Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The man who revived Atari from the brink of death is now building the fastest growing Corporate Bitcoin Treasury on the Paris Stock Exchange – and hardly anyone is paying attention.

Here’s the story of Frédéric Chesnais and Crypto Blockchain Industries () 🧵👇

On May 14th, 2025, CBI shocked the market.

They announced a 10-year partnership with @BlockwareTeam to build a Bitcoin-native treasury — not by buying BTC directly, but by mining it.

Since then:

▫️ Stock up 10x

▫️ Market cap +€500M

▫️ Trading Volume up 100x

This move took CBI from a zombie stock to Bitcoin proxy.

Why mining instead of buying Bitcoin directly?

- Accumulate BTC at a Discount to the Market Price

- Differentiate CBI from Other BTC Treasury Companies

- BTC-Denominated Cash Flow

- Tax Benefits

- ASIC Market Making

Right now it costs ~$105,000 to buy BTC but miners are producing it at an effective price as low as $50,000.

Why Did CBI Partner with Blockware?

Because this is the most time & capital efficient way to start mining Bitcoin.

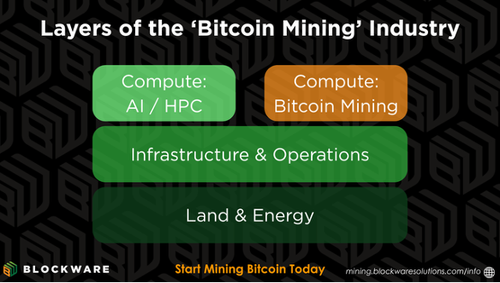

Most public “Bitcoin mining companies” are really bloated energy firms.

They build data centers. Negotiate the energy costs. Deal with months of lead time.

While this gives them vertical integration across the Bitcoin mining industry, it limits their directional exposure to BTC.

Blockware flips the script:

Plug-and-play access to low-cost hashpower.

ASICs are online in days — not years.

CBI = Capital → Miners → Bitcoin.

Whether you're a public company in need of a pivot or a retail investor looking to stack sats, Blockware enables you to acquire Bitcoin in the most capital efficient way possible: mining

To get started, go to

If you’re a public company executive looking to replicate the ‘CBI’ play yourself, DM @Mason_Jappa

35,12K

Johtavat

Rankkaus

Suosikit