Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

MacroMicro

Premier Financial Platform 📊Data & Charts | 📋Market Insights | 🧰Chart Tools | 📈Exclusive Indicators | 👥Community | Macro X Industry X Equities Databases👇

Dr. Ed Yardeni: Don't Panic! July’s jobs data looks weak, but the labor market is solid.

☑️ Record hours worked & wages

☑️ Real wages beating inflation

☑️ Q3 GDP at 2.1%

☑️ Tariff uncertainty slowing hiring

Is tariff turmoil causing a soft patch, or is the labor market as strong as ever?

🔗 Full analysis:

1,53K

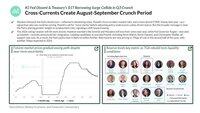

🇺🇸 2026’s Fed Is Already Shifting—So Is Policy

After weak jobs data & Trump calling Powell a “stubborn MORON,” headlines focused on drama.

📌 But in reality, the 2026 FOMC is already quietly becoming more dovish—no firings needed.

🔹 Permanent voters:

– Kugler resigned; Trump to appoint successor

– Powell’s term ends May 2026; exit may come earlier

– Frontrunners Warsh & Hassett support cuts

🔹 Rotating voters:

– Hawks Schmid & Musalem out

– 2026 adds: Hammack, Paulson, Logan, Kashkari = neutral/dovish tilt

⚠️ Trump may not need to fire Powell—he’s reshaping the Fed from within.

3,83K

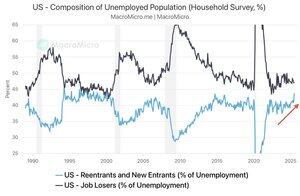

🇺🇸If you’re looking for a bright spot in the U.S. job market, here’s one:

The recent rise in unemployment isn’t due to layoffs, but rather from more people reentering the job market or looking for work for the first time—groups facing a tougher time finding jobs. This is different from typical recessions, where job losses drive unemployment higher.

With both labor supply and demand slowing, the job market is holding steady for now. But this fragile balance—marked by low supply, low hiring, and low layoffs—could easily break if hit by an external shock. That’s why the Fed’s ability to pivot quickly will be critical.

🔗Data:

1,66K

🎧 New episode: “You’re Fired”—Said the Jobs Report First

Only 73K jobs. Massive revisions. A fired BLS chief. A Fed split vote. $1T Treasury borrowing.

This week:

⚙️ Trump’s economic statecraft: tariffs, tech, Treasuries

💸 Dovish Fed momentum builds

💻 Big Tech’s AI: real monetization vs. empty hype

Watch/Listen:

▶️ YouTube

🎙️ Apple Podcasts

🗣️ Spotify

1,19K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin