Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

I may have found a cool tax loophole with the new Trump accounts

High earners can potentially use this account type to set their children up with millions of dollars of tax-free money in retirement

Here's how this could work:

Caveat: This is based on my interpretation of the law as it's written

Please cross-check me & be gentle in the comments. It also only makes sense for high earners with kids

I'm not a tax professional and this is not tax advice &for educational / informational purposes only

Trump accounts are ultimately a special type of retirement account for your children

Everyone is focusing on how these accounts are given a free $1,000 from the federal government

While that's cool, that's not what I believe to be the most powerful feature of these accounts...

If you set up a custodial retirement account for your kids like a Roth IRA, they need to have earned income before you can contribute on their behalf

This is tough! Kids typically can't work till their teen years at the earliest

But Trump accounts do NOT have this requirement

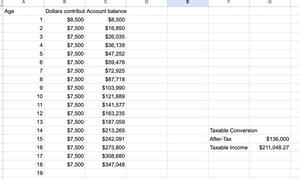

Parents can contribute $5,000 a year to these accounts for 18 years

The business the parents work at can contribute an additional $2,500 a year

It's conceivable that a business owner parent can contribute $135K over 18 years to these accounts with 0 earned income!

But here's where it can get super powerful: once your child turns 18, they can convert these accounts to a Roth IRA

The earnings + employer contributions would be taxable on conversion

But doing it over a few years when they are in college and at a low bracket can be worth it

The upshot is your kids could have a Roth IRA worth $300k+ by the time they are 18 years old

Letting that compound into retirement is manymillions of tax-free dollars

And they can withdraw the converted amount at any time from age 23ish onwards

All with 0 earned income

Like most good tax arbitrage, I do not think these accounts were intended to be used for this purpose

This could be a very cool strategy for high-earners who want to set their children up with a tax-free retirement piggy bank

And avoids the whole "hire your kids" thing

52,55K

Johtavat

Rankkaus

Suosikit