Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The year is 2025, and in crypto we still think a leading non-sovereign store of value needs to provide yield. This is objectively wrong. Look at gold and art -- neither provides yield and by far they are the leading non-sovereign store of value. In fact, I'd go as far as saying that no yield is a feature -- not a bug. Hence, bitcoin and gold stand on their own.

9.7. klo 02.55

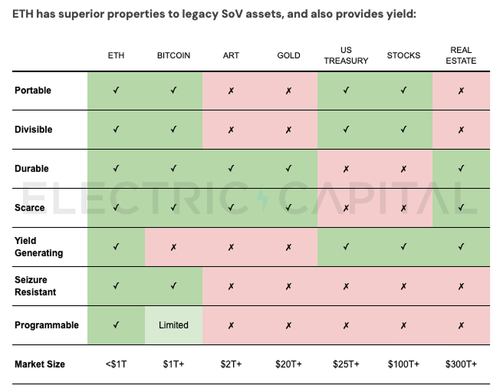

As ETH demand grows, it’s positioned as a SoV that can take share from legacy assets

Like gold & BTC: scarce, censorship-resistant

But it has yield

Americans hold $25T in dividend stocks vs. <$1T in gold

ETH & BTC may both disrupt legacy SoV (US treasuries, gold, real estate)

6,07K

Johtavat

Rankkaus

Suosikit