Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

interob

Co-Founder @wormholefdn | @wormhole contributor

With the passing of the GENIUS Act, a wave of new stablecoins are coming & Wormhole will be the core infrastructure powering their issuance & movement across chains

Grateful to the industry leaders & contributions from the foundation’s legal team who helped make this possible

W

Rapid Response 4719.7. klo 03.28

🚨 @POTUS signs the GENIUS Act into law — a historic piece of legislation that will pave the way for the United States to lead the global digital currency revolution.

3,88K

Good things take time.

A little over six months ago, I sat down with the Head of Digital Assets at Hamilton Lane ($1T~ Asset Manager) to talk about bringing private credit onchain, and how we might actually start delivering on the promise of "democratizing finance."

Today, after months of collaboration, we’re announcing the multichain expansion of Hamilton Lane’s Private Credit fund, $SCOPE, now live with our partner Securitize across Ethereum and Optimism.

At Wormhole Foundation, our focus is on connecting the future financial system, and institutions will be a big part of that.

*Throwback to one of our late night sessions in Zurich

Wormhole17.7. klo 22.14

🏦 $956 billion asset manager @hamilton_lane expands their flagship Senior Credit Opportunities Securitize Fund ($SCOPE) multichain to @Optimism and @ethereum Mainnet.

Tokenization by @Securitize

Interoperability by @wormhole

11,85K

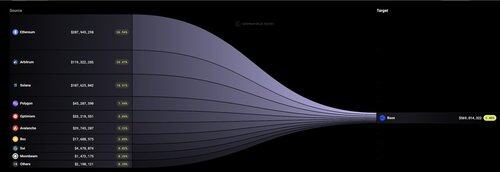

The most overlooked part of crypto today is interop.

Maybe that is a good thing? It could mean that the "coordination layer" is working and falling to the background so applications like can simply trade assets on pump swap no matter what chain they are native too.

It could also be changing and becoming less overlooked, I've mentioned some of these before but these themes are only increasing in relevance...

- L2 fragmentation continues to be a major issue for the EF

- New L1's are still coming online (see below)

- Some older L1's want to capture more value so are building appchain frameworks like cosmos and polkadot

- RaaS providers are building businesses based on "chains as a service".

New L1 theme is seeing asset issuers launch their own chains or chains they are closely aligned with.

- Ethena/Securitize --> Converge

- Tether --> Plasma

- Ondo --> Ondo Chain

- Robinhood --> Robinhood Chain

There will likely be many more within the next 3 months, I personally know of 3 high profile ones as a ref point.

- - - -

More chains doesn’t equal more usability. Without interoperability, liquidity is fragmented, user experience suffers, and developer overhead increases.

We just saw this with tokenized stocks: $aTSLA, $bTSLA, $cTSLA.. which one do you buy?

SWIFT processes between $5-7 TRILLION/day by offering one thing: reliable, standardized interoperability.

This is the opportunity size for interop protocols.

Interoperability isn't new. We've simply solved an age old problem for systems and have applied it to blockchains.

If crypto is serious about building a parallel financial system, we need shared, neutral infrastructure that connects assets, apps, and users across environments.

Interop is the dark horse.

982

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin