Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

nemi.lvl 🆙

growth @levelusd | Wooden drain れ日

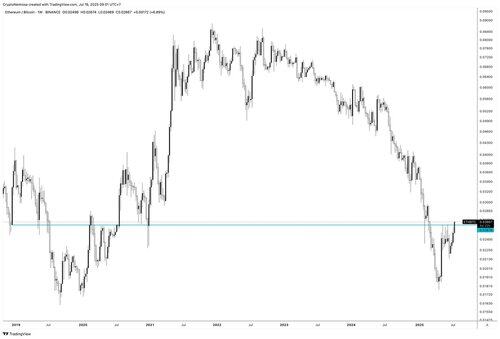

$PENGU has been dominating since the $ETH bottom on April 9th, up +728%

Notable runners

• $SPX: +283%

• $VIRTUAL: +279%

• $MOG: +269%

• $GOAT: +234%

• $WIF: +226%

Pretty much memecoins and AI leading the recovery

DeFi also showing strength: $AAVE (+116%), $SYRUP (+93%), $MORPHO (+82%), $ETHFI (+155%), $UNI (+91%)

Top performing L1s: $HYPE (+220%), $SEI (+140%), $ETH (+121%)

23,14K

nemi.lvl 🆙 kirjasi uudelleen

How Level unlocks capital composability for Lenders

1️⃣ Your lending protocol receipt tokens are under-earning

Parking USDC or USDT in @Aave, earns the baseline crypto “risk-free” rate, yet the aTokens that represent your position rarely do more than sit idle. You forfeit a whole second layer of yield and the freedom to further redeploy that capital.

2️⃣ How @Levelusd turns aTokens into a composable asset

Level lets you permissionlessly mint lvlUSD with USDC, USDT, aUSDC and aUSDT.

Level deploys your collateral to Aave for the base lending yield, then distributes the earned yield to slvlUSD holders, which means stakers will still be earning that rate (and often more) while being capital efficient within DeFi.

3️⃣ Composability: slvlUSD × @Pendlefi

Because slvlUSD already embeds the full Aave yield, deploying it on Pendle lets a lender unlock opportunities without sacrificing the underlying rate:

→ Provide LP liquidity: earn swap fees and $PENDLE incentives on top of the slvlUSD base rate.

→ Buy discounted slvlUSD (PT-slvlUSD): lock in a lower entry price today and crystallize fixed yield at maturity.

→ Trade Yield Tokens (YT-slvlUSD): Trade directional views on future lending demand.

Your capital keeps earning Aave yield, with higher returns if the staking ratio is below 100%, and also receives extra rewards from Pendle.

Three independent yield streams built on a single deposit.

4️⃣ Put your receipts to work

Stop letting aTokens languish. Mint lvlUSD, stake for slvlUSD, and route it through Pendle to capture every layer of lending-driven yield the market offers, without ever unwinding your original position.

Start today at 🆙

(Not available to U.S. residents. Past performance is not a guarantee of future results. Always do your own research.)

18,41K

A few interesting opportunities within the @levelusd ecosystem below 👇

PT Looping Spreads 🔁

PT lvlUSD 25Sep2025 / USDC: 0.73%

PT slvlUSD 25Sep2025 / USDC: 1.29%

PT slvlUSD 25Sep2025 / lvlUSD: 2.82%

PT lvlUSD 25Sep2025 / lvlUSD: 1.54%

slvlUSD 💫

Last published yield: 8.01%*

Current staking ratio: 63.2%

Cooldown period: 3 days

lvlUSD/USDC borrow cost: 7.15%

Curve💧

60x Level XP on lvlUSD/USDC or slvlUSD/lvlUSD liquidity

Pendle 📿

PT-slvlUSD: 7.92%

PT-lvlUSD: 7.54%

slvlUSD pool yield: 10.47%

Level 🆙

Disclaimer: This isn't financial advice, do your own research.

*slvlUSD yield: Last update of July 11th. Protocol revenue rewarded to slvlUSD divided by daily average slvlUSD market cap since the last reward distribution, annualized with compounding. Past performance does not guarantee future results.

6,15K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin