Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Last week I had the opportunity to discuss my proposal for Jito's token-economic model to bring real-time value accrual to JTO through SOL-for-JTO epoch auctions.

I haven't shared my idea / proposal on Twitter yet, so here we go:

Today, only a handful of protocols make meaningful amounts of revenue, and even fewer have a model which directs the value created back to the token itself.

With the introduction of TipRouter, Jito is now directing a meaningful amount of revenue to the DAO treasury with a 2.7% take rate on Tips, but that value is not mechanically captured to the token.

Therefore, I'm proposing a flat 2% take rate on Tips from TipRouter which is then auctioned off on a per-epoch basis via an English Auction mechanism.

Mechanically, this looks similar to bundle style auctions, which also utilize the English auction method, where the highest bidder at the end of the duration wins. Simply put, the SOL that is taken via fees is auctioned off, with the important caveat that bids can only be placed in JTO.

A breakdown in the table below can used for assumptions of how this would potentially play out, using the current, 30, 60, and 90 day moving averages for Tips.

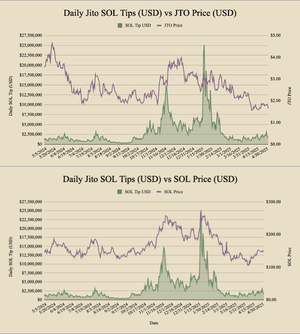

I believe this mechanism would take the volatility of Tips as a revenue stream, and use market forces to capture value back into the JTO token directly. For example, when looking at the largest days of Tips ever around the $TRUMP launch, SOL itself saw greater reflexivity than JTO itself.

If this mechanism would've been implemented during those epochs surrounding the largest day of Tips Jito has ever seen, it would have led to 4 consecutive Epochs of $500k+ SOL<>JTO auctions. And over one year of epochs, it would have led $21m of JTO being used to buy SOL from the protocol.

When analyzing the CEX float, as well as onchain liquidity, this leads me to believe that this could have had a material impact for JTO given the current market structure. (Details on float + liquidity found on forum post)

While this may at first seem like a slightly complex option, I think the market is the ultimate arbiter of complexity - delivering order out of chaos. This is a mechanism which I believe would consistently drive market demand for JTO throughout each epoch, reflexive to the amount of Tips seen during that time period.

The DAO + Foundation already have a significant portion of the tokens, and I think this would help further corner the market for JTO - thus allowing for enhanced control of token emission programs.

The end goal is of course to continue growing the protocol, and with the entire LST penetration rate of Solana still around only 10%, and jitoSOL at 40% market share, the game is far from over.

With all growth incentives being denominated in JTO, this sort of real-time value capture mechanism could create a synergistic flywheel where if JTO's price increases, the incentives for various products to grow increase in dollar terms, enhancing Jito's multiple forms of existing revenue streams.

Additionally, there are plenty of other products Jito could launch, many of which were discussed in the same conversation below.

Overall, I think Jito's monopoly on the MEV supply chain makes it incredibly valuable today, and this will likely continue to be its primary revenue driver for the foreseeable future.

Therefore, its also important the value Jito creates is captured and reflected back into the token price to fortify Jito's growth prospects, wherever they may arise - whether it be through M&A, new product launches, etc.

Overall, this was a great discussion alongside some fellow delegates and investors in the space, highly suggest listening in on all the ideas put forth, AND reading the summary in the Jito forum, along with the full posts found there. Also if you've got thoughts or feedback on Jito's future - I encourage you to share them.

But I'll leave it with this:

If we want high quality DeFi tokens to actually outperform like "beta" to the native network's asset, then real-time value capture to the token is a must.

29.4.2025

Roundtable One

16,05K

Johtavat

Rankkaus

Suosikit