Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

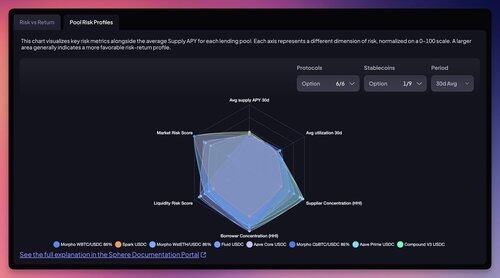

Where should you put your USDC to work?

Do you prioritize liquidity? Consider @0xfluid

Lower concentration risk? Try @compoundfinance

Borrowing with size? Explore @aave

Pool risk profiles make it easy to compare pools and pick the one that fits your strategy and risk appetite.

Two comprehensive risk metrics help you quickly compare the options at your disposal:

Market Risk Score → Looks at undercollateralization under stress

Liquidity Risk Score → Looks at liquidity under stress

But that’s not all ⬇️

You can also deep dive into concentration risk by looking at:

- Borrower concentration risk

- Supplier concentration risk

Both measured using the Herfindahl-Hirschman Index (HHI).

Finally, don't forget to look at:

- Average Supply Rate

- Average Utilization

Together, these metrics provide a more complete overview of the risk vs. return involved in depositing into different pools.

All data available here:

869

Johtavat

Rankkaus

Suosikit