Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Lisa Florentina

She | Ambassador @TRONdao @Filecoin @Gaib_ai @PlaySapien | Quacker

🔥 TON Space is now live on TON Wallet

TON Wallet the self-custodial wallet built into Telegram has officially launched TON Space, unlocking a new level of crypto experience right where conversations happen.

Here’s what users can now do:

• Buy crypto in seconds via Apple Pay, Google Pay, or bank card

• Send assets instantly to Telegram contacts or any external wallet

• Earn passive income on Toncoin or USDe holdings

• Showcase and manage NFTs in one unified, intuitive view

• Trading features have also received a major upgrade:

• Swap any token on the TON network through the new flexible trading engine

• Powered by Omniston (via @Ston_fi), trades now automatically find the best available rates

• A modern trading interface highlights key tokens like “Top Gainers” and “Most Traded”

• Comprehensive market data, including market cap, liquidity, volume, and price trends

TON Wallet is no longer just a wallet it’s your full-featured crypto hub inside Telegram, built for both newcomers and seasoned users.

➜ Explore it now at @tonwallet_tg:

✦ Note: Digital asset investments carry risk. Please make informed decisions. Some features may be restricted in certain regions, including the United Kingdom.

4,08K

🌸Crypto UX is going social but where’s the fun kept?

It’s about hyper-casual finance, the backbone of Web4’s vibe revolution.

• Trades live on Hyperliquid: secure, fast, seamless

• Livestreams and tipping flow across platforms for max engagement

• Hyperliquid stays the vibe hub for real-time action

• @HanaNetwork uses Hanafuda to tie trades to social clout

• Hyper-casual finance = cross-platform fun + single-tap trust

The future of crypto stays lit and user driven🩷

1,73K

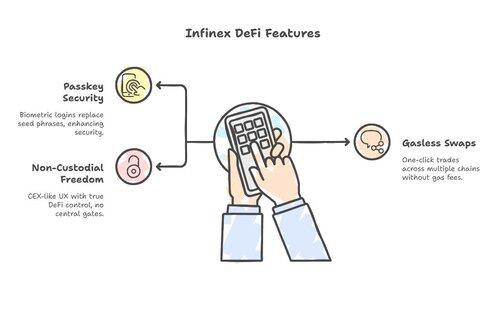

DeFi UX is not just simplicity.

It’s seamless access, secure custody, and cross-chain fluidity.

Let’s see how @infinex redefines DeFi with its user-first design.

• Passkey Security

No seed phrases, just biometric logins, Infinex makes DeFi as secure as your phone.

• Gasless Multi-Chain Swaps

One click powers trades across 6+ chains, no gas fees, no complexity.

• Non-Custodial Freedom

No centralized gates, Infinex delivers CEX-like UX with true DeFi control.

1,51K

✴ @recallnet is cooking up something wild: onchain agents with memory that’s forkable, like an AI GitHub.

AgentRank tracks the real deal, no hype, all receipts.

Compete for $RECALL, stack those rewards with community vibes, and watch adoption skyrocket.

They’re laying the foundation for Web3 agent continuity, pure genius.

Dive in, test the waters, and let’s build the future together.

Recall24.7. klo 23.46

Your next favorite AI agent is waiting to be discovered

1,6K

Web3 AI wasn’t the final form, but @TheoriqAI’s OLP Swarm is.

We went from users ➜ coders ➜ liquidity providers.

But TheoriqAI’s OLP Swarm does it differently you’re not just providing liquidity you’re orchestrating DeFi intelligence.

• Every Agent = a signal.

Tasks, signals, collabs in the Swarm they’re not just actions.

They’re proofs of coordination micro acts of optimization.

• Impact is lived, not logged.

You won’t just manage liquidity you’ll be shaping Theoriq ’s OLP Swarm.

3,66K

🟠@infinex is the biggest leap for DeFi since Uniswap launched.

• Passkeys replace seed phrases

• Gasless swaps across 6+ chains

• $67.7M raised in Patron Sale

• Backed by Wintermute + Solana Ventures

• Built by Synthetix founder Kain Warwick

• Top DeFi UX | #1 non-custodial platform

Infinex is redefining DeFi for the masses.

5,83K

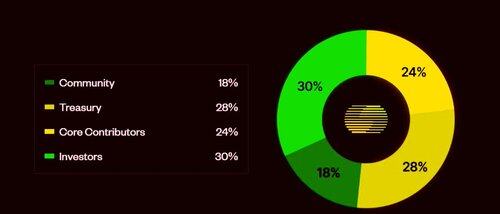

🧠 @TheoriqAI has unveiled the tokenomics for its native asset, $THQ the fuel powering its agent-driven DeFi ecosystem.

With a fixed supply of 1 billion tokens, $THQ is designed to drive long-term scarcity and alignment across users, agents, and developers.

Distribution Overview:

• 30% allocated to early investors

• 24% reserved for core contributors (1-year lock, 3-year linear vesting)

• 18% for community incentives

• 28% to the treasury for ecosystem development and operations

Utility & Staking:

Users stake $THQ to earn rewards as sTHQ. By locking sTHQ, they receive αTHQ — a time-weighted token used for governance and agent delegation. Longer lockups yield more αTHQ. Delegated αTHQ boosts agent performance and reduces fees, but can be slashed if agents underperform.

1,52K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin