-sUSDe 25-SEP available for rollover: (holy moly)

TASTY on Pendle:

- Stables: Falcon USDf [25-SEP] [ETH] @ 20.44% LP-APY | USDf [25-SEP] [ETH] @ 14.86% PT-APY

- ETH: rswETH [25-JUN] [ETH] @ 9.28% LP-APY | tETH [25-SEP] [ETH] @ 4.25% PT-APY

- Trending: sUSDe [25-SEP] [ETH] 11.28% PT-APY | aUSDC [14-AUG] [SONIC] 8.97% PT-APY | tUSDe [25-SEP] [ETH] 13.98% PT-APY

LAST WEEK:

- $2b+ Pendle assets on AAVE:

- 71% of Terminal’s TVL is on Pendle:

- Updates from TN on Pendle’s Citadels:

- DeFi Maestro chooses Pendle as a top project (why wouldn't you?!)

- Pendle Print #75:

disclaimer: meow

12,39K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

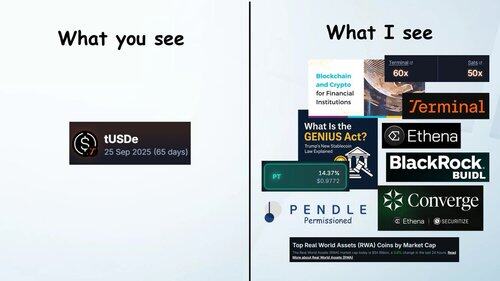

Terminal tUSDe being slept on massively now 😴

Aside from sUSDe (Jul 2025) which is expiring next week, this is the highest @ethena_labs fixed yield now at 14.37%

Momentum wise, this has the argument to be the most narrative-charged stablecoin:

🔹RWA + stablecoin exposure, both of which are picking up thanks to friendly regulations (especially in the US) and increased attention from our TardFi friends

🔹Key player in the "Pendthena" ecosystem, which will form the liquidity hub and foundation for Pendle Permissioned + Ethena's iUSDe (KYC-compliant version of sUSDe)

🔹YTs are tempting too considering $ENA is up ~44% in the past week and this has one of the highest 50x Sats exposure + Terminal Roots, which again both of which are part of the Ethena ecosystem

What we're looking at here, what you're buying here is not just "another stablecoin", it's the friggin gateway to DeFi yields for TradFi institutions.

9,34K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

Not long ago, Pendle's CEO TN @tn_pendle was invited to our office for a discussion interview on the future of DeFi and RWA, and we discussed:

▪️The future of DeFi

▫️TN believes that as more capital flows in, DeFi will show larger-scale applications that may even be more useful than we currently imagine.

▫️ Regarding yield tokenization: It refers to the transformation of future income streams into tokens that can be traded on the chain, which not only empowers the value of assets but also provides more controllable and considerable returns for the market and users while unlocking each asset yield transaction.

▫️ About options: Although options are very important in the financial sector, there is room for growth and improvement as there are no successful penetration cases on the chain that have been successfully implemented.

▪️ About stablecoins

▫️ Stablecoins are one of the most prominent use cases for crypto assets because they are a way to transfer money far superiorly over traditional transfers. Many projects offer stablecoin products and innovate around stablecoin yields.

▫️DeFi protocols attract users by offering attractive stablecoin yields, such as 5%-10% yield on USDe. The main driving force behind this strategy is the strong pursuit of yield incentives by institutions and individuals, as holding traditional stablecoins often does not yield high stable returns.

▪️The Rise of RWAs:

▫️ In terms of product development of RWA tokenization, the possible product life cycle model is slow at first, driving growth through continuous iteration of products, eventually reaching a critical point, and then entering the stage of explosive growth.

TN is really a very good and gentle founder, after the interview, he sent him away, he was going to help call a taxi, he looked at his watch and said that this point should be very congested, I will just take the subway, there is a subway station next to your company. I am very happy to be able to communicate with this kind of low-key and high-profile industry builder~

47,06K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

Before ETH rose, everyone commented that Vitalik was: nerdy, socially awkward, sloppy dress, talking like a prompt output by AI, doing rollups, ZKPs, and not doing serious things all day long, and the ETH Foundation also sold coins twice in three days, and it didn't look like a bull market at all.

After ETH rose, everyone commented that Vitalik was: geek genius, pure thinking, restraint and few words, beyond the hustle and bustle of the market, and a rare "philosophical prince" in the crypto industry. The ETH Foundation knows how to invest cash flow and control the rhythm, and these people are the ones who will make the most money in the bull market.

170,49K

Someone reported seeing the so-called @pendle_fi profit and loss statement in the Binance Square, and it was obvious that it was wrong.

After investigation, it turns out the data source is @tokenterminal (TT)... They have always been making mistakes, and the data is so wrong it seems randomly generated...

Moreover, I inquired with the team, and Pendle has provided a way for TT to correct it, but TT is still dragging its feet on the fix...

I advise everyone to go to the Pendle official website -> vePendle for reliable information.

6,18K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

So @protocol_fx has some serious stats:

➠ Total TVL: $280M

➠ $fxUSD Reserves: $172.8M

➠ $fxUSD Supply: $83.3M

➠ fxSAVE TVL: $46.3M @ 11.79% APY

➠ Aave TVL: $73.6M earning 3.14% = $2.3M/yr

➠ $stETH in protocol: 27,994

➠ $wBTC in protocol: 665

All while $FXN MC = $7.6M

Where’s the disconnect?

What’s really undervalued here?

7,41K

ViNc | Pendle Sensei 🌸 kirjasi uudelleen

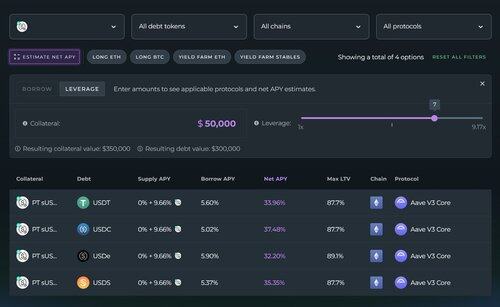

A new @pendle_fi PT just went live on @aave:

• PT-sUSDE-25SEP2025

As a reminder, at DeFi Saver you can:

• Leverage (loop) PTs in 1-transaction;

• Unwind PT based positions in 1-transaction.

And you'll be able to rollover existing PT-sUSDE-July positions once they expire.

4,64K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin