Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Enzyme

Global infrastructure for tokenized finance. Enabling industry leaders to manage on-chain assets, streamline operations, and build innovative financial strategy

Asset managers told us exactly what they need to bring the next wave of finance onchain:

“I want to build and manage cross-chain strategies, not just on one network.”

“I need access to any protocol such as DeFi, CEXs, banks, you name it.”

“I want to work with any asset, from crypto and NFTs to stocks and RWAs.”

So, we built Enzyme.Onyx.

Enzyme.Onyx is the wallet tokenization layer for unrestricted, institutional-grade asset management.

Three ways we’re solving the industry’s biggest challenges:

① True cross-chain execution: Run strategies seamlessly across blockchains, with all activity and assets consolidated at the vault layer.

② Unrestricted protocol access: Use your Enzyme.Onyx vault to interact with DeFi, CEXs, banks, brokers… no limits.

③ Universal asset support: Reflect, manage, and report on any financial instrument like crypto, NFTs, RWAs, stocks, bonds, etc. directly in your vault.

Enzyme.Onyx is built for the innovators designing tomorrow’s global funds and programmable finance products. Explore what’s possible:

427

The next generation of asset managers is building beyond single-chain limits, and Enzyme.Onyx is making it possible.

With Enzyme.Onyx, you can deploy Enzyme Vaults directly onto any wallet (EOA, MPC, Smart Accounts, or non-EVM) to transform it into a tokenized solution that can securely collect deposits from multiple participants and allocate funds with complete freedom. Enzyme.Onyx enables seamless movement of assets between networks, any centralized or decentralized protocols, and unlimited asset universe.

For managers and institutions, Enzyme.Onyx removes operational complexity while unlocking new distribution and interoperability opportunities.

Ready for unrestricted asset management?

Learn more:

1,6K

Enzyme kirjasi uudelleen

One of the biggest unlocks for DeFi risk management? Options.

Calls and puts enable risk-adjusted strategies, generate yield, and support more resilient portfolios. In traditional finance, options are central to how asset managers manage risk and target returns. In DeFi, we’re only beginning to scratch the surface.

But we’re getting there.

Protocols like Enzyme.Myso from @enzymefinance and @Panoptic_xyz are paving the way for fully on-chain option strategies built natively into smart contracts, without intermediaries, and with programmable execution flows. This unlocks transparency, automation if needed, and ultimately… composability.

We’ve already seen early examples of this in action. From covered calls to structured yield notes, the first wave of on-chain options is here, and it’s growing.

The implications are massive: more resilient portfolios, better risk-adjusted returns, and a real step toward institutional-grade DeFi.

We’re building the tools for that future. And I’m excited to see others leaning in too. Curious how on-chain options work? Happy to chat.

1,62K

What’s happening onchain now will shape the next era of finance, and most haven’t realized how early we are...

@RobinhoodApp @vladtenev

Watcher.Guru8.7.2025

JUST IN: Robinhood CEO Vlad Tenev says tokenization is the biggest innovation "in the past decade."

6,1K

Live from @EthCC 🎥

Sun, sand, sharp minds… the Enzyme crew has been soaking it all in here in Cannes.

The vibes? Immaculate.

Here’s what’s been happening so far:

・Had side events with our good friends at @NexusMutual, @sygnumofficial, and @chain_security

・Met with other industry leaders for deep talks

・Had our team workshop for Enzyme.Onyx (more details coming 🔜)

・Enjoyed the vibes, music, and the sun with the team

If you’re in town, come find us. We’re here all week, connecting, and celebrating what’s next for tokenized finance.

More to come. But for now, back to it 🏖️

23,35K

A 2030 vision, written in 2020.

Our founder @Mona_El_Isa’s article imagined what onchain asset management could look like. Five years later, much of that world is already here, and built on Enzyme.

Mona El Isa28.6.2025

As the industry gathers this week in Cannes for @EthCC, I’ve been reflecting on a piece I wrote back in 2020: A Day in the Life of an Asset Manager in 2030

→

Some things have changed since then. Melon is now @enzymefinance, we’ve grown into a global infrastructure layer, and a few of the actors mentioned are no longer around.

But the trajectory I imagined still feels right.

Onchain asset management, real-world strategies, structured products, and permissionless innovation… it’s all playing out.

Always fun to revisit a vision. Even more satisfying to build toward it.

Would love to hear your thoughts if you give it a read 🙌

9,64K

Enzyme kirjasi uudelleen

The next evolution in tokenized finance is already unfolding, and it goes deeper than most realize.

Crypto has gained recognition as an asset class, but holding tokens was never the full story. Stablecoins accelerated adoption by creating a liquid, interoperable base layer for value transfer.

Then came tokenized ETFs and funds, bringing familiar wrappers onchain. But most of these products still rely on offchain processes: traditional issuance mechanics, centralized NAV, and legacy custody setups.

They introduced structure, but not autonomy.

What comes next is full-stack financial instruments: term deposits, tokenized ETNs, convertible notes, bonds, stocks… all built with logic encoded from day one.

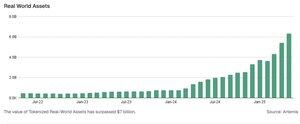

This isn’t theoretical anymore. Over $7B in tokenized treasuries are already live. Structured yield products are moving from pilot to production. Reinsurance deals are being executed onchain.

And the best part is, this is only the beginning. @enzymefinance already powers this evolution.

1,44K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin