Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Epic news for Solana DeFi

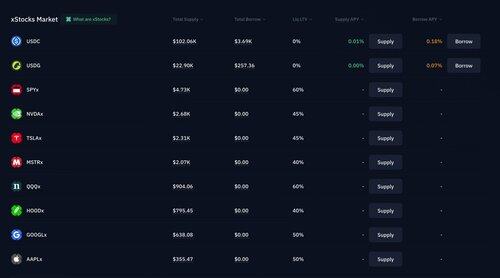

> Borrow using xStocks as collateral

> PUMP is now Live

> 36% APY on BTC

> 16%, 12% and 11% APY on Stablecoins

This and 4 more strategies 🧵👇

You can now provide xStocks as collateral to borrow stablecoins

> Supply xStocks

> Borrow USDC, USDG

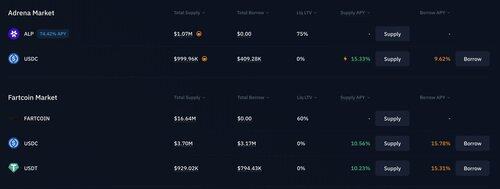

Right now the borrow rates are very low, so you could use those stables and lend on the Adrena Market for 15% APY

You can LP Bitcoin and stablecoins to get 36% APY

USDG incentives are pushing the APY high, and should remain in place for some time

There's obviously impermanent loss risk so be careful

Stablecoin Yields

> 15% APY on the Adrena Market

> 10.56% and 10.23% APY on the Fartcoin Market

> 21% APY on the FDUSD-USDC LP

I am making money with my stables through shorting the euro last week.

> Lend USDS

> Borrow EURC

> Repeat a few times

I borrowed EURC because I thought that the Euro had topped against the Dollar and so far its been correct - APY was at 8% till 2 days ago so I made money from yield AND the bounce of the dollar

If you are a trader then check out Kamino's Leverage page

> Collateral provided generates yield

> Auto-Deleveraging

> You pay a fraction of the cost of traditional perp DEXes

It is way more efficient to trade here than on most perp DEXes

If you're not a leverage trader but want to set bids for while you're asleep or AFK use the Limit Order feature from the Swap Page

In volatile times like this, putting stink bids can make you a LOT of money so try it out.

I hope you've found this thread helpful.

Follow me @0xGumshoe for more.

Like/Repost the quote below if you can:

16.7. klo 23.51

Epic news for Solana DeFi

> Borrow using xStocks as collateral

> PUMP is now Live

> 36% APY on BTC

> 16%, 12% and 11% APY on Stablecoins

This and 4 more strategies 🧵👇

22,17K

Johtavat

Rankkaus

Suosikit