Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

I finished watching the video about stablecoins that Xiao Lin talked about, and many comments compared it to QQ coins, as well as Yu'ebao and WeChat Wealth Management 😂

Although from a certain perspective (which is one-sided), they are all virtual currencies circulating directly online.

But the core lies in the uniqueness brought by the characteristics of blockchain (decentralization, low cost, high efficiency, etc.).

I can't help but sigh that the popularization of the concept of blockchain has a long way to go.

However, although many people know about stablecoins, they may not necessarily understand them, and naturally, they don't know what major events have happened in the stablecoin market recently.

Because we (including myself) belong to the Chinese, to the Chinese-speaking region, although currently, the mainland views cryptocurrencies as a "flood beast."

However, just across the river from us, Hong Kong, as the cradle of cryptocurrencies, is at the forefront of the world.

Stablecoins are also one of the core points of focus.

We don't need to deeply understand the situation of stablecoins, but we need to understand what tangible benefits Hong Kong stablecoins can bring to you and me in the future Web3, and what opportunities are hidden within.

➡️ We need to know:

1. CIRCLE, which just went public in the U.S. a few days ago, has seen a cumulative increase of over 700%+ after its listing. The demand for compliant stablecoins in the traditional financial market is very high.

Since the demand for USD stablecoins is so high, what about the Euro? What about the HKD? There is also a broad market demand.

After all, Hong Kong is still known as the world financial center.

2. The advantages of stablecoins bring us back to the beginning. Since stablecoins are different from QQ coins and WeChat Wealth Management, the differentiated advantages they bring compared to traditional channels are incomparable.

For example, transfer speeds, with confirmations in milliseconds or seconds; for example, costs (time costs and transaction fees), which are basically just gas fees, with no other costs.

This is extremely attractive to traditional funds.

3. For individual users: the normal demand for stablecoins, the financial management needs that arise from stablecoins (which can yield considerable returns), and the secondary stocks of certain stablecoin companies also present good profit opportunities.

👍 We also need to know:

Coincidentally, the Hong Kong Monetary Authority has released the main participating institutions for the stablecoin sandbox, which are three companies: JD.com, Yuan Coin (Hashkey is the major shareholder), Standard Chartered Bank, and Hong Kong Telecom, among others, applying together.

This piece of information is brief, but the amount of information is substantial. I have interpreted multiple conclusions to share with everyone.

1. Referring to some cases of U.S. stablecoin companies, this is the preparatory stage for the issuance of stablecoin licenses in Hong Kong and even the mainland.

2. Why these three companies? It is undoubtedly due to their government resources, company strength, compliance expertise, and technical capabilities, which are the top three companies.

(I'll extend this: why not the well-known four major families in Hong Kong? I specifically searched for them, and they are involved in many financial products. I believe this gives everyone a clear understanding.)

3. However, for me, JD.com and Standard Chartered feel too distant. I am more concerned about Yuan Coin's position among them because Yuan Coin is the only Web3 native company among all the companies involved, while the others are commonly referred to as Web2 giants, "monks who became monks halfway."

Moreover, I found out that Hashkey is its major shareholder.

The comparison is actually clear.

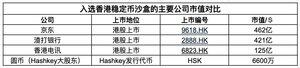

Because Yuan Coin and its major shareholder Hashkey are not publicly listed, I have somewhat compared their token market value to other listed companies.

You will find that the other selected companies are basically above a hundred billion in scale, and in USD, while Yuan Coin's major shareholder Hashkey's token market value is less than 100 million USD, so the potential can be calculated by yourself.

4. I personally believe: Yuan Coin's position and role in this context are irreplaceable. After all, Yuan Coin is the only selected Web3 enterprise, and its experience should be unmatched by the other few companies, and the development of the HKD stablecoin is already underway.

If a stablecoin is issued, it will definitely be centered around Yuan Coin's HKDR, with others as support.

If multiple stablecoins are issued, Yuan Coin will also play a guiding and advisory role in this.

Do you think HKDR will become Hong Kong's first stablecoin?

4. Of course, the above is a more direct observation, only regarding Hashkey's deep layout 👍

Yuan Coin becomes Hong Kong's first compliant Web3 company for stablecoins ➡️ Yuan Coin issues HKDR ➡️ Hashkey as the major shareholder benefits.

Benefits:

- OTC business profits: As Hashkey deeply cultivates the Hong Kong market, if HKDR is used as a supporting token in the future, its user coverage and capital volume will increase significantly.

- Exchange business: HKDR as a trading pair, Hashkey uses stablecoins as a hook to attract how many Web2 users to trade through it, which is one of the paths to large-scale adoption, and I am very much looking forward to it.

- On-chain business: Stablecoin online financial management, lending, DeFi, and a series of plays, I don't need to say much, just refer to other stablecoins.

- Coin price directly reflects: This is beyond doubt. A few days ago, the compliance license from Guotai Junan made HSK perform significantly. Moreover, from the perspective of business benefits, it will long-term reflect on the coin price.

5. Let me say something that others may not know, or so I heard, just for reference: Hashkey basically occupies half of the compliant crypto business in Hong Kong. No matter who it is, if you want to do compliant crypto business, you have to find Hashkey.

In Hong Kong, Hashkey is like BTC in Web3; it is an existence you cannot bypass or ignore.

6. Finally, let me ask a question:

Currently, the two most valuable compliant sectors in the crypto market: trading and stablecoin issuance, Hashkey has got them both.

Where do you think the ceiling for the entire Hashkey company lies in the future?

22,27K

Johtavat

Rankkaus

Suosikit