Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Holger Zschaepitz

German benchmark index Dax jumps in AH trading after headlines the EU and the US are progressing toward an agreement that would set a 15% tariff for most products. Member states could be ready to accept a 15% tariff and EU officials are pushing to have that cover sectors including cars. Steel and aluminum imports above a certain quota would face the 50% duty. (via BBG)

22,04K

OUCH! #Japan’s 10y bond yields have jumped to their highest level since 2008, driven by growing fiscal concerns. The spike came after President Trump announced a trade deal w/Japan. It appears Japan may be covering part of the cost of US car tariffs by using its own investment funds–essentially a partial bailout to smooth the deal.

52,73K

Good Morning from Germany, where auto stocks are rallying on hopes that Europe can secure a trade deal w/the US similar to Japan’s. Under the new US-Japan agreement, all Japanese imports — incl cars — will face a flat 15% tariff. That’s good news for Japanese carmakers, as it allows them to avoid the higher, sector-specific 25% tariff on vehicles. European automakers are now hoping for a similar deal.

26,8K

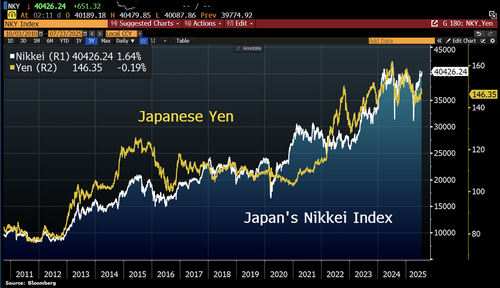

Nikkei jumps and Yen gains as #Japan's assets enjoy relief from US trade agreement. The headline 15% reciprocal tariff is a considerable discount from the 25% in the letter earlier this month. Toyota shares rising as much as 10% after NHK reported the US would impose a tariff rate of 15% on auto imports.

22,46K

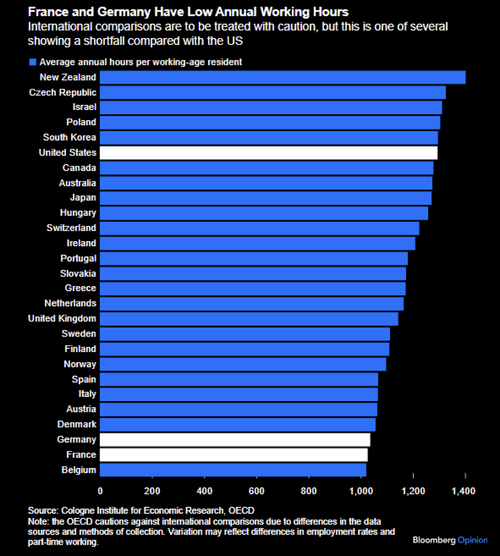

Good Morning from Germany, where annual working hours are among the lowest in the world – and even that might be overstated. On avg, employees take 31 vacation days a year, plus at least 9 public holidays, many of which cluster between Easter and early June when offices are often quiet. On top of that, the avg number of paid sick days has risen to ~15 per year, up from 10 in 2015.

27,99K

Opendoor is the market’s latest Meme Stock w/insane trading volumes. Shares of the San Francisco-based tech group that focuses on the stagnant real estate sector have nearly tripled in value over the past week. The rally appears to have been sparked by a prominent investor discussing the stock on social media, which drew the attention of retail traders.

The company has struggled since peaking at a $20.6bn valuation in February 2021, shortly after merging with the SPAC (special purpose acquisition company) Social Capital Hedosophia Holdings Corp II, led by Chamath Palihapitiya.

That decline isn’t surprising: Opendoor’s core business is in the "instant buyer" market, where it aims to make home sales faster and bypass traditional realtor fees—an idea that has faced serious challenges in a cooling housing market.

21,2K

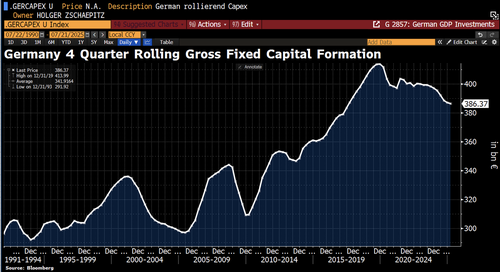

Good Morning from #Germany, where over 60 of the country’s top companies have kicked off a major new investment push worth at least €100bn. The goal: to help revive Europe’s largest economy, which has been stuck in a prolonged slump.

One of the biggest concerns is that business investment has been falling. Back in 2019, gross fixed capital formation – a key measure of investment in infrastructure, machinery, and equipment – made up 11.7% of GDP. Today, that share has dropped to below 9%, a clear sign of the country’s fading economic dynamism.

57,18K

Good Morning from Germany, where electricity prices on the energy exchanges have surged again – topping €100 per megawatt hour. So far this year, prices have crossed that level on 68 days. At these rates, building and operating large, energy-hungry data centers in Germany becomes increasingly difficult.

99,77K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin