Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

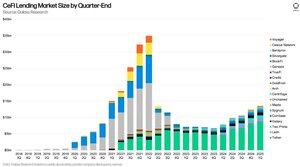

.@RelayerCapital's thesis is that we are only in the very earliest stages of a renaissance in CeFi lending catalyzed by new product types, in particular more secure overcollateralized loans sourced from onchain DeFi lenders/capital.

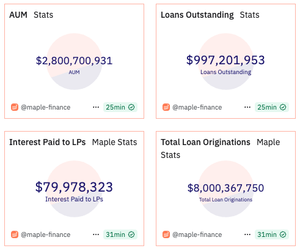

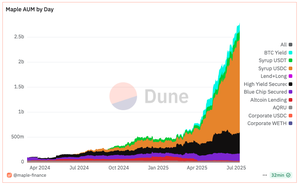

@maplefinance has led the way in this new market segment, currently meeting the needs of $1B in outstanding loan demand driven by the hyper growth in their permissionless syrupUSDC product.

At a $1B loan book today (up multiples in just the last few months), $SYRUP is rapidly gaining market share. Today CeFi lending is an approximately $15B market, but is well on its way back towards its Q1 2022 peak of $35B and beyond. It now serves a much larger addressable market of funds, market makers, OTC desks, miners, digital asset treasury companies, family offices, and HNW individuals but with a more secure product.

The melding of traditional demand sources with composable DeFi capital represents a fundamentally new dynamic for lending markets and I expect will become an increasingly dominant force disrupting traditional lending capital sources.

3,25K

Johtavat

Rankkaus

Suosikit