Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

🚨 BREAKING: Citi unveils it's stablecoin strategy.

And it's GENIUS (😁).

Circle spent years fighting for regulatory clarity.

Guess who benefits when the Genius Act passes?

The banks.

Here's what most people missed:

Tokenized deposits become the settlement layer for everything. Stablecoins, onchain FX, Tokenized securities. everything.

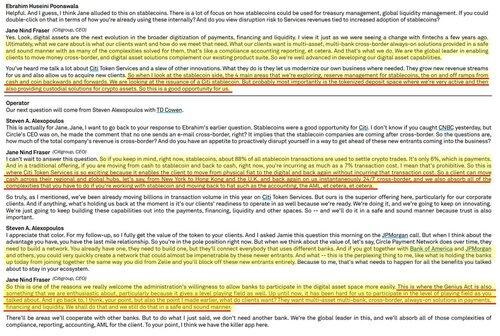

From the earnings call:

"We are looking at the issuance of a Citi stablecoin. But probably most importantly is the tokenized deposit space"

Jane Fraser mentioned four areas

1. Ramps

- Converting fiat to crypto for clients

This is huge. Instutional grade entry to onchain markets

2. Reserve management

- Managing stablecoin reserves for folks like Citi

- Managing reserves. This is a new client a logical step

3. Tokenization services

- Citi Tokenized Deposits already work closed loop

- Move cash between Citi Bank hubs

- Instantly, 24/7, no pre funding

4. Own stablecoin in a consortium

- We don't know much about this

- But mentions a Zelle like consortium

- With BofA and JPM

Put these pieces together and this move is GENIUS and insightful

1. The regulatory unlock

2. Allows banks to own onchain FX because the Tokenized deposits ARE THE OFF RAMP

1. The Regulatory Unlock is key:

"This is where the Genius Act is also something that we are enthusiastic about, particularly because it gives a level playing field as well."

2. Onchain deposits are HUGE

- A Deposit is an offramp

- AKA it's settlement

- Tokenized deposits will unlock 24/7 instant swaps from stables to deposit tokens

Long term this means global South FX markets and exotics becomes one single, global, instant, onchain FX marketplace

Fraser described that transformation happening in real-time.

Citi is positioning to capture a lot of upside.

65,87K

Johtavat

Rankkaus

Suosikit