Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

TuongVy Le

General Counsel, @veda_labs, Advisor @Anchorage, Ex @BainCapCrypto @Worldcoin @SECgov @WilmerHale

Joseph deserves so much credit for helping to accelerate the institutional adoption of crypto - looking back, Blackrock changed everything. Can’t think of anyone more visionary to lead this charge. He even has the pfp to prove it. Congrats @joechalom and @SharpLinkGaming !

Joseph Chalom7 tuntia sitten

After 20 years at BlackRock and helping to lead its digital asset strategy, I’m beginning a new chapter:

I’ve joined @SharpLinkGaming as Co-CEO.

Here’s why.

At BlackRock, I helped launch:

- IBIT — world’s largest Bitcoin ETP

- ETHA — world’s largest Ethereum ETP

- BUIDL — world’s largest tokenized fund (built on Ethereum)

We didn’t just talk about digital assets, we bridged TradFi and crypto.

Now, I’m joining @SharpLinkGaming, a company led by @ethereumJoseph and built on a clear belief:

That Ethereum is becoming the foundation of global finance.

And I couldn’t agree more.

Stablecoins, tokenized assets, AI agents, are all moving onchain.

And it’s happening on Ethereum.

That’s where the future is being built.

SharpLink is already one of the largest corporate holders of $ETH.

Our goal is not just to hold $ETH, but to activate it, using native staking, restaking, and Ethereum-based yield strategies.

All to increase the value of our treasury and create long-term shareholder value.

We’re building a bridge between institutional capital and Ethereum-native yield, packaged in a single public equity.

The asset is $ETH, the ticker is $SBET.

1,29K

It can be intimidating to put your work out in the world like that, but then you get feedback that people really got it and actually found it useful and that makes it all worth it ❤️

ALSO stay tuned...part II dropping soon 😊

thibauld 🌍🔥⏳🦇🔊20.7. klo 04.12

As everyone is talking about tokenized stocks, I can only encourage you to read this paper by @CampbellJAustin and @TuongvyLe12 about "Crypto and the Evolution of the Capital Markets".

As someone building at the intersection of crypto and tradfi for many years at @FairmintCo, I can say this is one of the best paper ever published on the topic.

Everyone talks about "tokenizing securities" but few truly understand that crypto fixes the market plumbing, not just the assets!

A thread...

2,14K

Delay is one of the most profound but overlooked inefficiencies in today’s capital markets - one that on-chain capital markets are uniquely positioned to solve.

In traditional markets, public companies have up to 45 days to file quarterly reports, up to 90 days for annual disclosures, and insiders can delay filing beneficial ownership disclosures (Forms 13D and 13G) for up to 5 days (or even 45 days in some cases). This means that material, potentially market-moving information can remain hidden from the public for some time. The result? Reduced transparency and price efficiency, and the heightened risk of insider trading and market manipulation.

By contrast, on-chain capital markets offer the possibility of real-time, tamper-proof disclosure. Financial performance, insider activity, and governance changes could potentially be publicly available in real-time. Eliminating delays means more fairness, efficiency, accountability, and market integrity: markets that work better for everyone, not just those on the inside.

Larry Florio18.7. klo 04.40

The full thread is worth reading & is an interesting preview of what’s coming for activist investing

One of the most absurd takeaways here is that no one knows how many shares there are in a company’s float at any specific moment except @ reporting time.

Why’s it matter? 🧵

1,1K

1/ Today we’re publishing Crypto and the Evolution of the Capital Markets. Skeptics like to say crypto is a solution in search of a problem, but in reality, it’s an answer to a decades-old one that the traditional securities markets still haven’t fixed: the lack of a more direct, efficient, and trustless system for owning and trading assets. Blockchain and tokenization represent a natural evolution of the capital markets, the same way the move away from paper stock certificates did, half a century ago.

280,45K

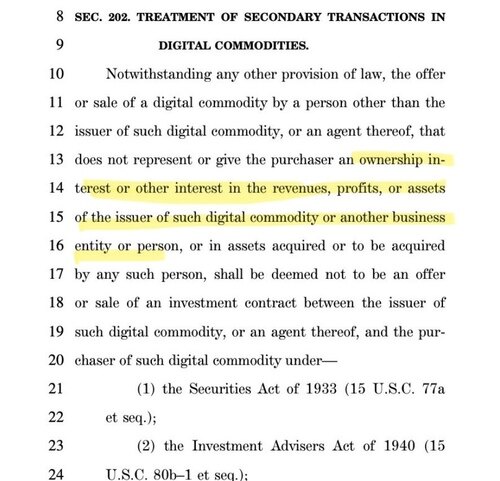

Like the crazy person ranting on the NYC train platform, I’ve been saying for years that “investment contract” never meant to include assets that didn’t provide the holder with a direct ownership interest or share of revenues, profits, or assets of the issuer. Remarkably, the latest draft of FIT21 codifies this view for secondary transactions of crypto:

6,45K

TuongVy Le kirjasi uudelleen

The @worldcoin U.S. launch event last night was incredible and exactly what crypto needs right now.

The message and delivery was crisp and free of jargon.

Real products (incl beautiful hardware!) and applications have been delivered and have massive, growing adoption.

Brand names from outside of crypto signed on as partners: Match, Stripe, Visa and more

+ It was beautiful and well executed with so much more to come

Welcome to the U.S., @worldcoin and congrats on a killer entry 👏🏻👏🏻

13,08K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin