Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ByteTree

Actionable, high-quality, and contemporary investment research in #Gold, #Bitcoin, #TradFi and #Crypto for private investors.

Despite a new round of tariffs and rebound month for $USD, the World Index makes another all-time high (chart) - #Bullish - but which stocks are leading or lagging the World Index?

🏆 Leading & Emerging Trends

This week's leaderboard is topped by Swiss engineering giant $ABB. Mega tech stocks like $NVDA and $MSFT continue to dominate the leaders while we have new theme coming from Asian capital markets and exchanges, including the Singapore Exchange.

Meanwhile Samsung features in the emerging trends following strong sales while SoftBank also ranks on this list, capitalising on the AI mega-trend. Other emerging trends include mining stocks like PT Merdeka Copper Gold $MDKA and Impala Platinum Holdings $IMP.

📉 Weakening and Bearish Trends

Berkshire Hathaway $BRK-B tops the weakening trends, followed by Mastercard $MA. Notable weakening trend themes include insurance stocks like Chubb $CB and recruitment tech stocks like $ADP and Paychex $PAYX.

Bearish trends remain the biggest group with notable names including Procter & Gamble $PG, Home Depot $HD, $ASML (a recent European darling), Novo Nordisk $NOVO-B and Astra Zeneca $AZN. Chiming with this list, the biggest theme among bearish trends are consumer and pharmaceuticals, i.e. quality defensives.

📫 Subscribe

We publish a weekly report on the world's leading, emerging, weakening and bearish trends, sent out every Monday before the US market opens. It's free to read so why not sign-up:

203

What impact is the falling US dollar having on global markets? Does Bitcoin still have space to run? And is there still time to invest in gold?

These are some of the questions @AtlasPulse addressed during a recent webinar with James Early, CEO of Curia Financial.

Watch the full webinar on YouTube:

698

ByteTree Venture is our deep-value service, focusing on undervalued, good companies and should not be confused with Venture Capital. That being said, this ByteTree Venture update is about a UK venture capital firm. Venture capital stocks are starting to catch a bid, and this firm is on a 50% discount to fair value.

Read the Venture update by @AtlasPulse:

561

We are pleased to share our Q2 performance report (linked in the top comment) where @AtlasPulse reviews the performance of our model portfolios in The Multi-Asset Investor. We also highlight the performance of our special situations service, Venture, while touching on our other services in Global Trends, ByteFolio, and our proprietary Bitcoin and Gold ETF (BOLD).

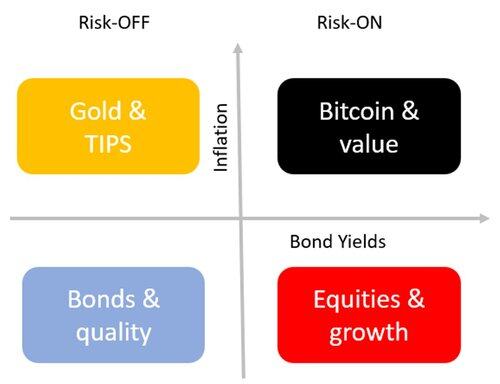

Our portfolios are built around the Money Map (image below), which is a framework we use to identify key areas in which to focus, and more importantly, the areas to avoid. Above all, this is how we diversify a portfolio by having exposure to each quadrant, whatever the weather, because macroeconomic environments can change quickly.

1,3K

Today's weekly Global Trends Investor (GTI) issue highlights that markets are strong but getting stretched. The #WorldIndex is now 28% above its 200-day moving average. That's hot, but not red hot, as a historically normal high reading is above 30%. Still, something to keep an eye on.

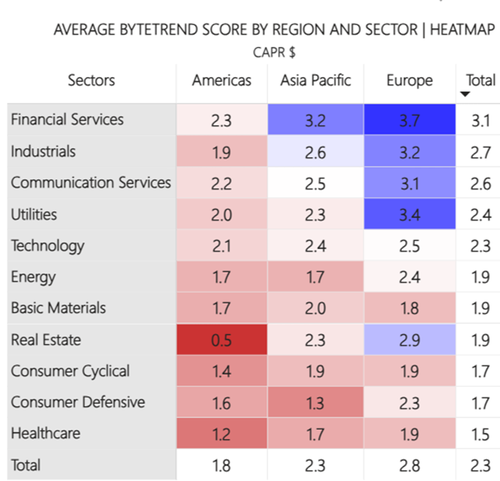

In other news, the US market leaders are at an all-time high, but only a few are able to beat the World Index. A similar picture is evident in our CAPR* chart, as highlighted below. Once again, the #USmarket is showing leadership, while Europe and Emerging Markets have eased back, with Japan the standout decliner.

In terms of individual stock highlights, JPMorgan $JPM and Capital One $COF lead in finance, with the latter's recent acquisition pitching it as a serious competitor against Visa and Mastercard. Meanwhile, Broadcom Inc. $AVGO and Amphenol Corporation $APH show notable leading trends in the tech industry.

On the other side of the coin, we have some heavy-hitters in the bearish trend category. Procter & Gamble $PG and McDonald's $MCD are notable, while Adobe has become a regular in this category.

The GTI Top 200 highlights the leading, emerging, weakening and bearish trends for the world's top 200 stocks. The weekly update is free to read here:

(*CAPR, or currency-adjusted price relative, converts all stocks and asset performance into a common currency, USD, and measures them relative to the World Index)

1,52K

Leading, emerging, weakening and bearish trends in global stocks - sign up for our free weekly report:

Charlie Morris30.6.2025

This week's relative strength report still shows European stocks in the lead. Financials, industrials and utilities stand out. US real estate lags the world.

733

BOLD has been listed on the Nasdaq in Stockholm 🎉

Join us for today's webinar to learn more about $BOLD and other Bitcoin and Gold products.

📅 17 June

🕒 15:00 BST

Register to attend:

21Shares16.6.2025

Swedish investors 🇸🇪 — we’re expanding our lineup on the @Nasdaq Stockholm!

With the cross-listing of BOLD, AVAX, ETHC, AUNI, and CSOL, we now offer 10 ETPs in SEK — giving you broader access to crypto via your local exchange.

Explore the full list:

11,66K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin