Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Prince

@avon_xyz

Prince kirjasi uudelleen

I spoke to @im0xPrince, the founder of @avon_xyz and he kindly gave me a code for test the product.

Let’s break down what makes Avon so interesting 🧵

___________________________________________________

1/ What is @avon_xyz ?

Avon is a decentralized lending protocol built around the CLOB mechanism. Yes, the same concept used by:

• Morpho Optimizers

• Morpho Blue

• Loopscale

But Avon pushes the design further, especially when it comes to capital efficiency & liquidity management.

___________________________________________________

2/ Traditional lending ≠ Avon’s model

In classic DeFi lending (like Aave/Compound), you deposit funds into a pool with predefined parameters.

Avon replaces that with a flexible order book:

• Lenders and borrowers place custom orders

•The protocol matches them dynamically

• Result = tailored, efficient lending markets

___________________________________________________

3/ Borrowers get full control

Borrowers can define:

• Loan amount

• Collateral type

• Interest rate

• LTV (Loan-to-Value) ratio

Lenders (via curators) can accept these offers, instantly matching and opening a position. No more waiting around for pool settings.

___________________________________________________

4/ What are curators?

Curators are strategic actors who manage where lenders’ funds are deployed. They select which borrower offers to match, aiming to maximize returns and minimize risk.

Think of them as “capital allocators” optimizing for yield.

___________________________________________________

5/ Avon fixes liquidity fragmentation

Instead of isolated pools, Avon redistributes liquidity across different pools depending on market needs.

✅ Lower utilization rates

✅ Reduced borrowing costs

✅ Smoother UX for both sides

This solves one of DeFi’s most persistent inefficiencies.

___________________________________________________

How to join the testnet?

You can already start testing Avon, but access is gated by codes.

👀 Where to get them?

• Avon’s Telegram (

• Early ecosystem insiders (like me lol)

• Probably in their discord when it opens

I hope to be able to get some and distribute them to the community. Maybe a public version will come out soon, who knows?

1,14K

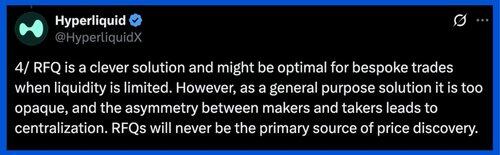

Intent-based systems don’t scale markets.

They rely on requests. Liquidity stays hidden until someone asks. Prices aren’t visible.

This breaks composability. It blocks coordination. And it limits price discovery, since there’s no shared view of supply and demand.

Markets scale when liquidity is continuous, pricing is public, and anyone can build on top of it.

Intent-based or RFQ designs don’t allow that. They slow things down instead of opening them up.

Order books make that possible.

5,78K

What looks like polished product is often the result of a few smart design decisions.

Hyperliquid is a good example.

They prioritized what actually matters to traders and MMs:

→ Gasless quote updates

→ Prioritized cancels

These aren’t features. They’re decisions made for real-time trading, where latency, cost, and reliability directly affect outcomes.

It comes down to what you optimize for and it matters.

3,83K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin