Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Windtree- A Deep Dive into the "BNB MicroStrategy" Play

A major capital markets play is unfolding.

A Nasdaq-listed biotech firm, Windtree Therapeutics ( $WINT), is pivoting to become the FIRST-EVER NASDAQ-LISTED @binance treasury vehicle.

This isn't a random move; it's one of the most calculated crypto plays of 2025, engineered by seasoned veterans.

1️⃣ The Architects: Build & Build x DNA Fund

The deal is led by @BNBCorporation (founded by @horsmanp , Joshua Kruger, & Johnathan Pasch), a team of former execs from the crypto hedge fund Coral Capital.

The key connection? Coral Capital was strategically acquired by the Web3 venture capital powerhouse,

@ThisIsDNA

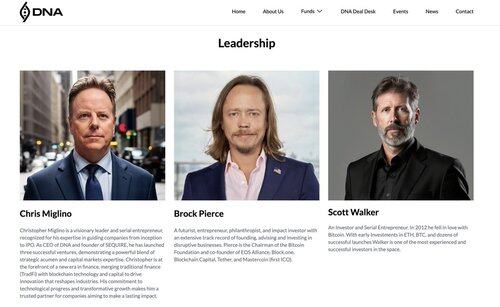

2️⃣The OGs: The Power Behind DNA Fund

DNA Fund was co-founded by crypto pioneers @brockpierce (co-founder of @Tether_to ) and Scott Walker.

Their involvement signals this is a top-tier operation, using a distressed public company ($WINT) as a vehicle for a rapid, compliant path to the @Nasdaq .

3️⃣ The CZ Nod: A Strategic Endorsement

The plan gained a massive signal when former Binance CEO @cz_binance referred to the plan as a "BNB 'microstrategy'".

He also cleverly distanced Binance from the deal, a textbook move of "plausible deniability" designed to navigate the regulatory landscape while providing a powerful endorsement.

4️⃣ The Deal: A $200M Capital Injection

Build & Build is injecting up to $200M ($60M initial) into $WINT.

The proceeds are a strategic mix of cash, shares of the Osprey BNB Chain Trust, and raw BNB tokens, designed to instantly capitalize the new treasury upon closing.

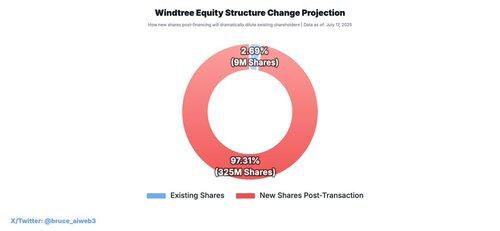

5️⃣ The Reality of Dilution: A Shareholder Reset

This massive financing requires a massive issuance of new shares.

Post-transaction, new shares (~325M) will represent ~97% of the company. For the new capital partners, this isn't a bug; it's a feature—the cost of acquiring a clean, publicly-traded platform.

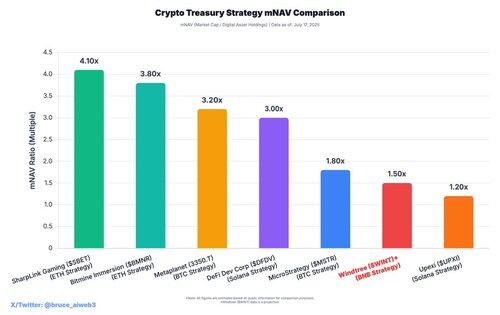

6️⃣ The Valuation Playbook: The mNAV Comparison

To value companies like this, we use mNAV (Market Cap / Digital Asset Holdings).

A high ratio indicates the market is assigning a significant premium for the company's strategy and accessibility. The chart below maps the mNAV landscape for various crypto strategies.

7️⃣ The Value Gap & Huge Potential

$WINT's initial valuation post-deal will likely be low. With a projected mNAV of 1.5x, it sits below many peers.

As the ONLY regulated vehicle for BNB exposure on Nasdaq, the potential for a major re-rating is immense once the market prices in its unique "BNB Strategy."

9️⃣Conclusion: The First-Mover Advantage

The investment thesis is clear.

$WINT is not just adopting a crypto treasury; it's pioneering an entirely new asset class for public markets as the FIRST to offer a pure-play BNB strategy.

This first-mover advantage gives it the potential to become the undisputed CATEGORY LEADER for regulated BNB exposure.

The market has not priced this in. Watch this space. #BNB #WINT #Crypto #Investing #Nasdaq

12,21K

Johtavat

Rankkaus

Suosikit