Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

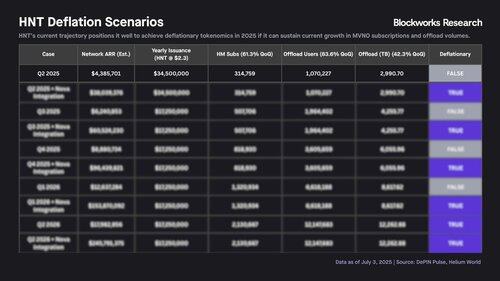

1/ Halving tailwinds are building for Helium.

Annual HNT emissions will fall from 15M to 7.5M tokens on August 1 2025, tightening supply just as demand ramps.

@helium 2/ At today’s ~$4.4M 30-day annualized revenue, a ~4x lift would push burn above emissions and make HNT net-deflationary in 2025.

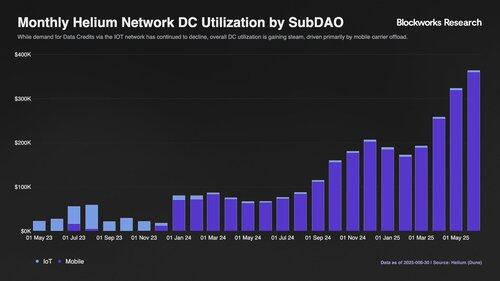

3/ Data Credit burn is exploding.

Monthly DC spend jumped from ~$189K in March 2025 to ~$361K in June 2025.

Roughly 85% of that burn now comes from carrier offload traffic, not Helium Mobile subscribers

@helium 4/ Major telcos are quietly offloading traffic onto Helium WiFi.

AT&T, and potentially T-Mobile (unconfirmed but strongly sign-posted) are the dominant flows behind the surge.

Today, the network supports between 800K – 1.1M daily users.

5/ Nova Labs generates ~$6M ARR offchain by selling anonymized coverage & location data.

CEO @amirhaleem is “spending 99% of [his] time” figuring out how to merge that cash flow into HNT tokenomics.

@helium 6/ Equity-to-token swap under discussion could dilute supply by 5–50%, but folds a significant increase in ARR into the onchain flywheel.

More burn, tighter float, fully aligned incentives.

7/ If usage momentum holds, the August halving could provide a clear path to deflationary economics right as revenue visibility improves.

Key catalysts to watch include:

- Sustained carrier offload volume growth (>40% QoQ).

- Governance proposal on Nova Labs integration, expected August 2025 after the halving.

- Any confirmation of tier-1 telco contracts or additional pilots.

@helium 8/ For our full analysis, subscribe to Blockworks Research and check out our latest report by @0xMetaLight

55,56K

Johtavat

Rankkaus

Suosikit