Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Sharples 🟪

data enjoooooyer | xgboost truther | data @blockworksres

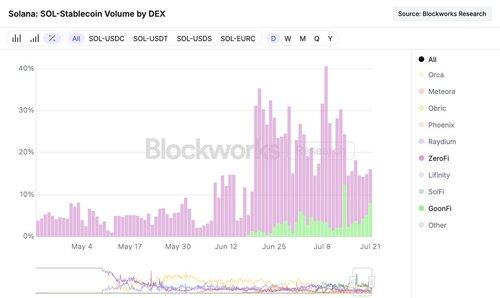

In the world of prop AMMs, GoonFi has passed ZeroFi in SOL-USD trading volume.

SolFi remains the largest prop AMM, holding approximately a 25% market share on SOL-USD pairs.

GoonFi, like all other prop AMMs, relies heavily on DEX aggregators. About 98% of their volume originates from aggregators.

4,35K

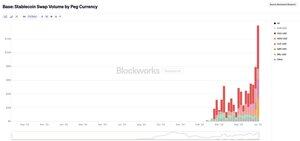

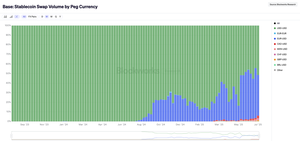

Weekly FX volume on pairs excluding EUR<>USD hit an all-time high on Base.

About 50% of stablecoin swaps on Base are driven by FX pairs. For comparison, only 1% of stablecoin swap volume on Ethereum is related to FX pairs; USD-USD drives the entirety.

CADC by @Paytrie has experienced a revival, with over $6 million in weekly CAD-USD spot volume.

Other peg currencies, such as GBP and CHF, are also seeing an increase in trading volume. @VNX_Platform-backed stablecoins drive the major stablecoins associated with these currencies (VGBP and VCHF).

5,17K

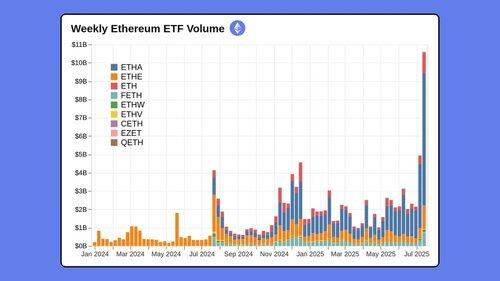

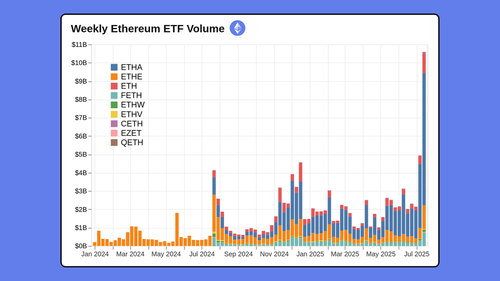

Ethereum ETF volume paints a similar picture.

Ethereum ETF volumes more than doubled last week from the previous week.

Did about 1/3 of Bitcoin ETF volume despite the Bitcoin ETFs being 8-9x larger.

TylerD 🧙♂️19.7. klo 22.06

40% of the overall ETH ETF assets under management have come in the past 8 trading sessions 🤯

eth/acc

10,89K

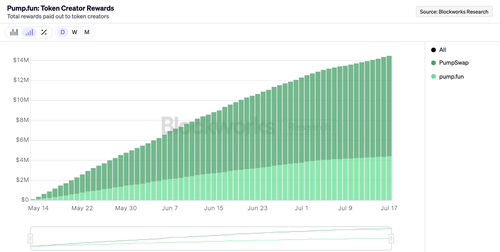

About $14 million in fees have been redirected to token creators (and now CTOs) on @pumpdotfun.

Over 10k addresses have received over $100 in rewards.

pump.fun19.7. klo 03.25

sitting in a coin that the dev abandoned? feel like there’s someone more deserving of the creator fees?

fret no longer - Creator Fees for Community Takeovers is finally here 🔥🔥🔥

how to claim Creator Fees as a CTO 👇

11,45K

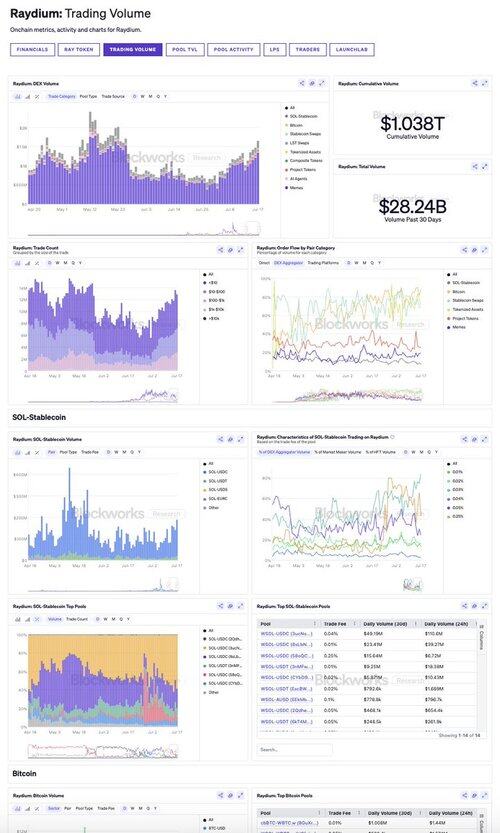

Good time to announce we've revamped our public Raydium trading volume dashboard.

The most in-depth look at where this $1 trillion volume came from.

Covers in detail every major trading pair category that Raydium offers (SOL-USD, Bitcoin, Tokenized Assets, Memes, etc.).

Answers questions like: where this order flow came from, what pool fees generated the most volume, most popular pairs, tokens, and a lot more.

The financials page is next 🛳️🛳️🛳️

Raydium18.7. klo 22.25

The Raydium Protocol just crossed $1T in all-time trading volume

Accelerate DeFi on Solana

2,13K

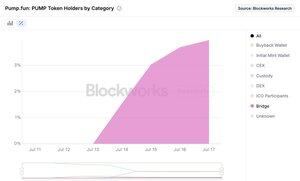

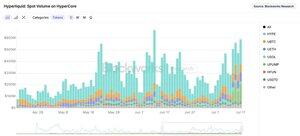

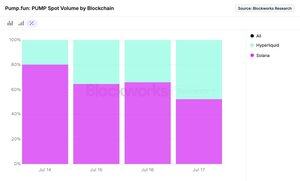

The launch of PUMP on Hyperliquid has been a tremendous success.

Using @hyperunit, PUMP's spot market on Hyperliquid is currently the second-largest market.

Its spot volumes on Hyperliquid are up to $150 million daily, accounting for 25% of HyperCore's total spot volume. HYPE, the largest market, has about 37%.

Hyperliquid also has about 45% of the total onchain spot volume for PUMP, with Solana at 55%.

About 39B PUMP tokens (3.9% of the total supply) are bridged by hyperunit.

1,1K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin