Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

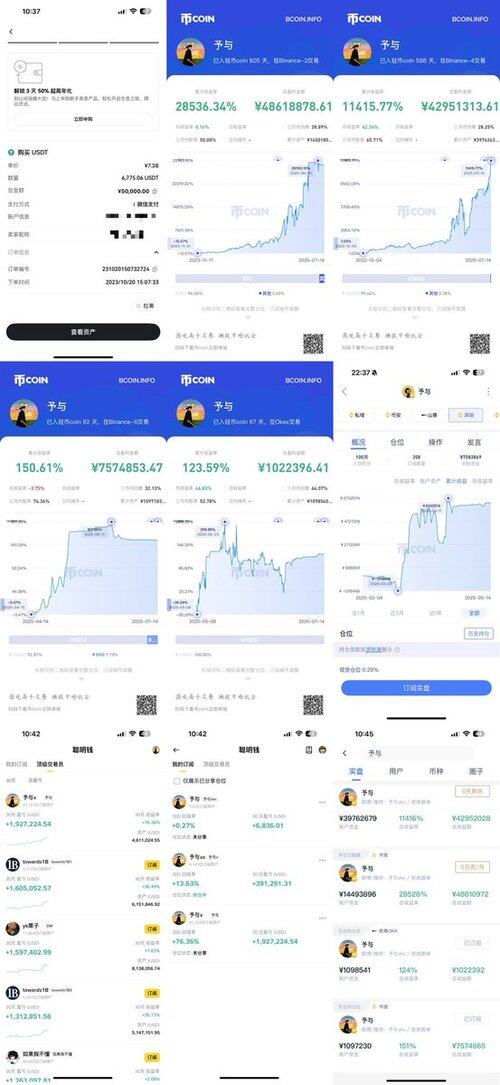

It took one year and nine months to grow from 50,000 to 100 million in real trading, a 2000-fold increase. During the same period, BTC also rose from 30,000 USDT to 120,000 USDT, reaching new highs.

Looking back, this journey has been relatively smooth. Thanks to strict position management and risk control, I only encountered one major drawdown during this time. After breaking through 10 million, I mainly relied on trading BTC, ETH, SOL, and other altcoins, using higher leverage to achieve excess returns, with most of the profits coming from this year.

The cryptocurrency market is never short of geniuses; every market cycle births new "gods," and the times create heroes. However, in this market, what is more important than getting rich overnight is how to survive in the long term. You must ensure that you stay at the table until you achieve your goals. In the future, as more institutions enter the market, the difficulty of operations will increase, so I advise everyone to cherish this market cycle before interest rate cuts, aiming to achieve your goals and exit gracefully.

There’s a lot I want to say, and I will share slowly in the future. Let’s briefly discuss why I can incur small losses during downtrends and make big profits during uptrends:

1. Do not average down on floating losses, but add to positions on floating profits.

When your position is underwater, never average down to lower your cost; you can choose to hold (provided you have a strong conviction about the future market), but you must not average down. Conversely, when you have floating profits, that’s when you should add to your position and set a stop-loss to lock in a safety net.

2. Stay clear-headed during uptrends, and know when to rest during downtrends.

Everyone will encounter market conditions that suit them, but don’t mistake a phase for permanence. Overconfidence often leads to significant drawdowns - my major drawdowns and liquidations stemmed from this. When the market trend diverges from expectations, you need to know when to take a break and adjust your state.

3. Block out external noise and establish your own trading system.

Most people's problem is that after watching countless analyses, they hesitate to open positions or can’t hold onto their trades. The root cause is a lack of confidence. You need to develop your own trading logic through practice, summarizing and optimizing the strengths of successful traders' take-profit and stop-loss strategies, rather than relying on external noise.

---

Achieving over 100 million in real trading profits has always been a small goal, and today I finally reached it. I will restart real trading on Binance, pausing operations on other accounts, and focusing on a single account. The Coin will also be made public, allowing my friends to grow together.

Let’s give my friends a chance to win a prize; a quick three-click for good luck.

The draw will take place after I return to Shenzhen. The lucky winner should DM their Binance UID, and I will share this joy and luck with you all.

---

307,38K

Johtavat

Rankkaus

Suosikit